EOS TVL Up by More Than 200% in February

EOS had a TVL of $69.54 million at the start of February and experienced a sharp increase to $273 million on February 23. On March 1, its TVL stood at $283 million, representing a roughly 9% increase over a month. The vast majority of its TVL comes from EOS REX.

This could be considered an optimistic sign for EOS, which has had a rough few years. Development since its announcement has steadily shifted towards Ethereum and other networks, which has negatively affected EOS price. From being in the top assets by market cap, it has dropped to the position by 56 at the time of publishing.

But there may be a bright future yet for EOS, which is showing some signs of a burgeoning DeFi market. Lending platforms, a cornerstone of the DeFi market, now exist on the EOS network and could herald a second coming for the network.

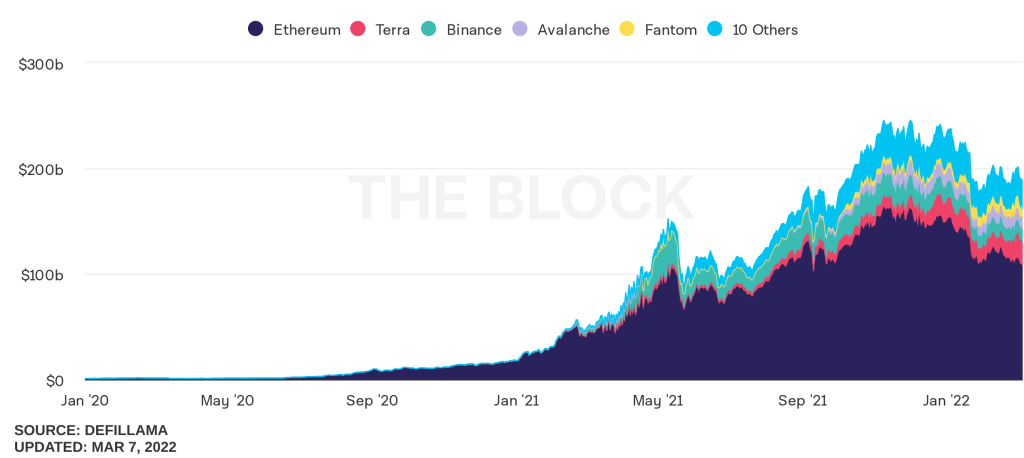

However, there will still be some work yet for EOS to catch up with its competitors. The latter group, spearheaded by Ethereum, has made major progress with DeFi, though the past few days have seen some slumps. EOS will need some captivating unique selling points to gain that ground.

EOS Being Outshone by Competitors

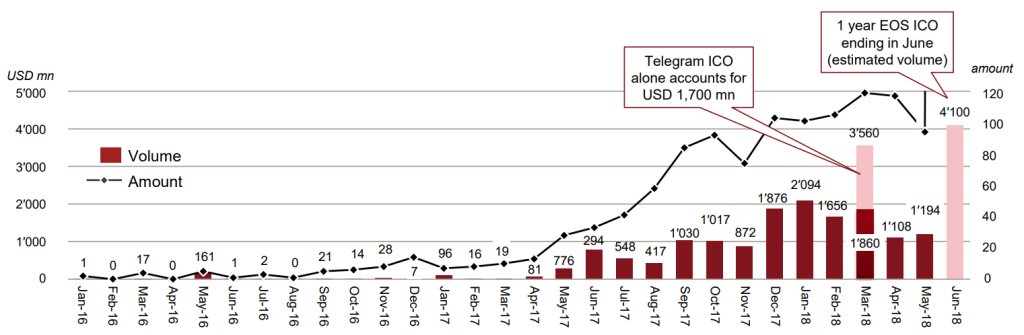

The amount locked in does pale in comparison to Ethereum, which has many billions locked in. This is something of a disappointment for EOS enthusiasts, who have long held the belief that it could topple Ethereum as the premier DApp platform. EOS held one of the biggest ICOs of the market’s history, raking in more than $4 billion.

However, EOS has been making some progress in the past few months. One major contributor to the increase in its TVL is the DeFi lending DApps EOS REX and DeFiBox, which are the top two contributors.

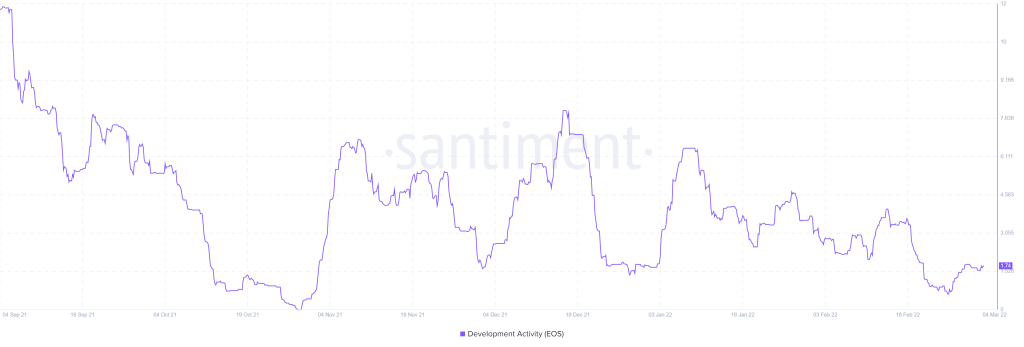

Develop activity is also showing signs of holding steady, with Santiment data showing consistent development activity over time. The consensus seems to be that EOS is still undergoing development, even if newer networks have popped up since.

Source: Read Full Article