U.S. Employment Jumps In May But Misses Economist Estimates

Job growth in the U.S. reaccelerated in the month of May, according to a closely watched report released by the Labor Department on Friday, although the increase in employment still fell short of economist estimates.

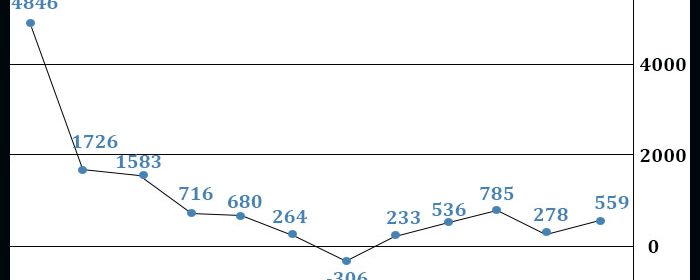

The report said non-farm payroll employment jumped by 559,000 jobs in May after climbing by an upwardly revised 278,000 jobs in April.

Economists had expected employment to surge by 650,000 jobs compared to the addition of 266,000 jobs originally reported for the previous month.

Paul Ashworth, Chief U.S. Economist at Capital Economics, noted employment remains 7.6 million below its pre-pandemic peak and said it would take more than 12 months at the current pace to fully eradicate the shortfall.

“Only a few months ago we had expected to see several months’ worth of gains north of one million as the economy reopened, but labor supply is bouncing back much more slowly than demand,” Ashworth said.

Employment in the leisure and hospitality sector showed another significant increase, spiking by 292,000 jobs during the month. Notable job growth was also seen in public and private education and health care and social assistance.

The Labor Department also said the unemployment rate fell to 5.8 percent in May from 6.1 percent in April, while economists had expected the unemployment rate to dip to 5.9 percent.

With the bigger than expected decrease, the unemployment rate dropped to its lowest level since hitting 4.4 percent in March of 2020.

The decline in the unemployment rate came as household employment jumped by 444,000 persons and the labor force shrank by 53,000 persons.

The report also said average hourly employee earnings climbed by $0.15 or 0.5 percent to $30.33 in May. Annual wage growth accelerated to 2.0 percent in May from 0.4 percent in April.

“Overall, in any other set of circumstances, monthly gains in excess of half a million would be amazing but, with a 7.6 million shortfall, it will be some time at that pace before the Fed’s ‘substantial further progress’ has been met,” Ashworth said.

The Federal Reserve has said it won’t begin tapering its asset purchases until “substantial further progress” has been made toward its goals of maximum employment and price stability.

Source: Read Full Article