Rescue Package Includes $86 Billion Bailout for Failing Pensions

Tucked inside the $1.9 trillion stimulus bill that cleared the Senate on Saturday is an $86 billion aid package that has nothing to do with the pandemic.

Rather, the $86 billion is a taxpayer bailout for about 185 union pension plans that are so close to collapse that without the rescue, more than a million retired truck drivers, retail clerks, builders and others could be forced to forgo retirement income.

The bailout targets multiemployer pension plans, which bring groups of companies together with a union to provide guaranteed benefits. All told, about 1,400 of the plans cover about 10.7 million active and retired workers, often in fields like construction or entertainment where the workers move from job to job. As the work force ages, an alarming number of the plans are running out of money. The trend predated the pandemic and is a result of fading unions, serial bankruptcies and the misplaced hope that investment income would foot most of the bill so that employers and workers wouldn’t have to.

Both the House and Senate stimulus measures would give the weakest plans enough money to pay hundreds of thousands of retirees — a number that will grow in the future — their full pensions for the next 30 years. The provision does not require the plans to pay back the bailout, freeze accruals or to end the practices that led to their current distress, which means their troubles could recur. Nor does it explain what will happen when the taxpayer money runs out 30 years from now.

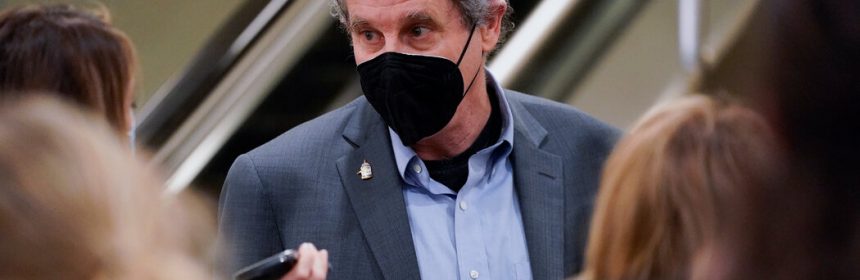

Senator Sherrod Brown, a Democrat from Ohio who has been leading the charge to rescue the ailing pension plans, said that including the provision in the relief bill is a “really big deal” for both the retirees who depend on the money and the employers now being crushed by promises they cannot afford to keep.

“It goes back to the fact that these workers didn’t do anything wrong,” Mr. Brown said in an interview on Thursday. “They have earned these pensions.” He added that the pandemic had worsened the crisis facing the plans.

The measure has received criticism, with some experts calling it a Band-Aid.

“Imagine that you have a college-aged kid who runs up $1,500 in credit card debt,” said James P. Naughton, an actuary now teaching at the University of Virginia’s Darden School of Business. “If you give him $1,500 dollars and you don’t do anything else, the odds that the problem is going to get fixed are pretty low.”

At the same time, Republicans assailed it as a union handout masquerading as pandemic relief. They have tried to turn the provision, which would benefit only union workers and retirees, into a political liability for Democrats.

“Just to show you how bad this bill is, there’s more money in this to bail out union pension funds than all the money combined for vaccine distribution and testing,” Senator Bill Hagerty, a Tennessee Republican, said last week.

On Friday, Senator Chuck Grassley, Republican of Iowa, introduced his own legislative proposal for the failing pension plans, which he said would bring structural reforms to make them solvent over the long term. He called the measure put forth by Democrats “a blank check” and tried to have it sent back to the Senate Finance Committee for retooling.

Frequently Asked Questions

“Not only is their plan totally unrelated to the pandemic, but it also does nothing to address the root cause of the problem,” Mr. Grassley said in a statement. His motion failed in a vote of 49 to 50.

Using taxpayer dollars to bail out pension plans is almost unheard-of. Previous proposals to rescue the dying multiemployer plans called for the Treasury to make them 30-year loans, not send them no-strings-attached cash. Other efforts have called for the plans to cut some people’s benefits to conserve their dwindling money — such as widow’s pensions, early retirement subsidies and pensions promised by companies that subsequently left their pools.

The federal government does provide a backstop for certain failing pension plans through the Pension Benefit Guaranty Corporation, which acts like an insurer and makes companies pay premiums, but does not get taxpayer dollars. Currently, the pension agency has separate insurance programs for single-employer and multiemployer pensions. The single-employer program is in good shape, but the multiemployer program is fragile. As of 2017, the country’s 1,400 or so multiemployer pension plans had a total shortfall of $673 billion.

One huge Teamster plan, in particular, is expected to go broke in 2025, and when the pension agency starts paying pensions to its nearly 200,000 retirees, its multiemployer insurance program will go broke, too, according to the agency itself. That would leave the roughly 80,000 other union retirees whose pensions the agency now pays without their payouts.

The new legislation changes that. It calls for the Treasury to set up an $86 billion fund at the pension agency, using general revenues. The agency would be required to keep the money separate from the funds it uses for normal operations. It would use the new money to make grants to qualifying pension plans, allowing them to pay their retirees. The Congressional Budget Office estimated that 185 plans were likely to receive assistance, but as many as 336 might under certain circumstances.

The grants are intended to pay the retirees their full pensions, a much better deal than the pension agency’s regular multiemployer pension insurance, which is limited by statute to $12,870 per year. Many retirees in the soon-to-be rescued plans have earned pensions greater than that.

The taxpayer money will also be used to restore any pensions that were cut in a 2014 initiative that tried to revive troubled plans by trimming certain people’s pensions. The stimulus bills — there is a House version and a Senate version that have minor differences — call for the affected retirees to get whatever money was withheld over the past six years.

The legislation requires the troubled plans to keep their grant money in investment-grade bonds, and bars them from commingling it with their other resources. But beyond that, the bill would not change the funds’ investment strategies, which are widely seen as a cause of their trouble.

For decades, multiemployer pensions were said to be safe because the participating companies all backstopped each other. If one company went under, the others had to cover the orphaned retirees. Because they were considered so safe, multiemployer pensions never got much oversight.

While companies that run their pension plans solo must follow strict federal funding rules, multiemployer plans do not have to. Instead, the companies and unions hammer out their own funding rules in collective bargaining. Both sides want to keep the contributions low — the employers to reduce labor costs, and the unions to free up more money for current wages. As a result, many of the plans have gone for years promising benefits without setting aside enough money to pay for them.

In hopes of making up for the low contributions, the plans often invest unduly aggressively for their workers’ advancing age. In bear markets they lose a lot of money, and they can’t ask the employers to chip in more because the employers are often struggling themselves.

The new legislation does nothing to change that dynamic.

“These plans are uniquely unable to raise their contributions,” said Mr. Naughton, whose clients included multiemployer plans when he was a practicing actuary. “When things go well, the participants get the benefits. If things go badly, they turn to the government to make it work.”

Source: Read Full Article