Elon Musk exploring Twitter tender offer, lines up $46.5 billion in financing commitments for takeover bid

Charles Payne: Everyone is rooting for Elon Musk

‘Making Money’ host provides insight on Tesla stock, Biden’s new infrastructure regulations and the housing market on ‘Kudlow.’

Elon Musk poked Twitter on Thursday as he awaits an official decision on whether the company will accept or reject his takeover offer.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| TWTR | TWITTER INC. | 46.70 | -0.02 | -0.03% |

Now he is exploring whether to commence a tender offer to acquire all outstanding shares of Twitter's common stock, citing the board's lack of response to his $54.20 per share offer to take the social media giant private.

TWITTER VS MUSK: WHAT IS A POISON PILL DEFENSE?

The announcement, which was revealed in an updated filing with the Securities and Exchange Commission on Thursday, also notes that Musk has received commitments of approximately $46.5 billion to help finance a potential deal.

The funding includes roughly $21 billion in equity financing and around $25.5 billion in debt financing through Morgan Stanley Senior funding and other firms, including Bank of America, Mizuho Bank, Barclays, MUFG, Société Générale and BNP Paribas.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| MS | MORGAN STANLEY | 90.68 | +0.08 | +0.09% |

| BAC | BANK OF AMERICA CORP. | 39.50 | -0.16 | -0.41% |

The filing emphasizes that Musk has not decided on whether he will make a tender offer and that he may take other steps to further his proposal.

A Twitter spokesperson told FOX Business that the company is in receipt of the updated, non-binding proposal from Musk.

"As previously announced and communicated to Mr. Musk directly, the Board is committed to conducting a careful, comprehensive and deliberate review to determine the course of action that it believes is in the best interest of the Company and all Twitter stockholders," the spokesperson added.

ELON MUSK'S BORING COMPANY NOW VALUED AT $6 BILLION, COMPANY SAYS

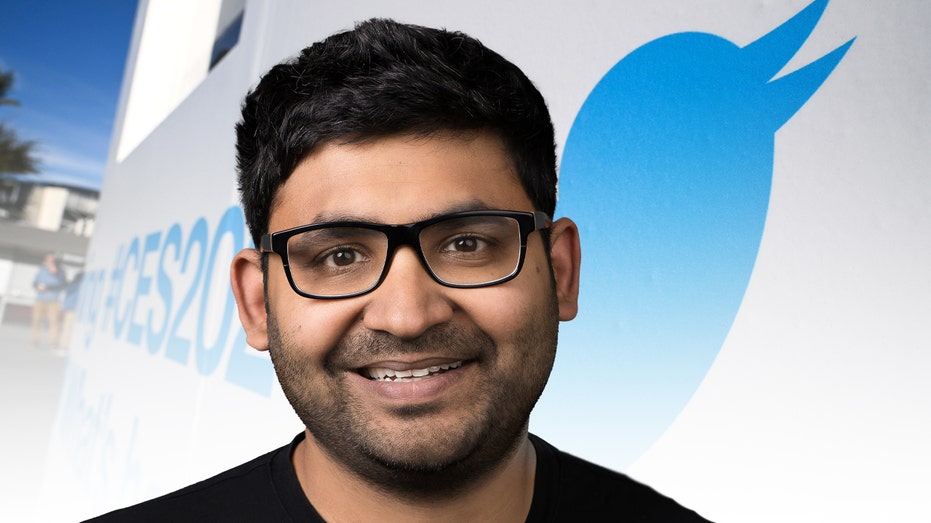

The filing comes after Musk, a self-described "free-speech absolutist," disclosed a 9.2% Twitter stake on April 4 after criticizing the company and its chief executive, Parag Agrawal, and questioning whether the company rigorously adheres to free speech principles.

Twitter CEO Parag Agrawal. (Photo by ROBYN BECK/AFP via Getty Images | twitter / Getty Images) Though Musk was initially invited to join Twitter's board, he later declined the offer. As part of joining the board, Musk would've been unable to own more than 14.9% of Twitter's stock while serving on the board or for 90 days after. Musk's board term would have expired at Twitter’s 2024 annual meeting. CEO of Tesla Motors Elon Musk speaks at the Tesla Giga Texas manufacturing “Cyber Rodeo” grand opening party in Austin, Texas, on April 7, 2022. (SUZANNE CORDEIRO/AFP via Getty Images / Getty Images) Musk proceeded to make the $43 billion takeover bid for Twitter, noting it was his "best and final" one. Following the offer, Twitter adopted a limited duration shareholder rights plan, commonly referred to as a poison pill, to prevent Musk or any other entity or group from acquiring beneficial ownership of 15% or more of Twitter's outstanding common stock in a transaction not approved by the board. The plan will expire on April 14, 2023. CLICK HERE TO READ MORE ON FOX BUSINESS Musk had teased during an interview at the TED2022 conference earlier this month that he had a plan B if his $54.20 per share offer was formally rejected by Twitter. On April 16, Musk hinted at a possible tender offer for Twitter after tweeting the words "Love Me Tender" with music notes, a nod to the Elvis Presley song. On Tuesday, the billionaire issued a second Tweet which reads " _____ is the Night", which appeared to be a reference to the F. Scott Fitzgeral novel "Tender is The Night". Source: Read Full Article