The Purpose Ethereum ETF Now Holds Over 62k ETH

The Purpose Ether ETF Offers Investors Direct Exposure to Ethereum

The Purpose Ethereum ETF offers retail and institutional investors a chance at gaining exposure to Ethereum without worrying about security and regulatory hurdles. The Purpose Ethereum ETF is physically settled and held in cold storage. Additionally, purchasing the ETF is similar to buying shares of your favorite stock as it is listed on the Toronto Stock Exchange.

Interest in Ethereum Continues to Grow and ETH Might Not Dump After August 4th

An increment in ETH holdings of the Purpose Ethereum ETF is a sign of demand for the digital asset amongst retail and institutional investors. This is partly due to the progress being made to transition Ethereumm from Proof-of-Work to Proof-of-Stake.

To note is that the Ethereum London Upgrade is only days away as it is scheduled for launch on the 4th of August.

In a normal scenario, such an event would be a ‘sell the news’ event. However, the upgrade is one of many that will usher in the era of Proof-of-Stake (PoS) on Ethereum. The upgrade also introduces the highly anticipated EIP1559 that tames high gas fees and turns Ethereum into a deflationary asset.

As a result, the price of Ethereum might not be negatively affected by the activation of the London Upgrade as investors and traders are aware it is a hug step towards the end goal of PoS.

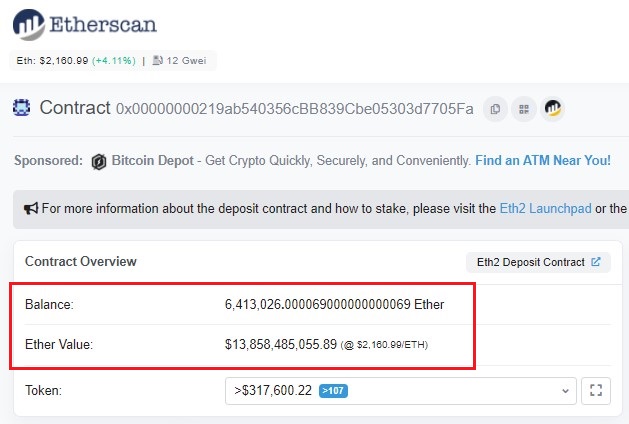

6.413 million ETH is Staked on the Ethereum 2.0 Deposit Contract

Evidence of investor confidence in the Ethereum Upgrade can be seen in the amount of ETH already staked on ETH2.0. At the time of writing, 6.413 million ETH, worth $13.858 Billion, is currently locked on the Ethereum 2.0 deposit contract, as highlighted in the screenshot below. This amount will only be unlocked once Ethereum completely transitions into a PoS network.

Source: Read Full Article