Inflation is accelerating under Biden and it's a tax no American voted for

Strong job market, high inflation rate ‘tale of two economies’: Steve Moore

Economist Steve Moore weighs in on the March jobs report.

In January of 2021, President Donald Trump’s last month in office, inflation was running at 1.4%. The economy was in full recovery mode, but consumer prices were actually running BELOW the Fed target of 2 percent.

Fast-forward to today. Inflation hit 8.5% in March. That’s a whopping SIX times higher in just 14 months. We marvel that President Joe Biden and his economic team could screw things up so quickly.

What is even scarier is that inflation is accelerating.

INFLATION SURGES 8.5% IN MARCH, HITTING A NEW 40-YEAR HIGH

In just the last month, prices have risen 1.2%. That may not sound like much, but if that pace keeps up for the year ahead, we would see not 8.5% inflation, but closer to 15%. The trend is ugly.

Inflation at 40-year high for fifth consecutive month

FOX Business’ Cheryl Casone reports on the latest inflation data, which showed another jaw-dropping figure as the war between Russia and Ukraine sent oil and gas prices spiraling higher in March.

Biden is calling it "Putin-flation" and there’s no doubt that the bloody invasion of Ukraine has jacked up energy prices even further. But, Joe, let’s be honest, 80% of the inflation rise happened BEFORE Putin’s military machine rolled into Ukraine.

It also leaves out of the narrative that Biden’s disastrous energy policies have hamstrung our domestic oil, coal, and natural gas production. We went from energy independence and energy dominance to energy begging. Biden would rather get oil from Moscow than Midland, Texas.

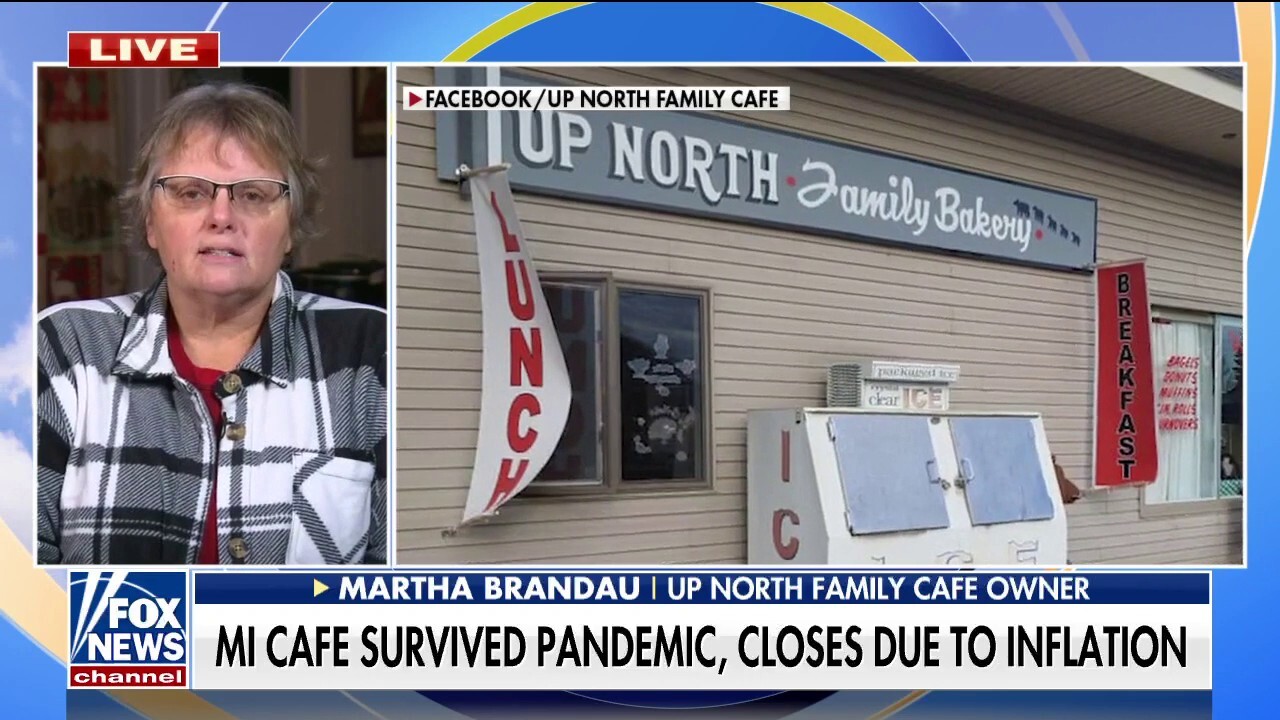

We believe that if Trump were still president today, the United States would be producing 15 million barrels a day of oil. Instead, we are closer to 10 million. That’s a lot of money flowing out of the United States and financing our enemies. Since Biden took office, the real value of the average American’s earnings has collapsed, falling 4.5% in little more than a year. This is the equivalent to losing $2,445 a year, and that’s why inflation is a ‘hidden tax.’ The multi-trillions of dollars of spending by Congress and the White House have also flooded the zone with cheap money that has accelerated the price increases. The total extra spending authorized in 2021 alone exceeded $4 trillion. That was on top of the $1 trillion of COVID money that had been approved by Trump. GET FOX BUSINESS ON THE GO BY CLICKING HERE To finance this multi-trillion-dollar spending spree, the Fed, led by Chairman Jerome Powell, has primed the pump by buying up assets (which shovels more dollars into the economy) and he has kept interest rates at historic low levels. His rate hikes so far have been slow in coming and timid. Remember, the Fed told us six months ago that inflation was "transitory." How long does transitory last? Who gets hurt by Biden’s ragin’ inflation? Since Biden took office, the real value of the average American’s earnings has collapsed, falling 4.5% in little more than a year. This is the equivalent to losing $2,445 a year, and that’s why inflation is a "hidden tax." Up North Family Café owner Martha Brandau says rising prices made it a ‘no-brainer’ decision to close the restaurant indefinitely. No one in Congress voted for this tax. None of us can vote out Fed Chair Jerome Powell for this miserable performance in doing his primary job of keeping the currency strong and stable. It hasn’t helped matters that the Biden administration has been pushing the Fed to expand its mission to climate change, "diversity," and "inclusion." It’s no wonder the Fed took its eye off the ball of fighting inflation. It’s clear to us that policymakers could do three things to stop the accelerating inflation tax. CLICK HERE TO READ MORE ON FOX BUSINESS First, stop the spending and approve an across the board cut in federal spending by 5 to 10%. FILE – Federal Reserve Chairman Jerome Powell, right, testifies before the Senate Banking Committee on Capitol Hill. (AP / AP Newsroom) Second, get back to an America first energy policy of producing here at home massive increases of domestic production of oil and gas. This would increase the global supply and take power away from the OPEC countries to raise prices. Finally, the Fed has to raise interest rates faster to stem this tidal wave of higher prices. We aren’t confident that any of these things will happen anytime soon, and that means Bidenflation could get a lot worse before it gets better. And at that point, it will be too late for a soft landing. A 1982-type crash landing would be more likely and that will cause a lot of pain and suffering. Stephen Moore is a distinguished fellow in economics, and E. J. Antoni is a research fellow in the Center for Data Analysis, at the Heritage Foundation. Moore is a cofounder of Committee to Unleash Prosperity where Antoni is a senior fellow. Source: Read Full ArticleFamily café closes doors due to inflation: ‘It’s a sad day for us’