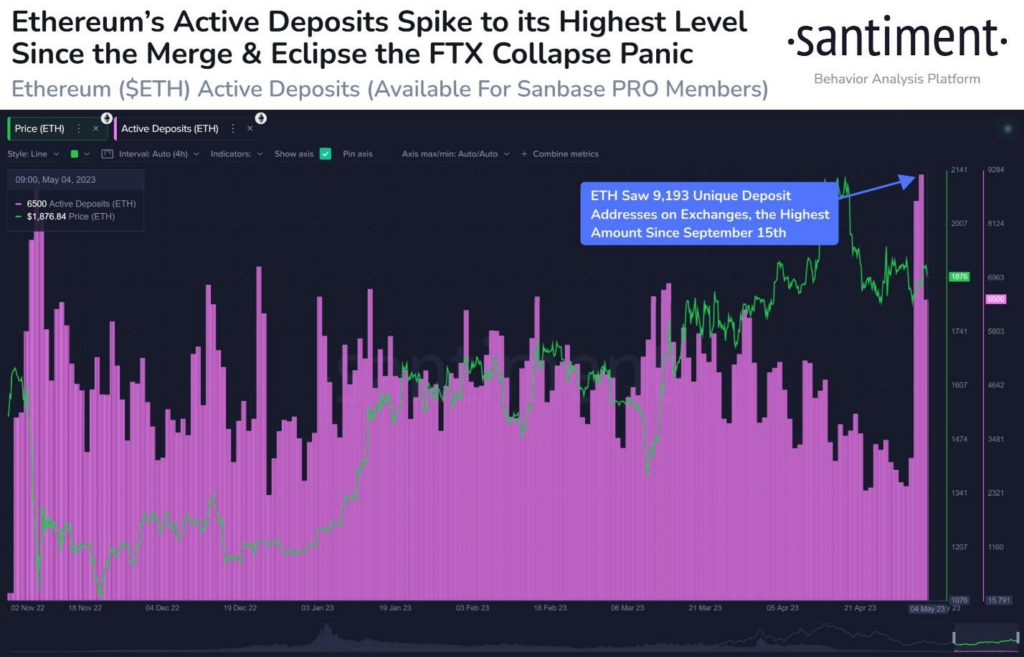

Ethereum's Fate Hangs in Balance as Exchange Deposits Spike to An 8-Month High

Ethereum (ETH), the second-largest cryptocurrency by market capitalization, continued to trade flatly towards the weekend, extending a two-week-long period of lacklustre price volatility.

Since plunging following the Shanghai-Shapella upgrade, the asset’s outlook has continued to weaken, with its price bouncing between $1,825 and $1,930. This weakness has resulted from various issues, key among them exchange inflow, which could be fuelling short-selling.

Exchange Deposits Soar

According to crypto analytics firm Santiment, Ethereum is facing another bout of turbulence as it experiences a fresh influx of coins into exchange addresses.

On Friday, the firm noted that the asset’s active exchange deposits had hit an eight-month high, suggesting that the cryptocurrency may soon be poised for increased volatility.

“Ethereum’s active deposits just hit an 8-month high,” the firm tweeted, noting that Ether saw over 9,000 unique deposit addresses on exchanges. Notably, this has been the highest amount since September 15.

And while the cause of this surge in exchange deposits is still unclear, the firm warned that this trend could lead to an outcome similar to the spikes observed during the merge and FTX collapse. These incidents caused significant volatility in the Ethereum market, creating an unfavourable trading environment for many.

Today’s news comes just days after the firm reported a single transfer of 273,781 Ethereum tokens to Binance, one of the largest self-custody to-exchange transfers in five years.

“With a $505M transfer of Ethereum tokens onto Binance today, this is one of the largest self-custody to exchange transfers in 5 years,” the firm tweeted on Tuesday, May 2. Reportedly, the transfer also led to the largest daily exchange supply increase since the day before the merge.

Ether’s Price Outlook

Normally, when users deposit cryptocurrencies onto exchanges, it indicates that they intend to sell or trade them. Selling can indicate potential negative price movement, so the recent surge in exchange deposits for Ethereum should be a cause for concern for investors and traders.

In the past two weeks, Ether whales with 1,000 to 10,000 Ethereum have offloaded over 110,000 Ether, according to a recent tweet by crypto analyst “Ali-charts.”

According to analyst “Crypto Patel”, Ether’s chart currently shows a strong range-bound market, with strong support at $1800 and resistance at $1930. In his view, there are currently two potential scenarios for Ether’s price.

Either the $1800 support breaks leading to a drop to $1400-$1500, or the $1800 support holds, and the price pushes to the $1930 resistance. If the price breaches that resistance, it could surge to $2100-$2500.

At press time, Ether was trading at $1,840, down 1.32% in the past 24 hours, as per CoinMarketCap data.

Source: Read Full Article