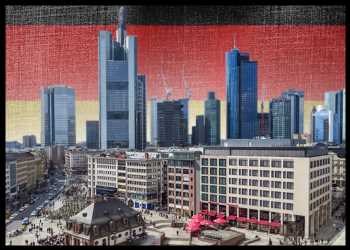

German Economy To Undergo Shallow Recession: Ifo

Germany is set to experience a less severe recession next year as the economy would recover by the spring and rebound strongly with incomes rising faster than prices, the ifo Institute said in its Winter Economic Forecast, released Wednesday.

Gross domestic product is forecast to grow 1.8 percent this year, the Mannheim-based think tank said, revising up from its earlier projection of 1.6 percent from September.

Although GDP will shrink in the winter half-year of 2022-23, pushing the largest euro area economy into a recession, the region should recover at stronger rates in the second half, the ifo said.

The institute expects Germany’s overall economic output to fall 0.3 percent and 0.4 percent in the two quarters of the 2022-23 winter half-year, thus landing in a technical recession.

However, the increase in income over the second half of the next year will boost private consumption.

ifo upgraded the outlook for next year and expects GDP to fall only 0.1 percent compared to the previous projection of a 0.3 percent decline. In 2024, growth will be back up to 1.6 percent, the institute assessed.

Helped by government’s electricity and gas price brakes, inflation is expected to fall in the coming months. Inflation is expected to slow from 7.8 percent this year to 6.4 percent next year.

The inflation forecasts for both this year and next were lowered from 8.1 percent and 9.3 percent, respectively.

With persistently high inflation, the European Central Bank will hike interest rates further in the coming months, ifo said. Nonetheless, these are likely to be somewhat weaker than recent ones, the institute added.

The interest rate for main refinancing operations is projected to rise to 4.0 percent by the middle of 2023. In line with the weakening inflation rate, key interest rates are then expected to fall again slightly by around 50 basis points in 2024, moving toward neutral, ifo added.

Regarding the labor market, the ifo said the unemployment rate in 2023 is forecast to climb to 5.5 percent, before falling to 5.3 percent in 2024.

Source: Read Full Article