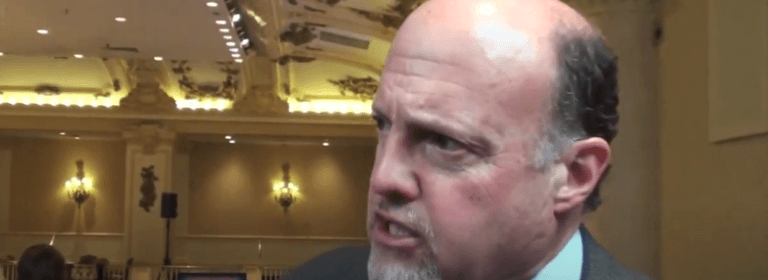

Jim Cramer on Crypto Investments: “It’s Never Too Late To Sell an Awful Position”

On Monday (5 December 2022), former hedge fund manager Jim Cramer offered some words of advice for crypto investorswho have unrealized losses on some of their positions.

Cramer is the host of CNBC show “Mad Money w/ Jim Cramer“. He is also a co-anchor of CNBC’s “Squawk on the Street“, as well as a co-founder of financial news website TheStreet.

According to a report by CNBC, Cramer said on Monday’s episode of “Mad Money”:

“You can’t just beat yourself up and say, ‘hey, it’s too late to sell.’ The truth is, it’s never too late to sell an awful position, and that’s what you have if you own these so-called digital assets…

“Tether, a so-called stablecoin that’s supposed to be kinda-sorta pegged to the dollar, still has a $65 billion market cap… There’s still a whole industry of crypto boosters trying desperately to keep all of these things up in the air — not too different from what happened with bad stocks during the dotcom collapse.“

Last Thursday (1 December 2022), former hedge fund manager Jim Cramer made it very clear how he feels about Sam Bankerman-Fried (aka “SBF”), the disgraced co-founder and former CEO of bankrupt crypto exchange FTX.

As you may remember, on Wednesday (30 November 2022), the New York Times held its annual DealBook Summit in New York City, an an event which was hosted by Andrew Ross Sorkin, Times columnist and DealBook founder and editor at large.

Of course, the interviewee that most people were most excited about hearing from was SBF.

Based on the full transcript of Andrew Ross Sorkin’s interview with SBF published by CoinDesk earlier today, SBF said:

“Clearly, I made a lot of mistakes or things I would give anything to be able to do over again. I didn’t ever try to commit fraud on anyone… I didn’t knowingly commingle funds. And again, one piece of this you have the margin trading you have you know, customers borrowing from each other, Alameda is one of those. I was frankly surprised by how big Alameda’s position was, which points to another failure of oversight on my part. And a failure to appoint someone to be chiefly in charge of that. But I wasn’t trying to commingle funds…

“The time that I really knew there was a problem was Nov. 6. Nov. 6 was the date that the tweet about FTT came out. By late on Nov. 6, we were putting together all of the data, putting together all the information that obviously should have been put together way earlier, that obviously should have been part of the dashboards I was always looking at…

“We were spending an enormous amount of our energy on compliance. We’re spending an enormous amount of energy on regulation on licensure. We’re getting licensed in dozens of jurisdictions…

“Everything I have, I’m disclosing and you know, I’m down to…I have one working credit card left. I think it might be $100,000 or something like that in that bank account. And, I mean, everything that I had, even all the loans I had were, you know, those are all things I was reinvesting in the businesses…I put everything I had into FTX.“

https://youtube.com/watch?v=IyoGdwVIwWw%3Fstart%3D9%26feature%3Doembed

The next day, Sorkin asked his CNBC colleague Cramer what he thought about SBF’s comments at the DealBook Summit interview and Federal Reserve Chair Jerome Powell’s comments about the U.S. economy at the Brookings Institution.

Cramer replied:

“One’s just a total con artist, disgusting, makes me sick. The other guy did a good job. I thought he told a good story… I think that Sam whatever – I don’t even want to dignify his full name anymore – is just a con artist, as many of the people who talk about crypto believe coming on the show.“

Source: Read Full Article