Defi Flies to New Highs

The Decentralized Finance (DeFi) ethereum ecosystem has far surpassed its previous all time high.

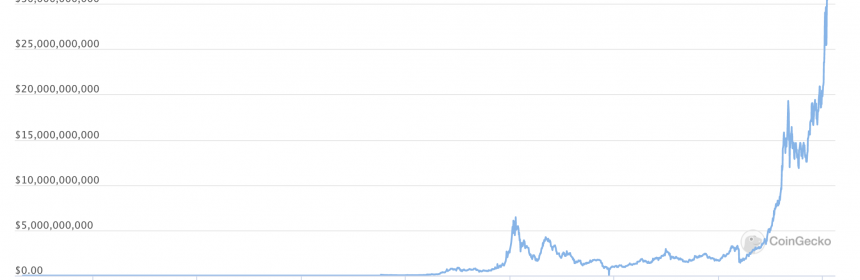

The combined market cap of all defi tokens is now nearly $34 billion, handling some $13 billion in trading volumes.

That’s considerably more than the $18 billion peak during the defi summer of 2020 as pictured above.

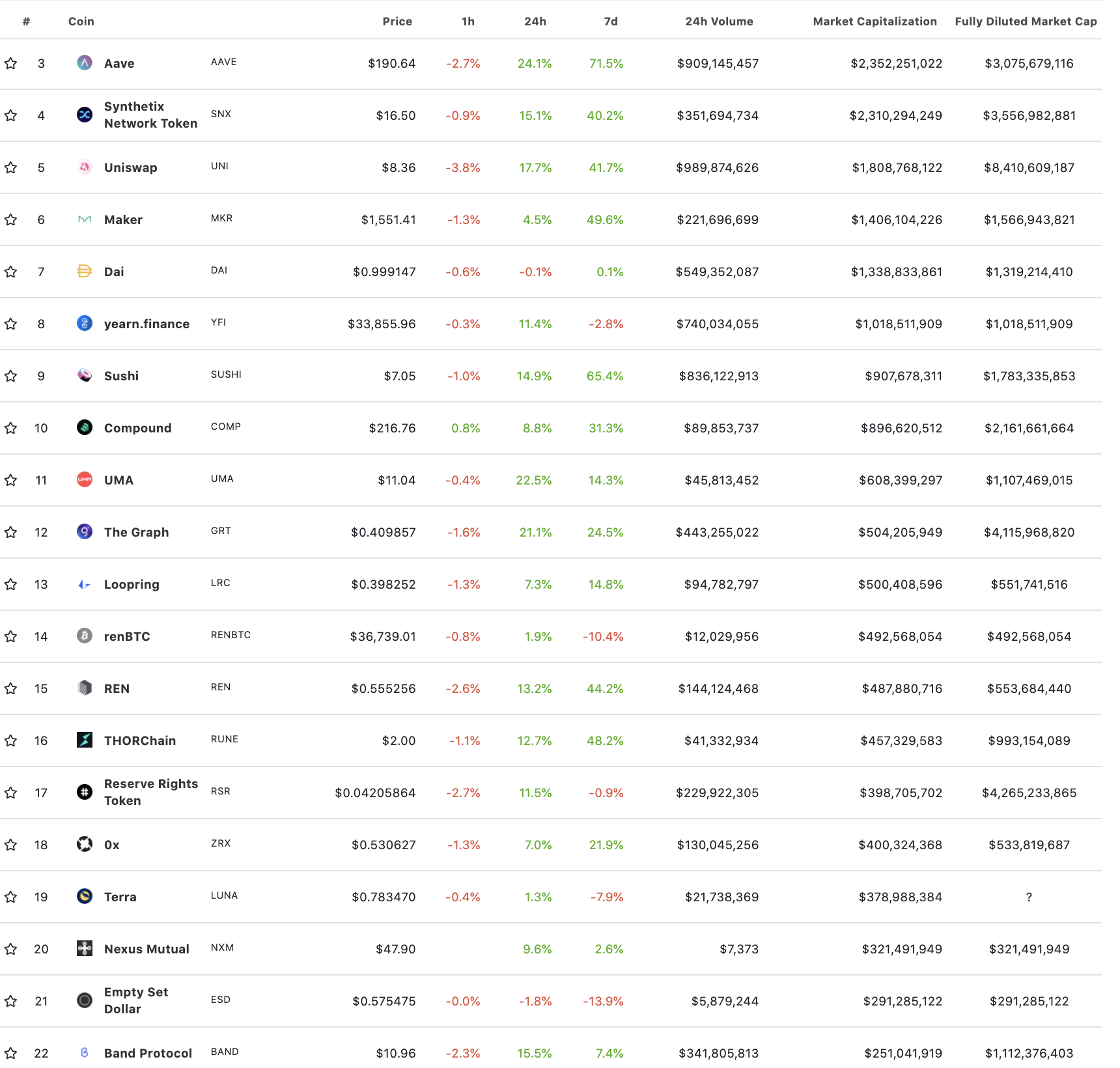

There’s numerous tokens now with a market cap above $1 billion, Aave rising to the very top of them all.

Unlike cryptos, these tokens are kind of like traditional publicly traded companies with revenues and profits as well as an equivalent of token dividents.

Uniswap for example has processed $2 million in fees during the past 24 hours for their 28,500 trading pairs.

These fees go to token holder with some going to liquidity providers, making these dapp systems amount to effectively decentralized autonomous organizations (DAOs) governed by the token holders.

Synthetix thus has risen to $2.3 billion, with this code based derivatives market having a defi index where you can effectively buy a basket of these tokens instead of select each and everyone.

That defi index has nearly doubled in days, showing much bullishness in this corner where innovation is accelerating.

Curve is apparently tokenizing a contract and then hedging it with it possible you can now tokenize this tokenized contract and hedge.

In effect they’re building complexity to hopefully end up with simplicity managed by the code in a fully transparent way.

That makes all this extremely efficient and the cost of handling it all far lower than in traditional finance, leading to a superior product and thus the growth of defi.

Some of that growth presumably will make its way to eth, if it is not doing so already, with a lot of this ecosystem having eth at its core even as tokenized bitcoins reach $5.5 billion with wBTC accounting for $4 billion of it.

Source: Read Full Article