U.S. Housing Starts Plunge To Lowest Level In Over Two Years

A report released by the Commerce Department on Thursday showed new residential construction in the U.S. tumbled by much more than expected in the month of January.

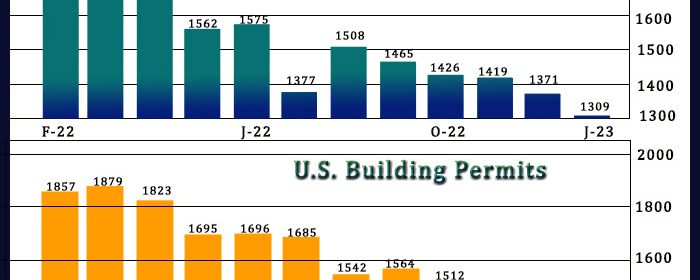

The Commerce Department said housing starts dove by 4.5 percent to an annual rate of 1.309 million in January after plunging by 3.4 percent to a revised rate of 1.371 million in December.

Economists had expected housing starts to slump by 1.6 percent to an annual rate of 1.360 million compared to the 1.382 million originally reported for the previous month.

With the much steeper than expected drop, housing starts fell to their lowest level since hitting a rate of 1.269 million in June 2020.

“We think housing starts are near a bottom for the cycle and look for activity be about flat in H1 2023 and to improve modestly later in the year,” said Nancy Vanden Houten, U.S. Lead Economist at Oxford Economics.

The decrease came as single-family starts tumbled by 4.3 percent to an annual rate of 841,000, while multi-family permits plunged by 4.9 percent to an annual rate of 468,000.

The report also showed substantial declines in housing starts in the Northeast and Midwest, where starts plummeted by 42.2 percent and 25.9 percent, respectively.

Meanwhile, the report said building permits inched up by 0.1 percent to an annual rate of 1.339 million in January after falling by 1.0 percent to a revised rate of 1.337 million in December.

Building permits, an indicator of future housing demand, were expected to jump by 1.5 percent to an annual rate of 1.350 million from the 1.330 million originally reported for the previous month.

The uptick in building permits came as multi-family permits surged by 2.5 percent to an annual rate of 621,000, offsetting a 1.8 percent slump in single-family permits to a rate of 718,000.

A separate report released by the National Association of Home Builders on Wednesday showed a much bigger than expected improvement in U.S. homebuilder confidence in the month of February.

The report said the NAHB/Wells Fargo Housing Market Index jumped to 42 in February from 35 in January. Economists had expected the index to inch up to 37.

With the much bigger than expected increase, the housing market index reached its highest level since hitting 46 last September.

Source: Read Full Article