Maruti Suzuki has a blueprint to regain market share in SUVs

Maruti’s strategy for the SUV segment is to arrest the decline in customers for entry level hatchbacks.

Maruti Suzuki is looking to launch a slew of products, particularly in the SUV segment, this financial year to regain the lost market share.

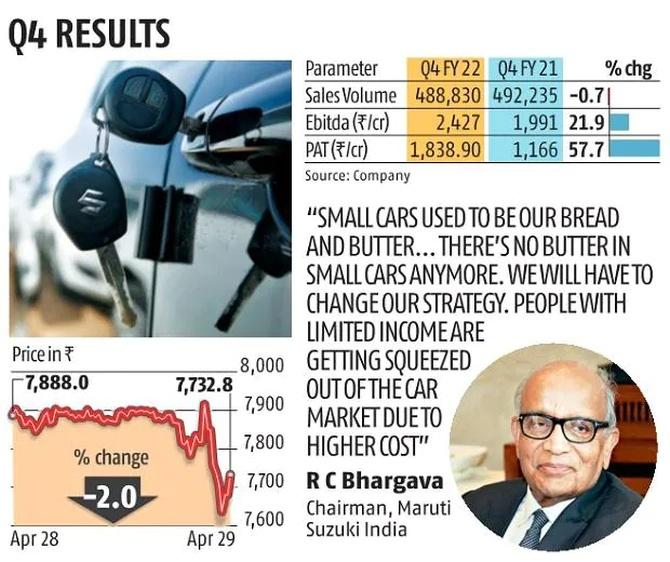

The company reported a 58 per cent rise in net profit in the fourth quarter of FY22 as price hikes and lower sales promotion costs helped the country’s top carmaker outweigh the impact of high raw material costs and global semiconductor shortages.

The company said chip shortages had severely hurt its domestic sales but it had been able to make it up with exports.

Maruti’s strategy for the SUV segment is to arrest the decline in customers for entry level hatchbacks.

While the company’s market share, excluding the SUV, stands at 65 per cent, the overall market share has declined to 43 per cent, pointing at the growing popularity of SUVs in the Indian market in recent years.

Maruti Chairman RC Bhargava said there had been a 25 per cent decline in the market for hatchbacks in the past four years due to an increase in commodity prices and taxes by state governments.

The company will adjust its investments to align with demand, which is in higher-end cars, Bhargava said.

“Small cars used to be our bread and butter,” Bhargava said in a post-earnings media call.

“There’s no butter in small cars anymore. We will have to change our strategy. People with limited income are getting squeezed out of the car market due to higher cost,” he said, adding that the market for hatchbacks is “shrinking significantly.”

In order to press the pedal after two years of modest performance, Maruti will invest a little more than Rs 5,000 crore in FY23, of which $21 million (around Rs 1,600 crore) will go towards increasing capacity at the Manesar plant.

The company plans to expand the annual capacity of Manesar by 100,000 units by April 2024.

The pending order book of the company has grown from 270,000 to over 300,000 vehicles.

“The supply situation of semiconductors is still uncertain, which can impact production going ahead,” said Ajay Seth, chief financial officer at Maruti Suzuki.

The carmaker recorded a net profit of Rs 1,839 crore in the January-March period.

It was Rs 1,166 crore in the corresponding period of last year.

“The prices of commodities, such as steel, aluminium, and precious metals, witnessed an unprecedented increase during the year. The firm was forced to increase prices of vehicles to partially offset this impact,” Maruti said.

Feature Presentation: Rajesh Alva/Rediff.com

Source: Read Full Article