Venmo joins PayPal in crypto offerings

Investors should fully understand the ‘risk’ of crypto: Wealth management expert

Gibbs Wealth Management President Erin Gibbs and B. Riley National chief market strategist Art Hogan discuss cryptocurrency, insider ‘sell’ transactions, and which stocks to watch.

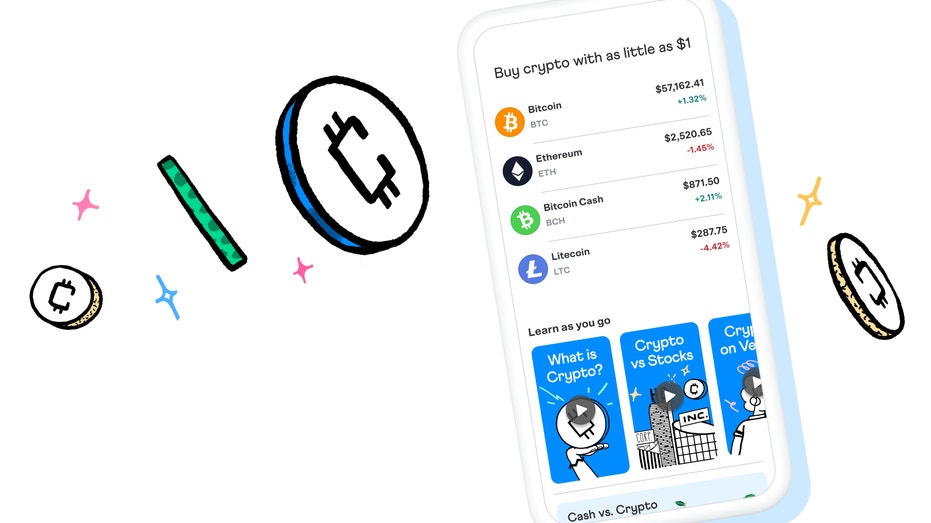

Venmo is joining big brother PayPal in offering cryptocurrencies for the first time.

The payment app, starting Tuesday, will allow customers to buy, sell and hold cryptocurrencies, including bitcoin, bitcoin cash, Ethereum and Litecoin, by using traditional cash in one’s Venmo account.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| PYPL | PAYPAL HOLDINGS, INC. | 267.91 | -1.96 | -0.73% |

"Our goal is to provide our customers with an easy-to-use platform that simplifies the process of buying and selling cryptocurrencies and demystifies some of the common questions and misconceptions that consumers may have," said Darrell Esch, SVP and GM, Venmo in a statement.

While dogecoin is not offered, the company tells FOX Business the suite of currencies is the same as Paypal's offerings which are based on "customer preference."

COINBASE FUELS BITCOIN ETF RACE LED BY WISDOMTREE, VANECK

About 20% of Venmo users, which tend to skew younger than PayPal’s, started purchasing crypto and stocks, during the pandemic, according to the 2020 Venmo Customer Behavior Study. This crowd is a growing segment of the retail trading community moving into cryptocurrencies and likely includes some of the folks known for chasing the so-called "meme stocks" such as GameStop and AMC. Venmo is also following Robinhood, the popular trading app which came under fire for restricting some of those heavily traded and shorted stocks in January, as it ramps up its crypto offerings to tap the swelling interest. Earlier this month the company disclosed that "In the first quarter of 2021, 9.5 million customers traded crypto on Robinhood Crypto, compared to 1.7 million in the fourth quarter of 2020" according to the company’s blog. Robinhood is also preparing to go public. COINBASE CEO CASHES IN $290M IN STOCK AFTER DIRECT LISTING It also comes less than one week after Coinbase successfully debuted its direct listing, now the largest publicly trading crypto exchange, to the public markets. The Nasdaq set a reference price of $250, shares opened at $381 and closed at $333 on Monday. BITCOIN'S NOSEDIVE: WHAT HAPPENED, WHAT'S AHEAD The move also comes amid what some coined a so-called ‘flash crash’ in bitcoin over the weekend the price tanked over 14%, falling from its record high of $63,000 without a clear-cut explanation. CLICK HERE TO READ MORE ON FOX BUSINESS Late Monday it saw some bounce back to the $56,000 level, before drifting lower, but the volatility reminded many investors of the unpredictable nature of cryptos. Source: Read Full ArticleTicker Security Last Change Change % GME GAMESTOP 164.37 +9.68 +6.26% AMC AMC ENTERTAINMENT HOLDINGS INC 9.66 +0.33 +3.54% Ticker Security Last Change Change % COIN COINBASE GLOBAL 333.00 -9.00 -2.63%