Appeal overturns New York's suit over OCC fintech charter

- An appeals court panel overturned a ruling that let the state’s Department of Financial Services challenge the Office of the Comptroller of the Currency’s special-purpose charter.

- A national fintech charter would give banking challengers a fourth path to legally become banks.

- Insider Intelligence publishes hundreds of research reports, charts, and forecasts on the Banking industry.Learn more about becoming a client.

A federal appellate panel overturned a 2019 lower court ruling that allowed New York’s Department of Financial Services (DFS) to challenge the legality of the Office of the Comptroller of the Currency’s (OCC) special-purpose fintech charter, per Banking Dive.

DFS has argued that the OCC’s special-purpose charter violates the National Banking Act because the credential can be issued to fintechs that don’t take deposits—an interpretation that the OCC has disagreed with.

In its decision, the appellate panel:

- Ruled that DFS lacks the proper legal standing to bring the challenge, and that the state regulator is pursuing its action prematurely.

- Left open the possibility that DFS could bring action again in the future.

A national fintech charter would give banking challengers a fourth path to legally become banks. Three other paths forward are already available:

- Regular OCC charters: Varo made history last August when it became the first US neobank to obtain a regular OCC charter. However, the process cost Varo $100 million and took three years.

- Industrial banking charters: Square, a fintech offering payment services to small and medium-sized businesses (SMBs), got approval in March 2020 for an industrial banking charter; a year later, it rolled out a business bank. The charter allows Square to collect deposits—a low-cost funding source that it can subsequently lend out to SMBs.

- M&A: In March, US-based SoFi agreed to buy community bank Golden Pacific Bancorp Inc. for $22 million. The deal would give SoFi its own banking licenses, which would follow the alt lender’s public market debut on June 1. SoFi chose the M&A path after dropping slower methods of pursuing a charter: its 2017 attempt to get an industrial banking license in Utah, which it withdrew, and an application for a regular OCC charter which just obtained preliminary approval last October.

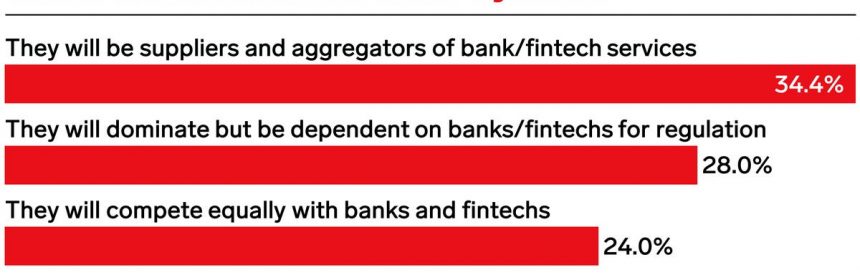

A fintech charter would make the banking regulatory landscape more hospitable to tech giants like Google, Amazon, and Facebook. Big companies could use fintech charters to jumpstart banking services without ever recruiting partners—and they’d be formidable competitors to established financial institutions. Tech companies with charters may also covet revenue from embedded finance, a space where financial institutions now provide software that backs nonbanks’ products.

Want to read more stories like this one? Here’s how you can gain access:

- Join other Insider Intelligence clients who receive Banking forecasts, briefings, charts, and research reports to their inboxes each day. >> Become a Client

- Explore related topics more in depth. >> Browse Our Coverage

Current subscribers can access the entire Insider Intelligence content archive here.

Source: Read Full Article