Republicans probe SEC Chair Gensler over potential violation of federal transparency laws

Americans ‘paying the price’ for bad fiscal policy: Joe LaVorgna

SMBC chief economist Joe LaVorgna says when the economy weakens, it weakens ‘very hard and very quickly.’

House Republicans on Wednesday questioned Securities and Exchange Commission Chairman Gary Gensler over his potential violation of federal transparency laws in 2013, even as the agency he heads seeks to crack down on Wall Street firms for similar missteps.

The GOP lawmakers accused Gensler of "skirting federal transparency and records laws," citing a 2013 incident when the then-chairman of the Commodity Futures Trading Commission used a personal email account to conduct official business.

An investigation into Gensler's handling of the collapse of MF Global Holdings – a commodities brokerage firm that went bankrupt in 2011 – uncovered the use of his personal email. Gensler defended his actions at the time, stating that he "did not know how to access" the official email at home.

On top of that, the Republican lawmakers wrote in the letter to Gensler that there were reports the SEC was "failing to comply with federal record-keeping statutes," with recent litigation showing that the "SEC is failing to identify and produce records of official business conducted on non-email or ‘off-channel’ platforms, such as Signal, WhatsApp, Teams, and Zoom."

SOCIAL SECURITY RECIPIENTS TO SEE BIGGEST COLA INCREASE SINCE 1981

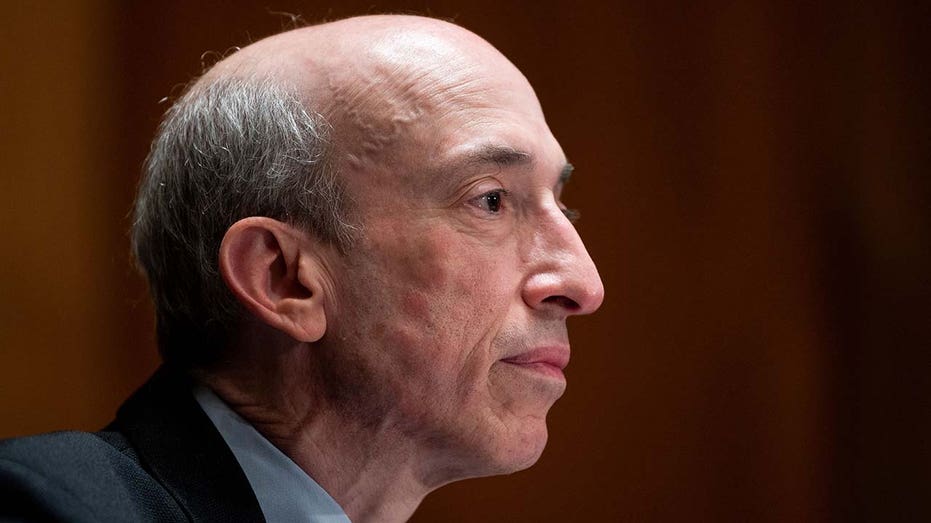

Gary Gensler, chair of the Securities and Exchange Commission, testifies during the Senate Banking, Housing, and Urban Affairs Committee hearing on Sept. 14, 2021. (Bill Clark/Pool/AFP via Getty Images) / Getty Images) "While the SEC is failing to comply with federal transparency and record-keeping laws, the SEC is aggressively enforcing record-keeping laws on private businesses," the letter said. It was signed by Reps. Jim Jordan, R-Ohio, James Comer, R-Ky., Patrick McHenry, R-N.C., and Tom Emmer, R-Minn. The SEC did not immediately respond to a FOX Business request for comment. The letter comes as the EC ramps up its scrutiny of how Wall Street conducts work-related communication on personal devices and apps like WhatsApp. The logo for Goldman Sachs on the trading floor at the New York Stock Exchange Nov. 17, 2021. (Reuters/Andrew Kelly/File Photo / Reuters Photos) In late September, the SEC and the Commodity Futures Trading Commission fined 16 financial firms, including Goldman Sachs and Morgan Stanley, a combined $1.8 billion after workers discussed deals and trades on their personal devices and apps. CLICK HERE TO READ MORE ON FOX BUSINESS The agency also had its enforcement unit send inquiries to a number of funds and advisers asking for information about their protocols for so-called "off-channel" business communications in October, according to Reuters, citing people with knowledge of the matter. The SEC has requested that those firms preserve and produce documents and share information on policies related to using devices and platforms. Source: Read Full Article