Before the Bell: It’s All About CPI Today, but ContextLogic Is Making Waves

Premarket action on Tuesday had the three major U.S. indexes trading higher. The Dow Jones industrials were up 0.14%, the S&P 500 up 0.24% and the Nasdaq 0.39% higher.

Ten of 11 market sectors closed higher Monday, with technology (1.77%) and consumer cyclicals (1.46%) posting the day’s best gains. The energy sector (−0.6%) was Monday’s only loser. The Dow closed up 1.11%, the S&P 500 up 1.14% and the Nasdaq up 1.48%. Two-year Treasuries added two basis points to close at 4.52%, and 10-year notes slipped by two basis points to close at 3.72%. Oil rose 0.03% and traded down by about 1.6% early Tuesday morning at $78.88.

Monday’s trading volume was below the five-day average. New York Stock Exchange winners led losers by 2,336 to 735, while Nasdaq decliners led advancers by about 3 to 2.

Before markets open on Tuesday, the Bureau of Labor Statistics will publish the consumer price index (CPI) reading for January. Economists expect the index to rise by 0.5%, reversing December’s 0.1% drop. Core CPI, excluding food and energy, is forecast to rise 0.4% month over month, slightly more than December’s 0.3% increase. The CPI 12-month all-item index has fallen from 9.1% in June to 6.5% in December, an indication that inflation is falling fast. If the all-item index fell again in January, markets are likely to be buoyant again. If the index rises, all bets are off.

On Wednesday, the Bureau of Labor Statistics reports retail sales for January. Economists are expecting an uptick of 2%, stopping the two-month run of declines. Housing starts and the producer price index (PPI) are due Thursday.

Among S&P 500 stocks, genomics firm Illumina Inc. (NASDAQ: ILMN) got a share price boost of 9.85% on Monday on no specific news. Maybe some investors have decided that Illumina will be successful in its efforts to convince U.S. and European regulators that an $8 billion acquisition of cancer testing subsidiary Grail is in everyone’s best interests. EU regulators are particularly steamed and likely to hit the company with a $450 million fine for completing the acquisition before receiving permission from the regulators.

Fidelity National Information Services Inc. (NYSE: FIS) is spinning off a company it paid $41 billion to acquire less than three years ago. The payment processing company acquired Worldpay, a merchant payment system, in March 2019. FIS took an impairment charge of $17.4 billion when it reported fourth-quarter results before Monday’s opening bell. The stock dropped 12.5% in Monday trading, but a Morgan Stanley upgrade to Overweight and a higher price target (from $73 to $79) may have given the shares a boost Tuesday morning.

Get Our Free Investment Newsletter

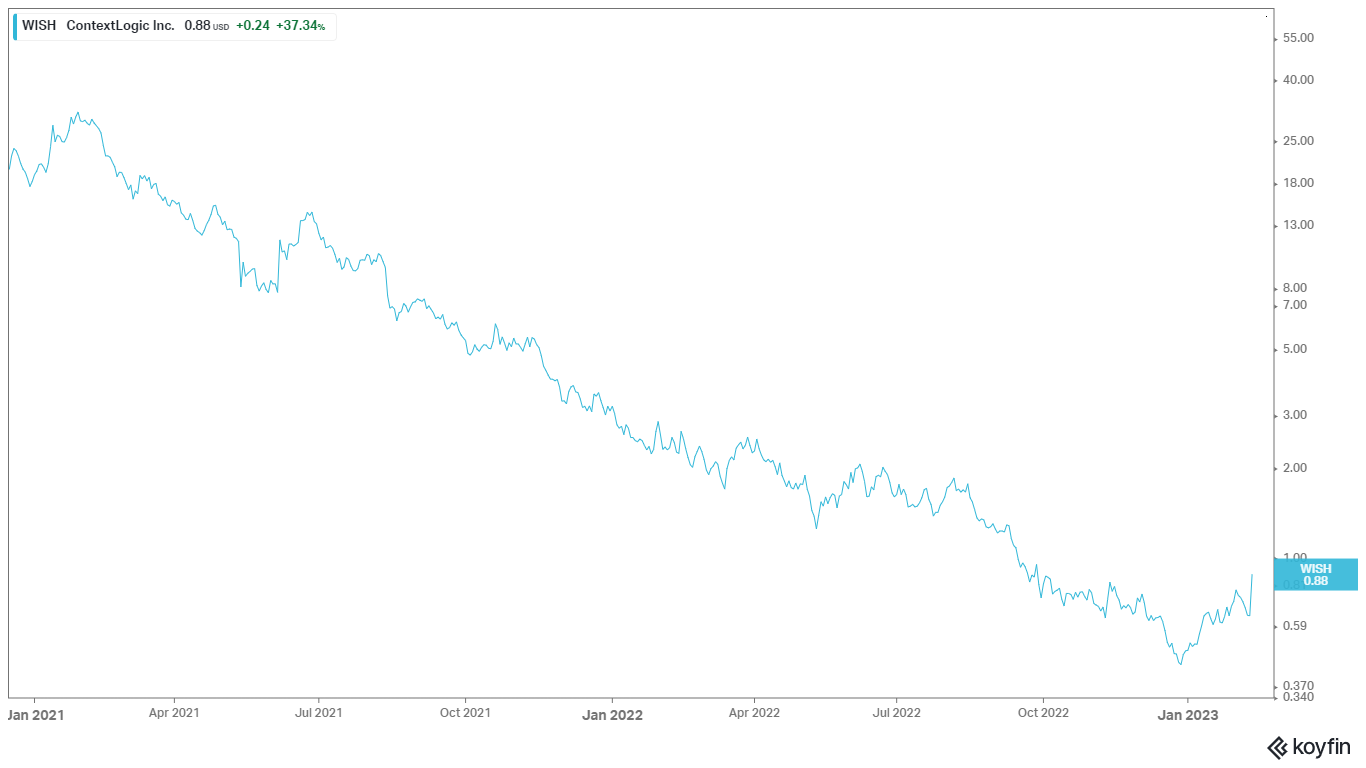

For the second day in a row, we cannot avoid taking a look at another penny stock. ContextLogic Inc. (NASDAQ: WISH) soared more than 37% on Monday to close at almost $0.88 per share. Well-known short seller Andrew Left of Citron Research said on Monday that Super Bowl ads for Pinduoduo marketplace Temu could juice ContextLogic’s stock. Both companies try to match consumers with available deals on products the consumers have shown an interest in. Here is ContextLogic’s three-year share price chart.

Since its heady days during meme-stock mania when shares topped out at more than $32, things have not gone well for the company. But at $0.88 a share, it might be a better bet than a lottery ticket. The stock traded up another 10% in Tuesday’s premarket. FOMO in action.

Sponsored: Tips for Investing

A financial advisor can help you understand the advantages and disadvantages of investment properties. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Investing in real estate can diversify your portfolio. But expanding your horizons may add additional costs. If you’re an investor looking to minimize expenses, consider checking out online brokerages. They often offer low investment fees, helping you maximize your profit.

Source: Read Full Article