Crypto Markets Started Running Behind the Fed

According to the recent research “Are Cryptocurrency Markets Running Behind The Fed? A significant shift in crypto markets microstructure” published by GrinisRIT and Finery Markets, 2021 became a year when crypto markets significantly adjusted it’s behavioural patterns, showing an increasing institutional influence.

The paper came with 2 major conclusions:

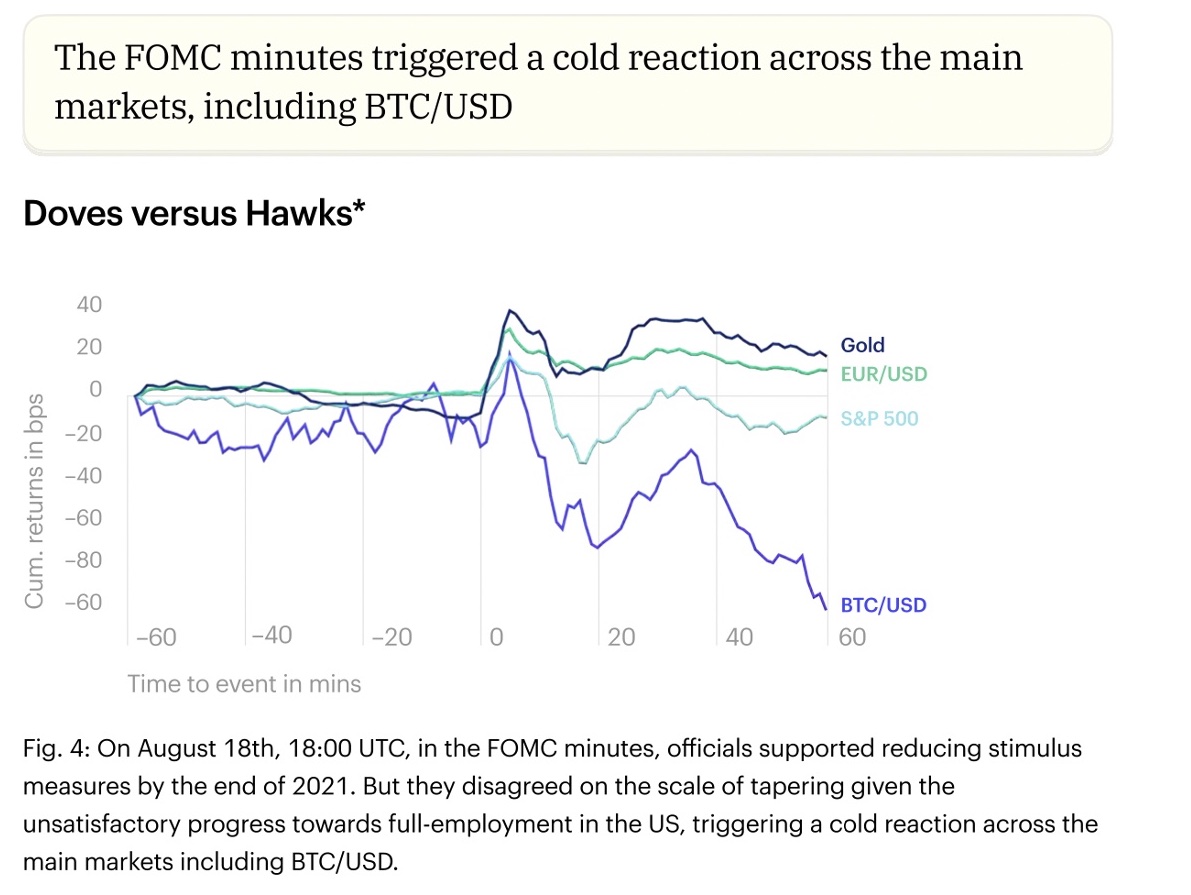

- In contrast to recent research, it was noted that BTC/USD was sensitive to major Fed policy announcements in Q2-Q3 2021 similar to main asset classes: commodities, equities & currencies.

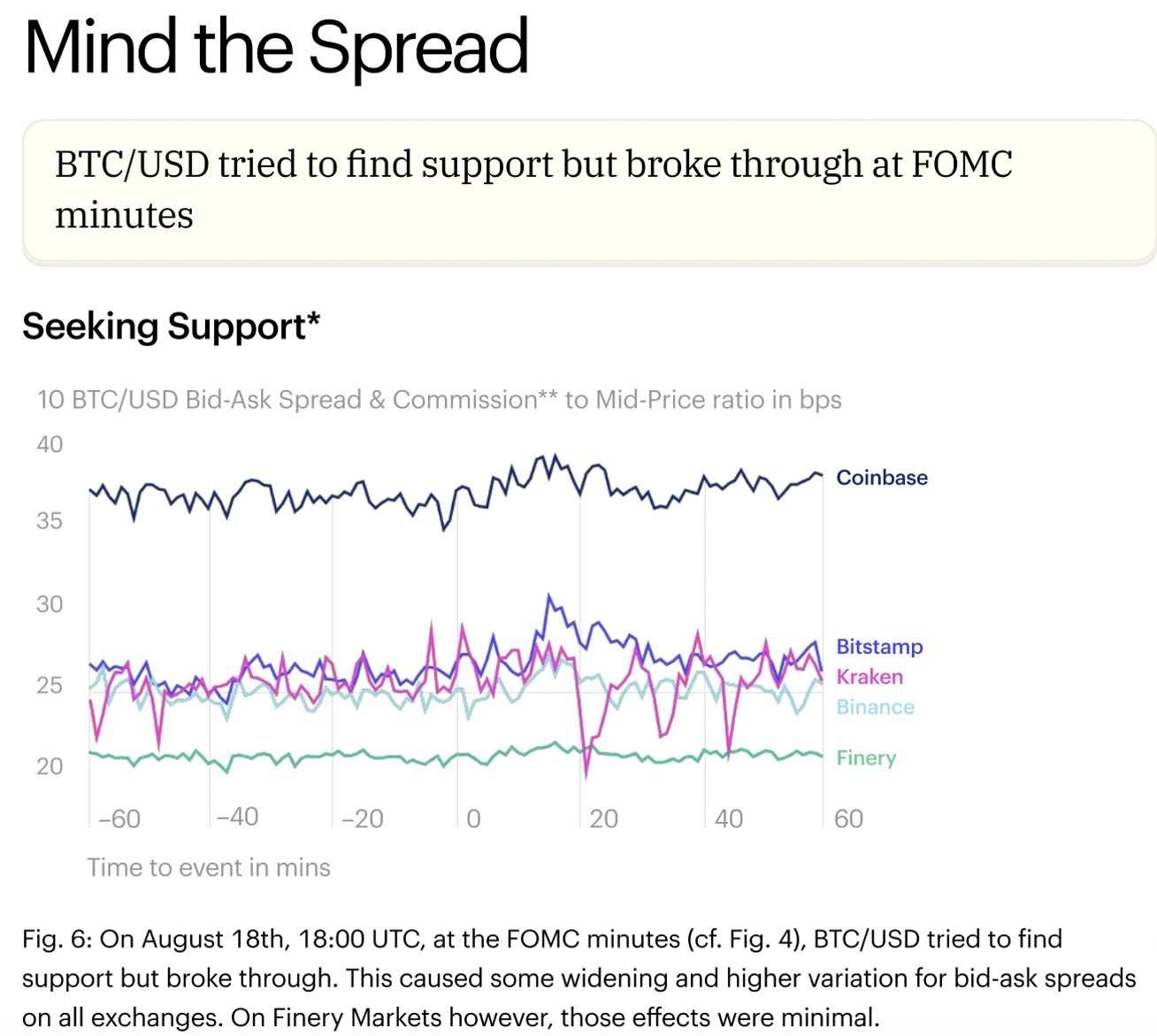

- OTC liquidity providers tend to provide twice as narrow spreads in comparison to major Centralised Crypto Exchanges during market volatility related to macroeconomic news.

The report analyzed data from major exchanges like Binance, Kraken, Coinbase and Bitstamp and global OTC desks: BlockFills, Cryptology, DV Chain, oneAlpha and Veliona on wholesale marketplace Finery Markets.

Various researches from 2019 and 2020 hardly managed to capture any sensitivity to the macroeconomics calendar, apart from forward-looking surveys. They ended up claiming that no influence from major index readings and policy announcements could be determined.

However, this year Bitcoin started to react to major macroeconomic news in a very similar manner to Gold and EUR prices. The events analysed included release of unemployment data and various Federal Reserve announcements.

What is important: during most of the macro events the pricing quality on major exchanges was worse relative to the OTC liquidity desks that were able to provide tight pricing.

Crypto market maturity will bring even more changes to the market’s structure. But we already have signs of crypto behaving as one of the major traditional asset classes.

In order to get a clear picture of digital assets going mainstream among the institutions, Finery Markets is conducting a survey on how institutional traders and investors execute trades in the digital assets markets. The results of that survey will be published in a report together with PwC and the goal is to gain a better understanding of institutional players’ situation and preferences in the maturing digital assets markets.

If you are a business entity that trades digital assets on larger scale, your participation in this survey would be highly valuable.

Survey takes between 5 to 7 minutes and here is the link – https://forms.gle/xFwdnDqygzK8z2Hp8

Source: Read Full Article