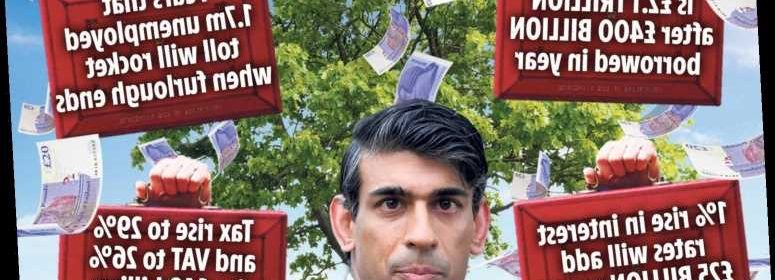

The Magic Money Tree can't go on for ever so whatever the Chancellor does… it's Riski Rishi

THE pandemic has caused Britain’s deepest economic downturn in three centuries.

Since the first lockdown, our cash-strapped Government has been living on tick.

? Read our coronavirus live blog for the latest news & updates…

In the House of Commons on Wednesday, Rishi Sunak’s Budget statement will confirm the biggest annual deficit in our history.

The Government has borrowed a staggering £400billion over the past year — EIGHT TIMES more than in 2019.

The Chancellor, though, will roll the dice once again. He will risk even higher borrowing to keep the economy moving before Covid restrictions are finally eased.

Will this gamble pay off, with more public spending kick-starting growth, sparking a post-lockdown boom? Or will it finally bankrupt Britain? The Government has spent vast sums on furlough pay, business-support schemes and measures to fight Covid.

Our locked-down economy has, meanwhile, struggled to generate tax.

That has opened a vast hole in the public finances, with this year’s multibillion-pound deficit adding to our already huge national debt.

After the 2008 financial crisis, bank bailouts and sluggish growth saw public debt balloon from 35 per cent of national income to 80 per cent. Thanks to Covid, that debt burden is heavier still.

The national debt has now grown bigger than the entire economy — at 101 per cent of GDP — for the first time since World War Two.

The Government’s debt pile just topped £2TRILLION: £30,000 for every man, woman and child.

A rise of one percentage point across all interest rates will add an extra £25billion a year to the Government’s cost of servicing the national debt.

Ambitious economists urge ministers not to worry about our public finances. That is terrible advice.

But as he contemplates his Budget this weekend, Mr Sunak’s choices are very limited. One option is to start tackling our vast debts by raising taxes. But doing that now would throttle the post-Covid recovery before it’s begun. Raising £40billion in extra revenue — just a tenth of this year’s borrowing — would mean the basic rate of income tax going up from 20p in the pound to 29p in the pound. That would do more harm than good.

Or VAT would need to rise from 20p to 26p — again, a political non-starter. One justified tax hike would be an online retail levy, paid by Amazon and other e-commerce giants whose profits have soared during lockdown.

It might give high street retailers a chance once non-essential shops re-open. But the only tax rise that looks certain on Wednesday is an uptick in corporation tax, raising just a few billion each year. That won’t dent our massive debt pile. But it will signal the Government under- stands that at some stage the public finances need fixing.

In the meantime, the national accounts will look a lot worse before they start to look better, with Mr Sunak about to wager on keeping the spending sluice gates open.

Yes, our national debt is vast. But the Chancellor is set to raise the stakes, punting that even more government spending will spark rapid post-lockdown growth.

That should generate more tax as the economy expands, helping repay our debts while avoiding sky-high tax rates and deep “austerity” spending cuts. It is a high-risk gamble that will send our national debt spiralling even more. Two post-lockdown risks, though, loom larger still.

The first is unemployment — officially 1.7million, or 5.1 per cent of the workforce. That is still quite low by historic standards.

But benefit claimant numbers and HM Revenue & Customs payroll data suggests the real jobless total is already much higher. On top of that, 4.7million workers were on furlough by the end of January, sharply up after tighter lockdown restrictions.

While Mr Sunak is set to extend furloughing beyond its current end-date of April 30, the scheme costs billions each month and cannot continue for ever. But if just a third of furloughed workers end up out of work, unemployment will soar well over three million — to levels that convulsed British politics during the early 1980s. And business opinion surveys suggest an even higher share of furloughed workers could ultimately lose their jobs.

“We’re concerned the Government is sleepwalking into an unemployment crisis,” wrote Michael Forsyth, chair of the Lords’ economic affairs select committee in a letter to the Chancellor this weekend.

The Tory former Cabinet minister and his committee of economic heavyweights want Mr Sunak’s Budget to “shift public spending away from job protection towards job creation”. Yet the Chancellor’s high-risk spending gamble is based on an even riskier strategy.

As well as the more usual government bonds to support spending, much of the lockdown borrowing has been funded by the Bank of England’s magic money tree — that is quantitative easing, or newly created money.

And if too much extra spending relies on such money-printing, history warns of inflation and financial collapse. Post-lockdown, it is policies sparking enterprise, investment and jobs, not magic money, that will restore economic prosperity, helping to pay back the Government’s massive pandemic debts.

But the longer lockdown continues and the more debt accumulates, the riskier our economic gamble.

Mr Sunak has, so far, been a lucky Chancellor. We must hope his good luck holds.

GOT a story? RING The Sun on 0207 782 4104 or WHATSAPP on 07423720250 or EMAIL [email protected]

Source: Read Full Article