Biden's proposed capital gains tax hike might hit wealthy Americans with 57% rate, study shows

How Biden’s capital gains tax will affect investors

BMO Capital Markets chief investment strategist Brian Belski provides insight into the possible market and economic impact of raising the capital gains tax, the Federal Reserve and earnings.

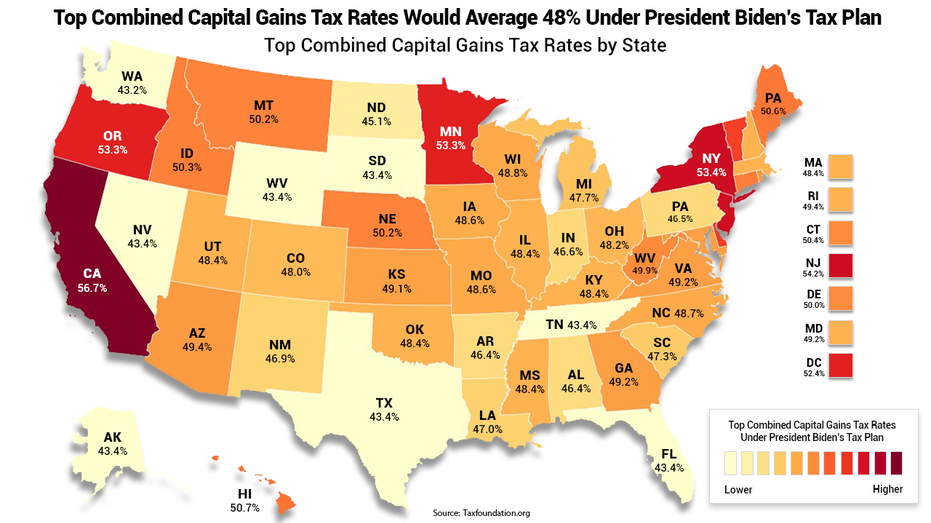

President Biden's coming proposal to increase capital gains taxes for the richest Americans could push the rate paid by investors when they sell stocks and other assets as high as 56.7% in some states.

That's according to a new study published by the Tax Foundation, which found that Biden's plan to raise the federal capital gains tax rate to 39.6% from 20% for households earning more than $1 million could lead to an average rate of 48% when factoring in state and local capital gains taxes.

WHAT BIDEN'S CAPITAL GAINS TAX PROPOSAL COULD MEAN FOR YOUR WALLET

Taxes on long-term capital gains – generally classified as an asset that's held for more than one year – currently range from 0% to 20%, depending on a person's income. Wealthier investors are also subject to an additional 3.8% tax on long- and short-term capital gains that's used to fund ObamaCare. Short-term capital gains on assets sold within a year are typically taxed as ordinary income.

Most states levy their individual income tax rates on long-term capital gains and qualified dividends. The average top tax rate on capital gains at the state level is about 5.2%. Under current law, the average rate paid by investors is about 29%, the analysis shows.

BIDEN'S PLANNED CAPITALS GAINS TAX HIKE COULD SLASH US REVENUE BY $33B But 13 states – Maine, New York, California, Oregon, Idaho, Montana, Nebraska, Minnesota, Vermont, New Jersey, Connecticut, Hawaii and Delaware, as well as Washington, D.C. – would have a top combined tax rate higher than 50%. Three states – California, New York and New Jersey – would have combined rates of more than 54%. California's combined state and federal capital gains tax would be the highest at 56.7%, followed by New York at 54.3% and New Jersey at 54.2%, the study shows. Wealthy individuals could pay even higher taxes depending on where in the state they live; for instance, New York City imposes a local capital gains tax rate of 3.876%, pushing the rate paid by investors to an all-time high of nearly 58.2%. "Under Biden’s proposal for capital gains, the U.S. economy would be smaller, American incomes would be reduced, and federal revenue would also drop due to fewer capital gains realizations," the Tax Foundation, a non-partisan organization, said. "Other proposals, such as partially repealing step-up in basis for capital gains, may help offset the realization effect and increase federal revenue, but it remains important to consider the combined tax rate on capital gains in the context of the President’s tax proposals." GET FOX BUSINESS ON THE GO BY CLICKING HERE Biden is widely expected to couple the tax increase with a plan to eliminate the so-called stepped-up basis, which allows heirs who inherit an asset that has appreciated in value to receive the holding at its current market value. Beneficiaries can sell those assets and pay capital gains based only on the time they receive the asset and the time they sold it, allowing them to minimize the tax bite. Source: Read Full Article