Bitcoin Just Dropped Below $33,000: What Analysts Are Saying

Bitcoin has begun to drop lower once again despite the flush on Monday to $30,000. The leading cryptocurrency currently trades for $32,500, below the $36,000 highs the cryptocurrency saw during a bounce earlier today.

Bitcoin’s drop comes in spite of the fact that the funding rates on leading crypto-asset futures platforms have reset. The funding rate is the reoccurring fee that long positions pay short positions to maintain the price of the future to the spot price. High funding rates, such as those seen on Saturday, are what signaled a correction to many on the weekend.

The cryptocurrency could see further losses, some analysts say.

Bitcoin Set to Drop Lower?

Not all analysts are convinced that the Bitcoin shakeout is done despite the cryptocurrency losing nearly 30% in the span of 48 hours.

Commenting on the recent price action and what is likely to come next, one crypto-asset analyst recently remarked:

“Still think we could use another drop lower to really take out some liquidity to fuel the next leg up to $50k+”

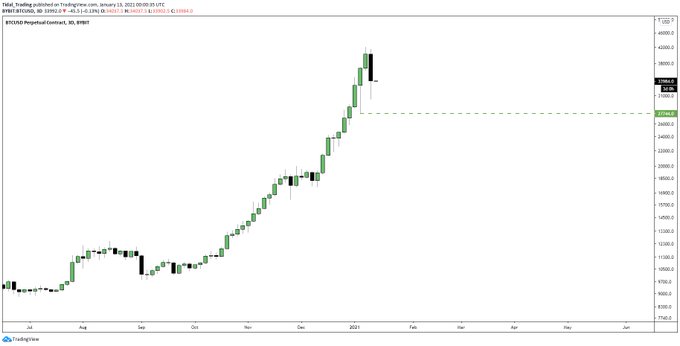

Chart of BTC’s price action over the past few months with an analysis by crypto-asset naalyst HornHairs (@CryptoHornHairs on Twitter).

Source: BTCUSD from TradingView.com

Related Reading: DeFi Founder Targeted in $8m Hack Says He Has His Hacker’s IP

On-Chain Trends Remain Bullish

Despite Bitcoin’s drop, on-chain trends for this market remain bullish. Aleks Larsen, a venture investor at Blockchain Capital, said on HODLer trends for Bitcoin:

“6/ Looking pretty good for growth rates in the HODLer segment! Nice and steady growth for BTC through the bear market. Retail is starting to pop in but for most of 2020 this was institutionally driven – less additional holders, but much larger position sizes.”

Another positive sign to look forward to is Grayscale Investments re-opening private placements for its cryptocurrency investment trusts.

Analysts found in December that whenever private placements were closed, Bitcoin underperformed. The reopening of these trusts to institutional and accredited players may drive prices higher as capital floods into the space.

Source: Read Full Article