Inflation expectations are on the rise again

For months, consumers have been steadily marking down near-term inflation expectations, a sign of confidence in the Fed's war on price pressures. That changed in March.

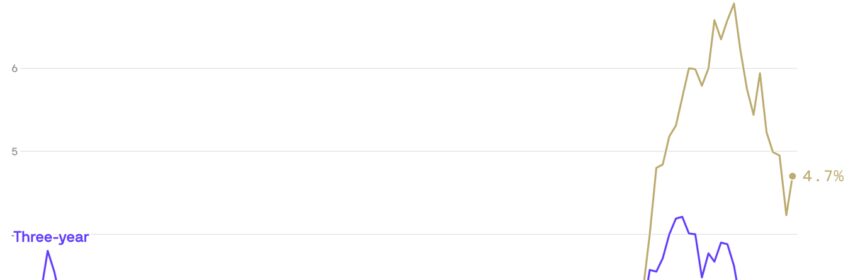

Driving the news: For the first time since October, median inflation expectations in the year ahead rose — by a half-percentage point to 4.7%, according to the New York Fed's latest survey.

- It came as expectations for the pace of price increases for essentials — including food, gas, rent and medical care — declined last month.

Why it matters: After this year's hotter-than-expected inflation reports, the data signals the public's belief that inflation will not fall quite as much as previously anticipated.

- A single month of data, however, does not necessarily mean the outcome the Fed fears most: that inflation expectations are becoming unanchored. But more readings of this kind could worry officials.

Details: Median expectations at the three-year-ahead horizon ticked up by 0.1%, to 2.8%.

- Consumers also pushed up expectations for household income growth and, for the first time since last fall, how much they plan to spend.

What to watch: Consumers also said it was getting harder to obtain a loan — a data point worth watching in the wake of the collapse of Silicon Valley Bank and Signature Bank.

- The share of households reporting that it was more difficult to access credit compared to one year ago rose to the highest level in the survey's 10-year history.

Source: Read Full Article