NFT Transaction Volume Plummets 90%: Has the NFT Bubble Burst?

After several weeks of price crashes and doldrums, the cryptocurrency market at large is showing signs of recovery. However, the non-fungible token (NFT) sector of the market may be a different story.

Over the last 24 hours, several headlines have reported that the NFT market has more or less “officially crashed”: for example, Gizmodo reported that “The current answer to the question ‘What is the value of an NFT’ appears to be ‘not much and dwindling fast.’”

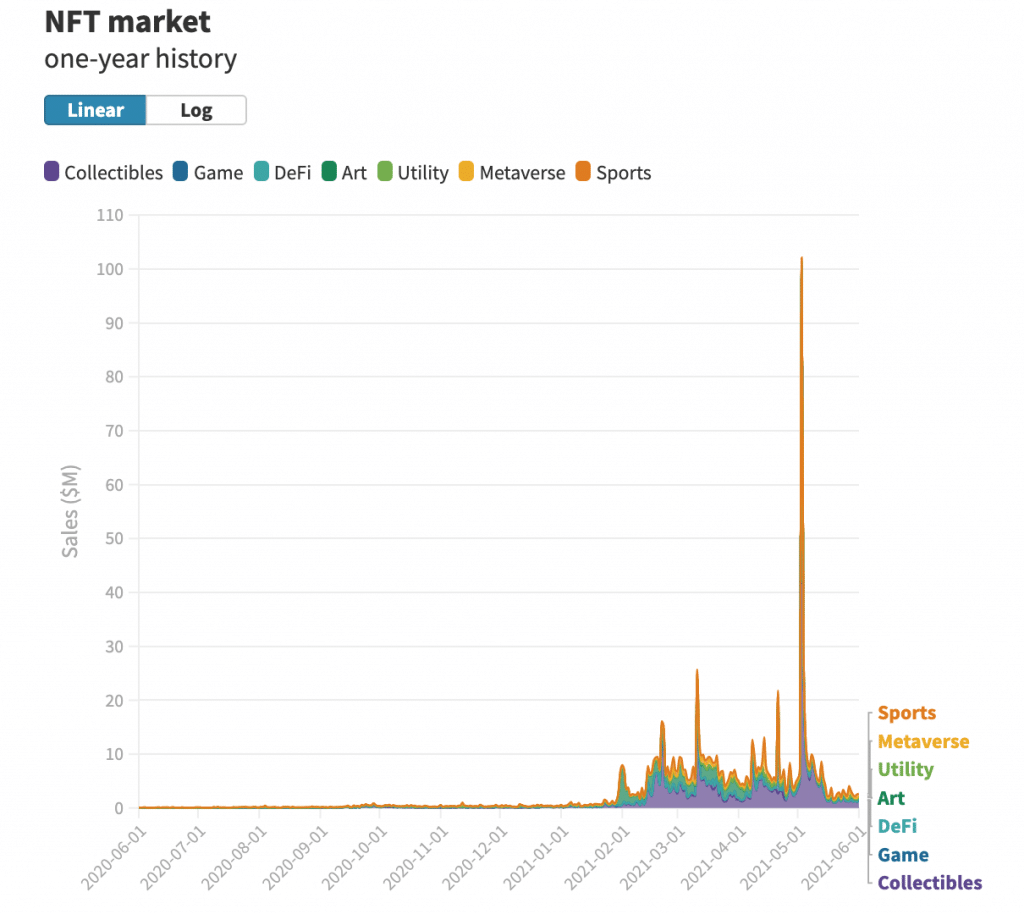

And, indeed, there was a steep drop in non-fungible token transaction volume over the course of May. Data from NonFungible.com shows that the week-long period surrounding the NFT market peak at the beginning of May saw $170 million in transactions. However, as reported by Protos, that figure has collapsed to just $19.4 million in NFT sales –a decrease of roughly 90%.

This steep drop in NFT sales could represent the confirmation of what many non-fungible token skeptics have been saying for months: that the boom in NFT markets earlier this year was nothing more than a hype-driven bubble.

However, proponents of these unique digital objects have a different point of view: that the NFT landscape is shifting, and–like the crypto market before it, many times over–that the crash is a healthy correction on the pathway to a more robust non-fungible token industry.

Which is true? Perhaps both.

May’s crypto market crashes may have had an outsized effect on NFTs

After all, cryptocurrency markets in general are famous for their volatility. Although Bitcoin is growing less volatile as its market cap continues to expand, its movements still have a large influence on coins with smaller caps. For example, when the price of BTC dropped roughly 30 per cent in May, some smaller-cap coins saw drops of 50-60 per cent–or even more.

And indeed, some analysts have connected the dots between the BTC drop and the decline in non-fungible token markets throughout the month of May: that as leverage was rinsed out of Bitcoin markets, much of the capital that had flowed into altcoin and NFT markets based on speculation and hype was similarly sent down the drain.

As a result, each of these markets was left bare–BTC with its diamond-handed die-hards, altcoins with their hopeful tech believers, and NFTs with a small, core group of serious collectors and artistic fans. In other words, the investors who stayed in each of these markets were a slimmer group of core believers in the technology and use cases that each of these crypto-asset sub-classes has.

NFTs may have been disproportionately affected by the cryptocurrency market crash last month because their use cases have not been as well-defined as the use cases of Bitcoin and altcoins. Andrew Miller, Head of Product Marketing at Oasis Labs, told Finance Magnates that “Current use cases of NFTs are limited to assets such as digital art, where buyers speculate on the piece’s potential value when marking their purchase.”

“This speculation is largely predicated on a belief that they will have social and historical value,” Miller told Finance Magnates. And indeed, the NFTs that have fetched large dollar amounts as of late have been associated with images or works of art that have penetrated the zeitgeist in some way–for example, Zoe Roth, also known as the “disaster girl”, fetched nearly $500K for the “original” copy of the meme in which her face is featured.

Over time, however, Miller expects that NFT use cases will continue to expand–and, as such, that investments in NFTs will be less based on speculation: “As the technology surrounding NFTs matures, we expect to see them represent assets that are more sophisticated and have higher intrinsic value,” he said.

Miller pointed specifically to an NFT project that his own company, Oasis Labs, recently initiated: “Take, for example, our recent partnership with Nebula Genomics & Akoin to mint an NFT that represented Harvard professor George Church’s sequenced genome data.”

“By backing NFTs with more valuable assets, we can unlock new economies where individuals, creators, and businesses can leverage financial vehicles to trade, monetize, and even collateralize off-chain assets on a diverse blockchain ecosystem.”

Addressing the NFT industry’s ongoing environmental issues will take time and education

In the meantime, however, the NFT industry has some important issues to address.

Perhaps the largest PR problem that the NFT industry has been dealing with so far is the narrative that NFTs are bad for the environment. Non-fungible token creators have faced intense backlash over beliefs that the tokens they mint have hefty carbon footprints.

However, the connection between minting a non-fungible token and energy consumption is hotly debated. Michael Blu, Co-founder of eco-conscious NFT platform LGND, told Finance Magnates that “We still have some educating to do when it comes to NFTs’ environmental impact.”

“The dominant narrative surrounding non-fungible tokens continues to be that they have an outsized carbon footprint, but this story is too narrow to accurately encompass the entire NFT space,” Blu said. “It incorrectly assumes that all NFTs are minted on Ethereum, which does consume a lot of electricity via its current deployment of proof-of-work consensus, but many other blockchains have emerged and are being utilized for NFT mints, including WAX, a proof-of-stake blockchain.”

Indeed, NFT proponents argue that there is not a direct relationship between the creation of a non-fungible token on the Ethereum blockchain and Ethereum’s total carbon footprint; others are in favour of using less carbon-intensive blockchains. Others still are holding off from creating NFTs until Ethereum completes its switch from a Proof-of-Work to a Proof-of-Stake consensus algorithm, which is slated to drastically reduce the amount of electricity it uses.

In spite of the non-fungible token industry’s carbon controversy, “I think the public is more aware of the potential for NFTs to transform the creative economy,” Blu said.

̧

“Many people are living through the digital transformation that all aspects of society is undergoing, and so understanding the digital art revolution, and the need for artists to verify the authenticity of digital works is more intuitive.”

The concept of NFT “ownership” still has a few kinks to work out

For example, Joanne Eberhardt, the Marketing Communications at Ton Labs, pointed to a major problem in the way that NFT “ownership” currently operates: that while it’s possible to own an NFT that corresponds to any kind of digital “object,” the permanence of that object is not guaranteed.

“There is no real NFT market and there never was one,” she said. “It’s make-believe.”

What does this mean? According to Joanne, until Web 3.0 is achieved–and, by extension, “true NFTs that are created on decentralized servers with decentralized backends,” any existing NFTs are “little more than something that can be removed from existence at the whim of the owner of the server or site, or at the behest of a third party with authority,” Joanne explained.

Indeed, earlier this year, Vice reported on the mysterious case of “vanishing” NFTs. The article explained that “̌When you buy an NFT…in most cases, you’re not purchasing artwork or even an image file. Instead, you are buying a little bit of code that references a piece of media located somewhere else on the internet.” As such, if that file is taken down by The Powers That Be, there’s no guarantee that it will ever reappear.

Joanne explained that therefore, true NFT “ownership” will not be possible until the web is truly decentralized; only then will truly permanent and immutable digital file storage be possible.

The future of the NFT industry

Still, in spite of the issues that this nascent market has yet to resolve, many analysts and technologists believe that the non-fungible token market of the future will be a resilient, diverse landscape, filled with myriad use cases.

“NFTs were born around things like kitties and punks, and as a result people still tend to go to that place of photos or music when thinking about NFTs,” Ton Labs’ Joanne Eberhardt told Finance Magnates. Earlier this year, this gave way to a “‘pop movement’” of “celebrities selling their own NFTs, popularizing adoption as a matter of both endorsement as well as new business ideas through collectables.”

“I think once the media hype around this movement subsides, the time will come when millions will understand that NFTs are way more than just art, and instead can be manifested in so many different ways,” Joanne said. “This will become a true market that stretches way beyond blockchain enthusiasm and instead moves toward adoption. Real adoption. Mass adoption.”

As such, “I think we have only seen the first drops into what will inevitably become an ocean of honey,” she said, referring to investor interest in NFTs over the long term. “The market will explode once NFTs can be guaranteed to exist outside of centralized environments and without the need to belong to any elitist clubs or foundations or to have to register anything. Have an idea? Make an NFT. Sell it. That will break open the flood gates and change the game forever.”

Source: Read Full Article