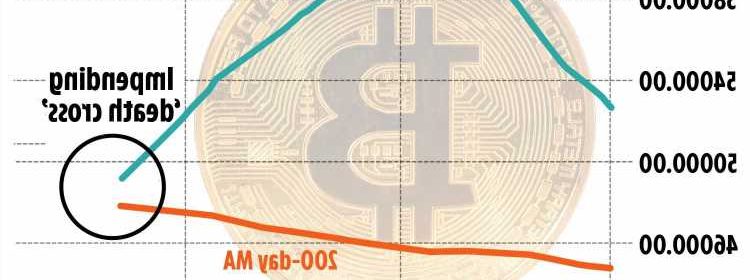

Bitcoin price plunges close to dreaded ‘death cross’ phase fuelling fears of catastrophic sell-off

BITCOIN has plummeted close to the dreaded "death cross" phase amid fears of a mass sell-off.

It has been tumbling since the US Federal Reserve withdrew massive liquidity, which has been pumped into markets since the onset of the coronavirus pandemic.

Fears are also growing that the Fed could further cut back support for the US economy, which is bad news for riskier assets like crypto.

Today the Bitcoin price dipped briefly below $40,000 for the first time since September.

At the time of writing, Coindesk shows the price of bitcoin slumped, the largest cryptocurrency by market cap was changing hands at $40,834, based on CoinDesk pricing, down 12 per cent so far in 2022 —one of Bitcoin’s worst-ever starts to a year.

Naeem Aslam, chief market analyst at Avatrade, said: "The main culprit behind the slump in crypto prices is the Fed's decision to withdraw massive liquidity, which has been pumped into markets since the onset of the coronavirus pandemic."

Research by Kraken suggests many of Bitcoin’s previous death crosses, including those seen in 2014 and 2018, coincided with “either a sell-off in the days that followed or a continued macro downtrend that confirmed a bear market”.

But this does not always happen.

Most read in The Sun

PRICE TO PAY The real reason behind Katie Price’s ‘vile lies’ about ex Peter’s wife Emily

Wilko to close 15 stores across the UK – is your local shop closing?

Djokovic chaos as cops pepper-spray fans swarming car after arrest claim

Brits to get FOUR DAY Bank Holiday weekend to celebrate Queen's Platinum Jubilee

For example last time it happened on June 21 after China continued its tough crackdown on mining and trading the cryptocurrency.

That time it was resolved in a fresh bull run.

After the December crash Bitcoin was trading around $50,000.

The value of Bitcoin has wildly fluctuated since its launch in 2009.

Source: Read Full Article