November inflation breakdown: Where are prices rising the fastest?

Consumer inflation cooled in November

November CPI report lighter than expected. FOX Business’ Cheryl Casone with more.

Inflation continued to grip the U.S. economy in November as the soaring cost of rents and food kept consumer prices painfully high.

The Labor Department said Tuesday that the consumer price index, a broad measure of the price for everyday goods including gasoline, groceries and rents, rose 0.1% in November from the previous month. Prices climbed 7.1% on an annual basis.

Those figures were both lower than the 7.3% headline figure and 0.3% monthly increase forecast by Refinitiv economists, a potentially reassuring sign for the Federal Reserve as it tries to tame runaway inflation with a series of aggressive interest rate hikes. It marked the slowest annual inflation rate since December 2021.

In another sign that suggests underlying inflationary pressures in the economy are starting to slow, core prices – which strip out the more volatile measurements of food and energy – climbed 0.2% in November from the previous month, down from 0.3% in October. From the same time last year, core prices jumped 6%.

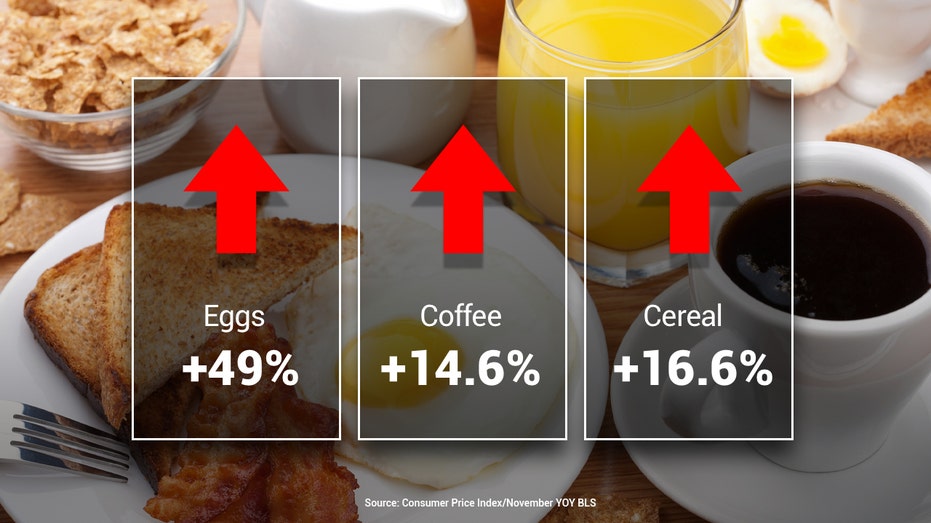

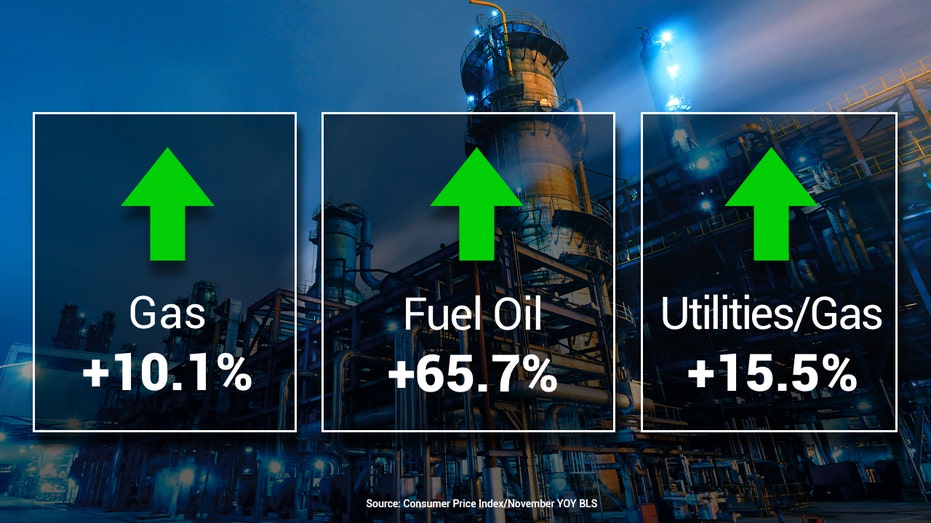

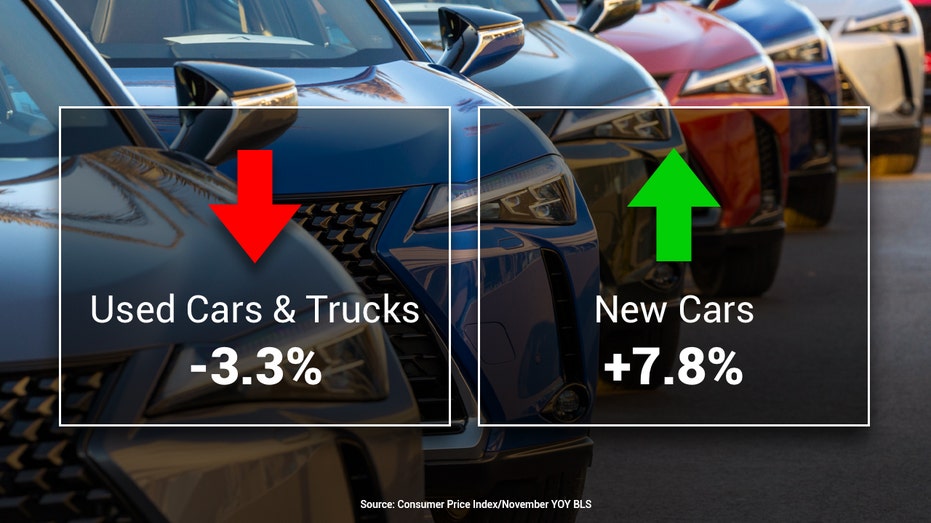

Shoppers in a Kroger supermarket Oct. 14, 2022, in Atlanta. (Elijah Nouvelage/AFP via Getty Images / Getty Images) "The Fed will take some comfort in the sharper than expected deceleration in consumer inflation, however, the rate remains still too high and services inflation [remains too] sticky," said Kathy Bostjancic, Nationwide chief economist. "And with wage growth running above 5% year over year, the Fed will continue to be concerned about wage-price spirals. Rate cuts are not anywhere in the near-term horizon." Here is a breakdown of where Americans are seeing prices rise the fastest – and where there has been some reprieve from higher inflation – as they continue to wrestle with the worst sticker shock in a generation: The cost of eggs, coffee and cereal remain higher than the year-ago period. (FOX Business) Food has been one of the most visceral reminders of red-hot inflation for Americans, with grocery prices climbing 0.2% over the month, according to the unadjusted figures. On an annual basis, food prices have soared 10.6%. Consumers paid more for a number of everyday staples in November. The cost of eggs, for instance, surged 2.3% in the one-month period from October to November. Other necessities that increased in price included cereal (0.5%), bread (2%), fish and seafood (0.2%), fresh fruits (0.8%) and fresh vegetables (0.8%), including tomatoes (5%) and lettuce (8.9%). A “For Rent” sign outside an apartment building in the East Village neighborhood of New York, on July 12, 2022. (Gabby Jones/Bloomberg via Getty Images / Getty Images) In another worrisome trend that will further squeeze U.S. households, shelter costs, which account for about 40% of the core inflation increase, rose 0.6% for the month. Over the past year, shelter costs have climbed 7.1% over the past year, the fastest increase since 1982. Rising rents are a concerning development because higher housing costs most directly and acutely affect household budgets. Another data point that measures how much homeowners would pay in equivalent rent if they had not bought their home, climbed 0.7% in November from the previous month. "Shelter costs continue to rise at a rapid clip," said Jim Baird, Plante Moran Financial Advisors CIO. "The surge in housing costs last year led the way to higher rents as well, as demand for housing far outstripped available supply. The one-two punch of higher prices and skyrocketing interest rates took the wind out of the sails for housing, but the lagged effect is still apparent. That momentum in housing costs is likely to persist well into next year before easing." Energy prices remain elevated from the same period a year ago. (FOX Business) There was some real reprieve for U.S. households last month in the form of lower gas prices, which dropped 3.6% in November from the previous month. Still, gas prices remain 10.1% higher than just one year ago. INFLATION MAY HIT SOME RETIREES TWICE The average price for a gallon of regular gas was $3.24 nationwide on Tuesday, according to AAA. That marks a major drop from the record high of $5.01 set in mid-June and is down from one year ago when prices hovered around $3.33. The cost of electricity also declined by 1.2% in November, though it's still up 13.7% from one year ago. In total, energy prices fell 2.5% last month. However, the drop was not broad-based: Fuel oil rose 1.7% in November from the previous month for an annual gain of 65.7%. The cost of used vehicles fell over the past year, while prices for new cars climbed. (FOX Business) After months of marching higher, the price of cars finally began to subside in November. The cost of new cars fell 0.1% in November from October, although it remains up 7.8% from the year-ago period, according to the unadjusted data. However, the cost of new trucks inched up 0.2% in November and remains 7.1% higher than one year ago. Used car and truck prices, which have been a major component of the inflation increase, also fell 2.8% in October from the previous month. The cost of a used car or truck is now 3.3% lower than it was one year ago. Shoppers look over produce at a store in Rosemead, California, on June 28, 2022. (Frederic J. Brown/AFP via Getty Images / Getty Images) GET FOX BUSINESS ON THE GO BY CLICKING HERE An American Airlines Airbus A321-200 plane takes off from Los Angeles International Airport on March 28, 2018. (Reuters/Mike Blake / Reuters Photos) Airline fares fell in November, with prices down 0.6% from the previous month. Tickets are up 36% over the past year, according to unadjusted data. Source: Read Full ArticleFood

Rent

Energy

Cars

Travel and transportation