Has the Rocketing Rupee reached its Zenith?

It does feel like we are close to the end of the rupee’s rally, says Jamal Mecklai.

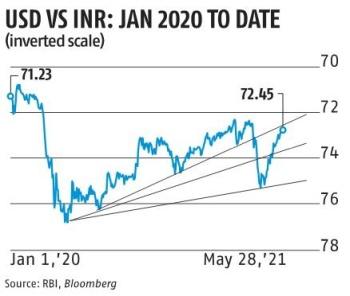

Technically, it is beginning to appear as if the rupee rocket, which has shot up by nearly 3.5 per cent in the past six weeks, could soon run out of steam; as the chart shows, 72.50 seems to provide a very difficult resistance level.

Already there are some exporters who are thinking of cancelling forward contracts booked at wonderful rates to encash some part of their MTM (mark-to-market) gains. And, while it is always dangerous to try to best the market, it is sometimes hard to look away from apparently ‘easy money’.

To assess this opportunity, we need to understand, first of all, that some part of the recent rupee strength is related to global USD weakness — the USD index, which has an approximately 30 per cent correlation with USDINR, has fallen by 2.2 per cent over the same period.

Sentiment for the dollar at the start of 2021 was very bearish — Stephen Roach, a celebrated Yale economist, forecast that the dollar would fall by 20 per cent from the then-current DXY of 89.50; Goldman Sachs and other marketwallahs joined in, confirming the view.

In the event, the DXY actually rose by about 3.5 per cent to 93.50, fulfilling one of the market’s primary jobs, which is to make celebrated marketwallahs look foolish. It has since, of course, subsided back below 90.

Where it will go from here and whether the rupee will follow suit is, of course, another set of billion dollar questions.

It is worth noting that the circumstances that drove Roach’s forecast — Covid-crumbling economy and ultra-loose monetary policy — have changed.

The US economy is booming and there is an increasing nervousness in global markets about the return of inflation.

The Fed continues to keep a straight face, but with considerable evidence piling up from trade and industry that input prices are shooting higher almost daily, more and more analysts believe that the Fed will have to ease up on its easy monetary policy sooner rather than later.

While this will doubtless give a shock to asset prices, it should — in normal course (whatever that is) — underpin the dollar.

Contrariwise, commodities — copper, gold, oil, among others — are holding at multi-year highs, and, as is well known, high commodity prices generally go hand in hand with a weaker dollar.

In other words, and as usual, nobody really knows where the dollar is going, whether there will be a sharp trend or what.

Thus, looking to the dollar to see whether the rupee has reached its zenith or not is not particularly useful.

What is significant, though, is that the rupee has been rising despite the fact that FPI inflows, usually one of prime drivers of rupee strength, have been negative since the rupee started rising, registering a net outflow of nearly $1.2 billion ($1.5 billion outflow in equity with a small $0.2 billion inflow in debt).

Given the terrifying state of India’s Covid management, this is hardly surprising; in fact, even today, with new cases falling, nobody really believes we have the crisis anywhere under control.

Nonetheless, the net balance of dollars has been hugely positive.

Foreign currency reserves have risen by more than $7.5 billion over the period, and, even though some of the rise is related to dollar weakness overseas (the non-dollar component of reserves increases in value in dollar terms), there are clearly excess dollars coming in from somewhere — probably direct investment into India’s rapidly multiplying unicorns plus net exports, which have been doing quite well over the past few months.

Indeed, the Reserve Bank of India has been intervening strongly — largely in the forwards to judge from the sharp increase in forward premiums — to keep the rupee’s strength in some sort of control.

To the RBI’s credit, it has been able to keep things on a relatively even keel — it has, for instance, properly chastised the NDF (non-deliverable forward) market, which had been a wild bucking bronco not that long ago, and is holding the 10-year yield tightly around 6 per cent.

But the entire structure feels somehow unstable, as if waiting for some event or another to create a dramatic move.

While the domestic equity markets are sanguine, the reality on the ground — still huge numbers of infections, the inefficient reporting of deaths, on-again off-again vaccination programmes — suggest that at any time there could be another hit to sentiment.

And, in the global context, much as the Fed tries to soft-pedal any potential policy change, we all know what a taper tantrum (or even the threat of a taper tantrum) can do to the markets.

As I said earlier, it does feel like we are close to the end of the rupee’s rally.

But, of course, the markets are littered with the corpses of people who just knew what was going to happen.

Thus, exporters who are wanting to catch the return of the rupee rocket should be sure to set a stop loss they live with — and abide by it.

Another idea would be to increase the share of options (or range forwards) for fresh hedges.

Jamal Mecklai is chief executive officer, Mecklai Financial.

Feature Presentation: Rajesh Alva/Rediff.com

Source: Read Full Article