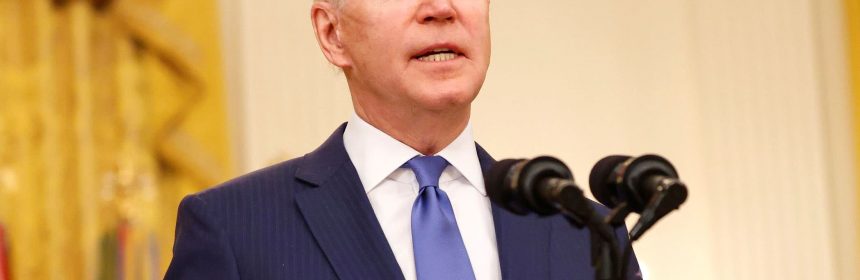

Biden Covid relief plan gives bigger boost to lower-income Americans than Trump tax cuts, study says

- The Biden coronavirus relief plan would boost after-tax income for the lowest-income Americans by about 20%, an analysis from the Tax Policy Center found.

- The bill would give low-income Americans more benefits, and the highest earners fewer, than the 2017 Republican tax law.

- The estimates analyzed policies such as $1,400 direct payments and the expansion of the child tax credit.

- The pandemic aid bill is set to pass the House by Wednesday and be signed into law by this weekend.

President Joe Biden's coronavirus relief plan will boost low-income households more than the tax law signed by former President Donald Trump did, an analysis shows.

The $1.9 trillion pandemic aid bill as passed by the Senate will raise after-tax income by about 20% on average for households making $25,000 or less, or the bottom 20% of earners, according to Tax Policy Center estimates released Monday. The typical first-year tax cut for those households under the 2017 Republican plan was 0.4%.

The two plans will have vastly different effects on the highest earners, the analysis found. Average after-tax income for households making more than $3.4 million, or the top 0.1%, would not rise under the coronavirus relief bill. It increased by 2.7% under the GOP law.

All told, low- and middle-income households would receive more than two-thirds of the tax benefits from the Biden stimulus plan, versus only 17% under the Republican tax law.

The pandemic relief bill passed by the Senate is expected to get through the House on Wednesday. Biden is set to sign it into law by the weekend.

Major economic aid provisions include a $300 per week unemployment insurance boost, $1,400 direct payments to most Americans and their dependents, an expansion of the child tax credit and rental assistance. The Tax Policy Center based its estimates on policies including the stimulus checks and a boosted child tax credit, earned income tax credit and child and dependent care tax credit.

Under the bill, Americans eligible for a $1,400 payment would get the same amount for every dependent. The child tax credit will go to $3,600 for children under 6 and $3,000 for kids between 6 and 17 for one year.

Because of those policies, low-income households with kids would see an average boost of roughly $7,700, or 35% of their after-tax income, according to the analysis.

Democrats have said the legislation will mitigate the economic damage from the pandemic and prevent future pain. They have also touted it as a means to slash child poverty in the U.S.

Republicans contend a recovering economy does not need nearly $2 trillion more in stimulus. They have said Democrats have piled money into policies unrelated to the public health crisis.

The Tax Policy Center analysis notes that most of the benefits of the pandemic aid bill will come over one year, while the Republican tax changes were set to last eight years.

Subscribe to CNBC on YouTube.

Source: Read Full Article