Revolut's additional fees for Ireland customers make its free offering less attractive

- Revolut introduced additional fees on its free plan that could push Irish users toward its paid accounts.

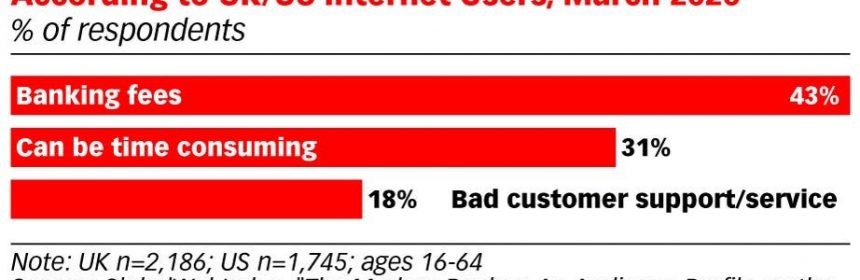

- But consumer sentiment over banking charges suggests an uphill battle could lie ahead.

- Insider Intelligence publishes hundreds of research reports, charts, and forecasts on the Banking industry. Learn more about becoming a client.

The UK-based neobank recently announced additional limits on no-fee ATM withdrawals and international money transfers for its Irish customers, per the Independent.

Users of its free Standard account are now restricted to five no-fee ATM withdrawals per month, in addition to the €200 ($228.05) per month limit on no-fee withdrawals that is currently in place. Standard customers who exceed either threshold will be charged a fee equal to 2.00% of the transaction or €1 ($1.14), whichever is greater. The €1 minimum fee is a new addition to all customer accounts.

Customers of Revolut’s paid Plus, Premium, or Metal accounts will not be limited to a specific amount of withdrawals, though they will face the same minimum fee if they exceed the monthly limit specific to their account. Since it brought its services to Ireland in 2019, Revolut has grown its customer base to over 1.2 million people in the country, or nearly a quarter of the total population.

Revolut’s new fees could be part of a bigger strategy to push users toward its paid accounts, and it follows a broader trend of neobanks turning to bank charges as they struggle to survive. Here’s how Revolut and other neobanks are monetizing their user bases as they search for a path to profitability:

- Increasing fees on standard accounts could sway users to instead opt for paid offerings. Starting last summer, the neobank began to introduce limits on certain capabilities for its standard accounts. Profitability has been fleeting for Revolut, and the recent changes could be a sign it’s focusing its overall strategy. By promising more perks (like travel and investment features) and fewer restrictions in return for a monthly fee, Revolut can build a stickier business model and a steadier income stream, thereby boosting its shot at profitability.

- Neobanks are increasingly reliant on fee income. Neobanks worldwide entered the playing field as a purported low-cost alternative to the monolithic incumbents that dominated the industry for decades. And though innovative products enabled by lower infrastructure costs have driven significant customer growth for challengers, profitability is proving elusive as customer acquisition costs remain high. Some are turning to fees as a solution: A recent scoop by Axios indicated that US-based Chime generated around 21% of its revenues from out-of-network ATM fees, while the fee schedule listed on N26’s website shows the neobank carries similar fees to those being rolled out by Revolut. Fee-based revenues may stand in contrast to the original intent of neobank alternatives, but they provide a more stable source of income for challengers.

- Though fees could help Revolut achieve profitability, it’s also a risky move, as customers could abandon ship altogether. A recent N26 survey of Irish consumers reveals strong feelings against fees, per Irish Tech News. Sixty-seven percent of respondents reported they had been dinged by an unforeseen fee, and 47% of respondents supported eliminating hidden charges altogether. In this context, Revolut’s transparency over changes to its standard offering could spur customers to lean more strongly toward a premium account, which carries fewer surprise fees. But the strategy still carries significant uncertainty: Customers could be more willing to pay up if they knew about the charges upfront, but widespread frustrations over banking fees suggests that they may instead choose to leave the service entirely thanks to new fees.

Want to read more stories like this one? Here’s how you can gain access:

- Join other Insider Intelligence clients who receive Banking forecasts, briefings, charts, and research reports to their inboxes each day. >> Become a Client

- Explore related topics more in depth. >> Browse Our Coverage

Current subscribers can access the entire Insider Intelligence content archive here.

Learn more about the financial services industry.

Source: Read Full Article