Fight over Victoria’s gambling tax as TAB wants online bookies hit harder

Victoria’s pubs, the anti-gambling lobby and Tabcorp are saddling up for an election year campaign to try to force the state government to increase the tax on online bookies, which is now among the nation’s lowest.

The Australian-based gambling companies will seek to pressure Treasurer Tim Pallas to boost the tax on digital gambling losses for companies such as Sportsbet which is based in Ireland and Ladbrokes which is on the Isle of Man. The tax rate is currently 10 per cent.

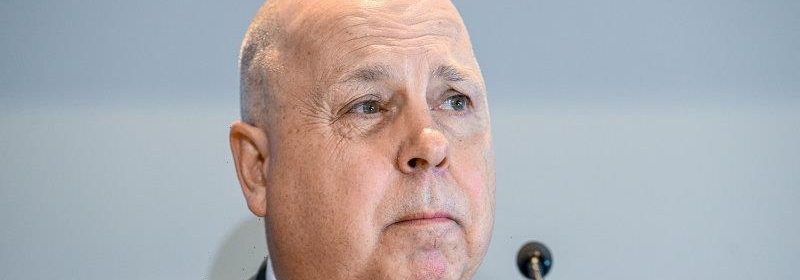

Treasurer Tim Pallas faces an election year fight to lift digital betting taxes Credit:Joe Armao

The point of consumption tax (POCT) was first introduced in Victoria in 2019 in response to concerns that foreign-owned online gambling services were effectively avoiding paying tax in Australia. Victoria initially set its rate at just 8 per cent, the lowest tax rate of any jurisdiction.

In 2021, the Andrews government lifted the rate to 10 per cent, in line with NSW, but significantly lower than South Australia, Western Australia, Queensland and the ACT which take 15 per cent.

Last week, Queensland’s Labor government agreed to lift its point of consumption tax from 15 per cent to 20 per cent following intense lobbying from Tabcorp, which claims it faces a higher tax burden than foreign-owned operators.

The Australian betting giant, which would be covered by the higher tax, now wants Victoria to follow suit. Chief executive Adam Rytenskild is pushing for online rivals, which have traditionally faced a lower tax burden, to pay their “fair share”.

Tabcorp chief executive Adam Rytenskild is hopeful that Victoria will consider following Queensland’s lead and boost the tax on online bookiesCredit:Eddie Jim

“TAB pays double the fees and taxes, which works in a monopoly environment, but the market share has changed. Online operators have increased their share and should be contributing to the industry on a level playing field,” Rytenskild said.

“All we want is a level playing field where everyone pays the same taxes and fees. That’s fair.”

A spokesperson for the Victorian government said “decisions on the POCT rate will be made in the best interests of Victorians and the racing industry”.

Chief advocate of the Alliance for Gambling Reform Tim Costello also wants online bookies to pay more taxCredit:Alex Ellinghausen

Most corporate bookmakers including Ladbrokes, Sportingbet and Neds — hold a sports bookmaker's licence in the lower-taxing Northern Territory despite operating nationally, meaning the bulk of their profits return overseas.

The online bookmaker lobby group, Responsible Wagering Australia (RWA), which recently appointed former Labor minister Justin Madden as its chief executive officer, strongly opposes any changes to the point of consumption tax.

Following Queensland’s tax hike last week, the lobby group said the taxes “unfairly entrench the monopoly enjoyed by established and land-based wagering service providers at the expense of the new and emerging online industry”.

Tabcorp has found an unlikely ally in its call to boost the tax on digital gambling losses with anti-gambling group, The Alliance for Gambling Reform calling for an overhaul of the tax, licensing and advertising arrangements enjoyed by online bookmakers.

Director Tim Costello told The Age foreign bookies can unfairly advertise and compete in the Australian market while sending their mega-profits offshore.

“Even at a 20 per cent point of consumption tax (POCT) Victoria will claw back a bit more, but these are still foreign-owned companies not paying their fair share of tax,” Costello said.

He said one solution would be for the federal government to buy out the licences from the Northern Territory and tax their profits and restrict their advertising.

While the state Coalition wouldn’t commit to lifting the tax rate, shadow treasurer David Davis seized on the campaign, questioning why Victoria would offer a tax break to foreign bookies compared to other states.

“There are legitimate questions about competitive neutrality between tax regimes in different jurisdictions,” Davis said.

“Why should we provide tax breaks to foreign corporations in direct competition with Victorian establishments?”

The Morning Edition newsletter is our guide to the day’s most important and interesting stories, analysis and insights. Sign up here.

Most Viewed in National

From our partners

Source: Read Full Article