Democrats’ IRS bank account monitoring plan would affect 87M Americans, analysis shows

IRS bank reporting proposal ‘will end up getting dropped’: Laperriere

Cornerstone Macro Head of U.S. Policy Research Laperriere discusses the IRS bank account controversy, reconciliation bill price tag, tax increases and climate change proposals.

Tens of millions of Americans could see their bank account information swept up and reported to the Internal Revenue Service under a deeply controversial proposal from Democrats, according to a new analysis.

Democrats crafted a plan earlier this year to require banks and other financial institutions to disclose accounts with $10,000 of annual deposits or outflows to the IRS, a move intended to help the agency crack down on wealthy tax cheats.

Recipients of federal benefits like unemployment and Social Security would be exempt from the policy under the latest iteration of the proposal, which would also exclude any income received through a paycheck in which federal taxes are automatically deducted.

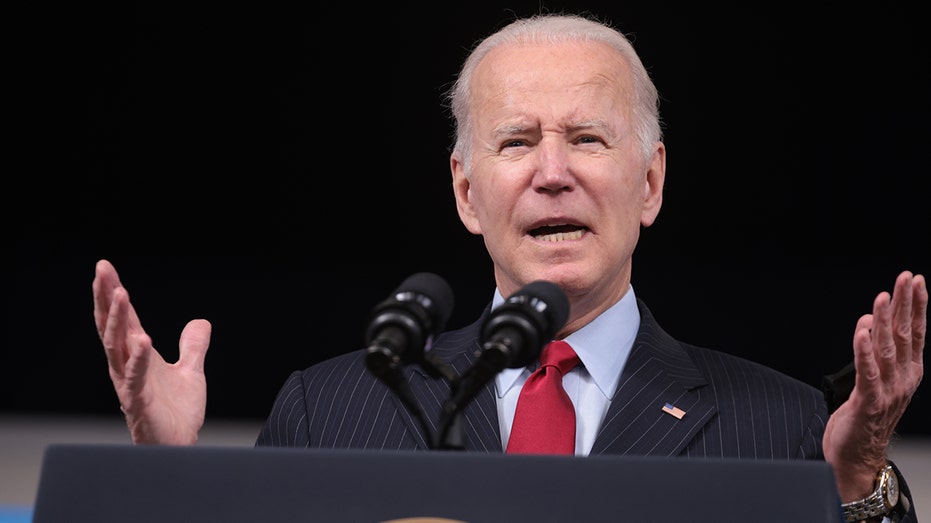

U.S. President Joe Biden speaks on the economy in the Eisenhower Executive Office Building in Washington, D.C., U.S., on Tuesday, Nov. 23, 2021. (Oliver Contreras/Bloomberg via Getty Images / Getty Images) The Joint Committee on Taxation estimated that some 87 million Americans who earn less than $400,000 in adjusted gross income would see their account information reported to the IRS. That represents a little more than half — about 59% — of the 148 million taxpayers in the U.S. earning less than $400,000. MANCHIN SAYS CONTROVERSIAL BANK-REPORTING PLAN LIKELY OUT OF FINAL SPENDING BILL The proposal will almost certainly not become law: House Democrats passed a version of the Build Back Better bill that omitted the IRS monitoring provision after opposition from Sen. Joe Manchin, who called it "screwed up." Revenue from the plan was intended to pay for Biden's signature economic spending measure, but it faced fierce criticism from banks, industry groups and Republicans. The analysis from the JCT came in response to a question from Rep. Jason Smith, R-Mo., who asked the tax scorekeeper to see how many Americans the policy would encompass. A man enters the Internal Revenue Service (IRS) building in Washington, D.C., U.S., on Friday, May 7, 2010. (Andrew Harrer/Bloomberg / Getty Images) "Is it fair to assume that an hourly W-2 worker who also drives Uber on the side or sells on eBay would have all of his or her income subject to scrutinization – severely punishing Americans for nothing more than working hard and trying to provide for their families?" Smith wrote in a letter dated Nov. 2. The White House has repeatedly defended the plan in the face of bank criticism, writing in a memo to congressional Democrats that requiring banks and financial institutions to provide a "little bit of high-level information" to the IRS on account flows gives the agency more information about wealthy Americans' earnings from investments and business activity. GET FOX BUSINESS ON THE GO BY CLICKING HERE The Biden team has stressed that banks will not have to report individual transactions to the IRS, but rather "basic, high-level information on account inflows and outflows" and that audit rates for Americans earning less than $400,000 annually would not go up. Banks are already required to report any individual transaction that exceeds $10,000 to the Financial Crimes Enforcement Network – part of anti-money laundering requirements. Source: Read Full Article