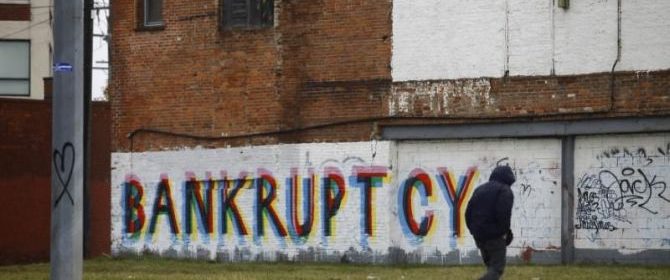

Retail investors put over Rs 2,000 cr in bankrupt firms, hoping for revival

Retail investors have put at least Rs 2,296 crore in listed companies facing proceedings under the Insolvency and Bankruptcy Code (IBC).

A median such-company had 16,163 retail investors as shareholders many of whom apparently have bought a stake on the hope of making money if the firm revives.

They own a fifth of the total stake in the companies under consideration.

The analysis looked at 75 listed firms for whom shareholding data was available for March 2022.

Market capitalisation, as of March 2022, was considered where available.

The last traded value was used in the few cases when data for March was unavailable.

Retail investors’ bets are more than twice invested by wealth high-net worth individuals (HNIs).

They own 8.7 per cent stake on a median basis in the companies under consideration.

The median retail stake is 22.9 per cent.

The bets seem to increase for smaller companies.

Analysts have pointed out that retail investors often believe there may be a possibility of bigger gains from a smaller base.

Equity shareholders have the last claim on the assets of a company under liquidation.

Many companies write off the entire equity value after the bankruptcy procedure is complete.

This means that the value of any shareholding would become zero in such cases.

The chances of a turnaround are typically remote.

Nevertheless, the median retail investor stake is highest for companies under Rs 100 crore in total market capitalisation.

The Reserve Bank of India’s December 2021 Financial Stability Report noted that lenders recovered less than a quarter of the loans after resolution.

“An analysis of 60 corporate debtors resolved under the Insolvency and Bankruptcy Code, 2016 between September 2019 and September 2021 shows that (a) the sample median recovery rate was 24.7 per cent and (b) the longer bad loans remain on banks’ balance sheets, the lower is the amount banks succeed in recovering, independent of the type of exposure or borrower…”it said.

Stock exchanges have previously announced special alerts to let retail investors know that they are trading in the shares of a company undergoing bankruptcy.

Exchanges announced in 2021 that they would “identify and tag the security in a manner, which will be easy for the members and market participants to know that the security is currently (under bankruptcy proceedings) …”

A March 2022 IBC update from rating agency Icra noted that only 457 cases have seen a resolution plan approved against the 1,514 admitted cases as of December 2021.

Around 73 per cent of the cases take over 270 days for closure.

It added that more than 10,000 cases are lying with the National Company Law Tribunal (NCLT) which haven’t been admitted or rejected yet.

“Delays are largely on account of legal entanglements and overburdened NCLT benches….

“Only 20% of the cases referred for liquidation have been completed.

“Almost half of the ongoing 80% cases have taken more than two years to complete liquidation,” it said.

Source: Read Full Article