Inflation tailwind drives S&P’s top stocks for 2021

GasBuddy analyst on what to expect in 2022

GasBuddy analyst Patrick De Haan warns the highest gas prices “will be in the first half of the year.”

Energy prices had a wild ride of ups and downs in 2021, including a bear market, but the year-end result was a big win for investors with S&P energy stocks posting the best year on record.

WHERE SURGING CONSUMER PRICES ARE HITTING AMERICANS THE MOST

Energy companies, tracked as a sector within the S&P, rose over 47%, just ahead of real estate's 42% gain – also the best on record – and technology, which added 33%, the best year since 2020. This as financials netted over 32%, the best year since 2013, all tracked by Dow Jones Market Data Group.

These sectors bested the overall performance of the S&P 500 which gained 27% – the largest one-year percentage gain since 2019.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| SP500 | S&P 500 | 4766.18 | -12.55 | -0.26% |

OIL POST THE LARGEST ANNUAL GAIN SINCE 2009: $75.21

Oil prices, which rose 55% in 2021 closing at $75.21 per barrel, got an inflation tailwind from the rapid pandemic rebound, as well as a curb in U.S. production that partly came from the Biden administration's policies, steered toward green energy and the canceling of pipelines.

WATCH: DANIEL YERGIN SAYS US OIL PRODUCTION IS COMING BACK

<strong>S&P 2021 Winners </strong>

Energy: +47% – Best Year On Record

Real Estate: +42% – Best Year On Record

Technology +33% – Best Year Since 2020

Financials: +32% – Best Year Since 2013

Source: Dow Jones Market Data Group

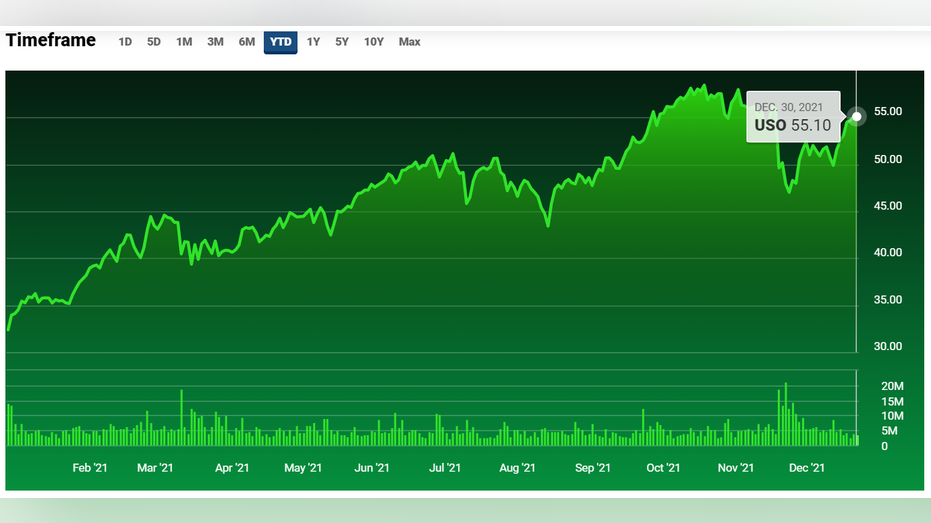

Energy-specific exchange-traded funds did even better.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| USO | UNITED STATES OIL FUND L.P. | 54.36 | -0.74 | -1.34% |

The United States Oil Fund, which mirrors spot prices of U.S. oil, gained over 60%.

OIL'S BEAR MARKET MAY BE A SHORT ONE

As did the SPDR S&P Oil & Gas Exploration & Production ETF. WHAT THE OIL MARKET SIGNALS ABOUT OMICRON READ MORE ON FOX BUSINESS BY CLICKING HERE Some stocks within the XOP ETF rose by triple digits including SM Energy, which gained 384%, and Callon Petroleum, which rose 263% for the year. What's ahead for 2022? Pulitzer prize winner Daniel Yergin, now IHS Markit vice chairman and author of "The New Map," says the Biden administration is changing its anti-oil tune, which will return America to energy independence achieved under the Trump administration. "You've seen this pivot in the Biden administration … how should we put it, indifferent to the oil industry or not very interested in it but in the last few weeks they are suddenly actually saying to the oil industry, ‘oh could you increase production?' because they are worried about inflation, they are worried about … gasoline prices and what the impact will be on the 2022 elections," Yergin explained. Gasoline prices closed out the year at $3.28 per gallon, down slightly from the seven-year-high hit during the fall. A year ago, prices averaged $2.25, as tracked by AAA. Source: Read Full ArticleTicker Security Last Change Change % XOP SPDR SERIES TRUST S&P OIL & GAS EXPL & PRODTN 95.87 -0.32 -0.33% Ticker Security Last Change Change % SM SM ENERGY CO. 29.48 -0.14 -0.47% CPE CALLON PETROLEUM 47.25 -0.59 -1.23%