Avalanche (AVAX) Climbs Higher: Q1 2023 Results Show Impressive Growth

According to the latest report by Messari, Avalanche (AVAX) has shown a strong rebound in the first quarter of 2023. The market cap of the blockchain platform increased by 65.8% quarter on quarter (QoQ), reflecting the broader market trend and the thaw of the crypto winter that took by storm the crypto industry in 2022.

Avalanche’s Q1 2023 Performance

According to the report, Avalanche experienced a decline in daily average active addresses and transactions during Q1 2023. The 20.7% and 31.9% decline followed an anomalous spike and a high growth period of subnet activity in Q4.

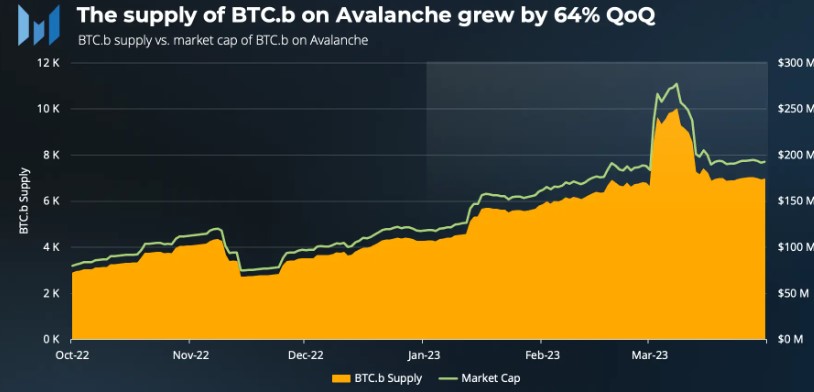

However, the report also highlights that Avalanche’s supply of Bitcoin BEP2, a token on the Binance chain (BTC.b), increased by 64% during Q1, reaching over $250 million in market cap. This is a positive sign for the platform’s growth and demonstrates the increasing interest in Avalanche as a blockchain platform.

The report further notes that mainstream interest in Avalanche network infrastructure continued to grow during Q1, with partnerships with blockchain services (AWS) and Tencent Cloud, a secure, reliable, and high-performance cloud computing service. This demonstrates the growing recognition of Avalanche as a major player in the blockchain space.

In addition, Avalanche launched several notable developments during Q1 aimed at ushering in developers. These include the launch of HyperSDK, Glacier API, and integration with The Graph. These developments are expected to increase the adoption of Avalanche as a blockchain platform and attract more developers to build on the platform.

The Avalanche Effect

According to Messari, Avalanche’s Total Value Locked (TVL) denominated in USD increased by 4.2% QoQ in Q1 2023, following the crypto market relief rally in January. However, TVL denominated in AVAX declined by 34.3%, suggesting that the increase in USD was due to asset price increases rather than new capital inflow.

Despite this decline, liquid staking derivatives (LSDs) and yield farming platforms supported Avalanche and its DeFi ecosystem. Benqi liquid staking TVL grew by 88.6% QoQ to $100 million by the end of Q1, and Vector Finance, a yield optimization platform, increased by 50% QoQ to $36 million. Collectively, these two protocols finished Q1 in the top 10 by TVL, with ~$136 million in TVL.

Avalanche’s most prominent protocol by TVL denominated in USD, Aave, was down slightly 5% QoQ, but Benqi Lending, Trader Joe, and GMX grew by 49%, 24%, and 70%, respectively. However, there remained concentration risk in the leading application, with Aave making up 43% ($432 million) of Avalanche’s DeFi TVL by the end of Q1.

Avalanche Validators Show Volatility

According to the report, Avalanche’s network health remained stable in Q1 2023, with the average number of validators, total stake, and average engaged stake remaining consistent. However, the average number of delegators grew by 26.1% QoQ, indicating increasing participation in the network.

Despite the stability of stake across a greater number of validators and delegates, there was some volatility in the number of validators that went offline during Q1. Both the average amount of unresponsive stakes and the number of unresponsive validators increased by over 70% QoQ. However, the percentage of unresponsive stakeholders and validators remained high enough to sustain block production.

Overall, the Messari report indicates that Avalanche’s network health remained stable in Q1 2023, with consistent numbers of validators, total stake, and average engaged stake. The growth in the number of delegators also suggests increasing participation in the network.

While there was some volatility in the number of validators that went offline during Q1, the percentage of unresponsive stakes and validators remained high enough to sustain block production. These findings demonstrate the continued growth and resilience of the Avalanche network and its potential for further expansion and adoption in the blockchain space.

Featured image from Unsplash, chart from TradingView.com

Source: Read Full Article