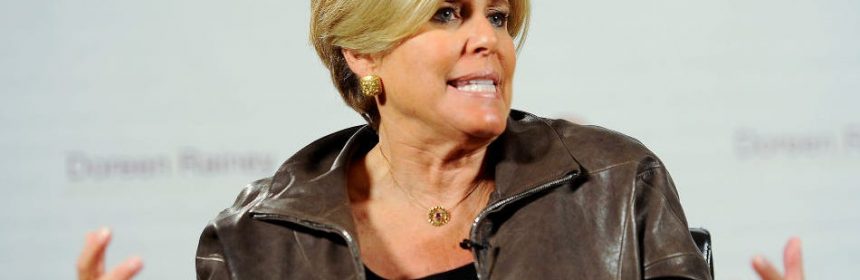

Nearly a year into the pandemic, Suze Orman says Americans should keep using credit cards to make ends meet

- Last year, Suze Orman gave advice to anyone struggling during the pandemic: Put your savings first.

- She advised anyone with extra cash to save it above all else, even paying off credit card debt.

- Her advice nearly a year later is still largely the same.

- Set up a free virtual consultation with a Financial Advisor to see how you can grow your portfolio »

Towards the beginning of the COVID-19 pandemic, personal finance expert and personality Suze Orman had some unprecedented advice: Save cash above all else.

Last year on the Today Show with Hoda Kotb, Orman advised millions of Americans recently out of work to use credit cards to make ends meet, and encouraged everyone to save cash in an emergency fund aggressively if possible during the pandemic.

Saving over paying off high-interest debt isn’t her typical advice, but these aren’t typical times. About 5.3 million Americans were unemployed at the beginning of 2021, reports Insider’s Ben Winck. And, now almost a full year into a global pandemic, many people have exhausted emergency funds, savings, and maxed out other resources.

The financial situation going into 2021 is largely similar to that of 2020, and so is Orman’s advice.

She suggests saving cash whenever possible

In her weekly newsletter via LinkedIn, Money Monday with Suze Orman, she reiterates that advice.

“I want to repeat advice I have been giving ever since the pandemic began: I would prefer you put your emergency fund ahead of paying down credit card debt,” she writes. In her opinion, saving should come before all else right now.

She suggests anyone with an emergency fund to bulk it up and add a few more months worth of expenses. “An emergency fund of at least eight months of living expenses (and ideally as much as one year) is the best way to be able to take care of yourself whenever the world throws you a serious curveball,” she writes.

Whether that extra money comes in the form of stimulus checks, tax refunds, or a bonus at work, saving it is her best advice.

It’s still not the time to worry about credit card debt, she says

For anyone who has lost income or is facing a financial struggle, she suggested using a credit card as a lifeline in 2020.

“Where do you have places you can get money from? One of the places you could possibly get money from is your credit cards,” she said in April 2020. “Can you believe Suze Orman is telling you, ‘Please use your credit cards?'”

Again, her advice is still largely the same many months later. “For now, consider paying the minimum on your credit card bills and using any extra income to build up your emergency fund,” she writes in her newsletter.

While it might be tempting to put stimulus checks towards things like credit card debt, as high interest rates can increase the total amount you owe, she says saving it it is still the smarter move in these unusual times.

“As much as I hate high-rate credit card debt, I hate the thought of your household being financially vulnerable even more,” Orman writes.

Disclosure: This post is brought to you by the Personal Finance Insider team. We occasionally highlight financial products and services that can help you make smarter decisions with your money. We do not give investment advice or encourage you to adopt a certain investment strategy. What you decide to do with your money is up to you. If you take action based on one of our recommendations, we get a small share of the revenue from our commerce partners. This does not influence whether we feature a financial product or service. We operate independently from our advertising sales team.

Source: Read Full Article