Aluminum prices soar in new construction headache

Housing market still seeing high demand despite sales drop: Home building executive

Tri Pointe Homes CEO Doug Bauer comments on the drop in new home sales across the nation.

Soaring aluminum prices are the latest worry for a construction industry that has been grappling with higher materials and labor costs as the U.S. economy emerges from the pandemic

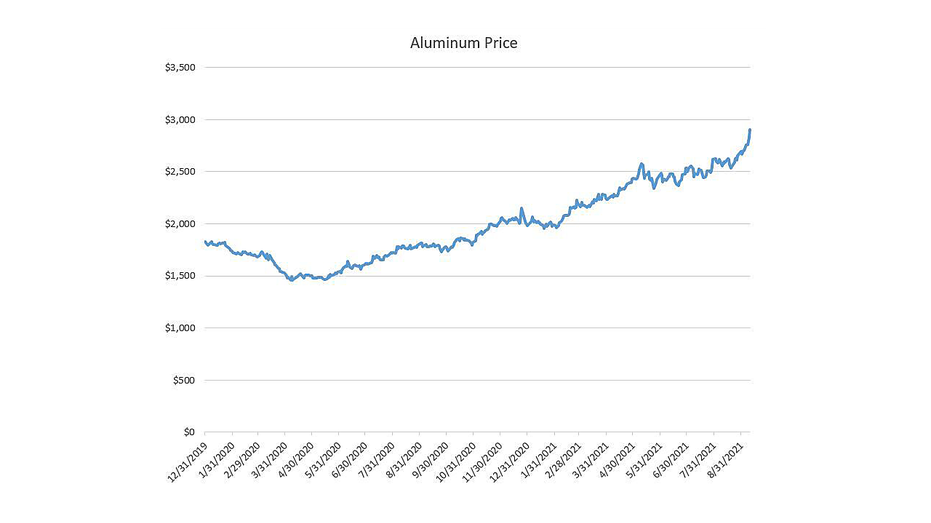

The three-month offer price for aluminum traded at the London Metal Exchange has surged 47% this year to $2,907 per tonne. Prices are up 73% from their pre-pandemic levels.

"Aluminum is integral to residential construction and used to make everything from siding and gutters to insulation, nails, and HVAC equipment," said National Association of Home Builders CEO Jerry Howard. Aluminum is also used in roofing, fencing and many other products.

Source: London Metals Exchange Higher aluminum prices have "translated into higher material costs for builders as the price of building materials made with aluminum has increased 15-25% over that period," he added. USED CAR PRICES SLIDE FOR FIRST TIME IN 7 MONTHS Higher aluminum costs aren’t the only headache for homebuilders. Lumber prices earlier this year had climbed by as much as 316% since the start of 2020, adding $36,000 to the cost of building an average-sized new home. Other essential materials including iron, copper, steel and natural gas have also seen their prices skyrocket. But it’s not only materials costs that are going up. BIDEN TAX HIKES BIGGER THREAT TO STOCK MARKET THAN SLOWING ECONOMY: GOLDMAN SACHS Builders and contractors are also dealing with higher transportation and labor costs. In addition, there aren’t enough roofers, glaziers, plumbers, electricians and other types of workers to fill the needs of the construction industry. "All of this is pushing in the same direction, causing project prices to rise," said Anirban Basu, chief economist for Associated Builders and Contractors. "Some project owners are saying, 'no more for me, I'm done. I'm not going to go with this project right now.'" An Associated Builders and Contractors report released Tuesday said its Construction Backlog Indicator fell to 7.7 months in August, down 0.8 months from July. The reading was 0.3 months below its year-ago level. The drop in confidence mirrors a decline in homebuilder sentiment that was reported last month. The National Association of Homebuilders'/Wells Fargo Housing Market Index fell 5 points in August to 75, the lowest since July 2020. Still, ABC’s Construction Confidence Index showed readings for sales, profit margins and staffing levels all remained above 50, indicating expectations of growth over the next six months. "The cure for high prices is high prices," Basu said. GET FOX BUSINESS ON THE GO BY CLICKING HERE "These lofty prices for aluminum, copper, steel and other inputs to production induce firms to increase short-term supply," he added. "So it should be the case that at some point in 2022 we see some relief for the construction industry and other goods-producing segments of the economy." Source: Read Full Article