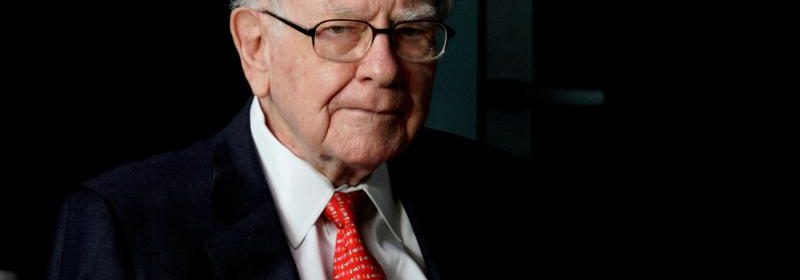

Warren Buffett says Greg Abel is his likely successor at Berkshire Hathaway -CNBC

(Reuters) -Warren Buffett ended years of speculation about his successor as chief executive of Berkshire Hathaway Inc by saying Greg Abel, who oversees the conglomerate’s non-insurance businesses, would take over if he were no longer in charge.

“The directors are in agreement that if something were to happen to me tonight, it would be Greg who’d take over tomorrow morning,” Buffett told CNBC. Buffett, 90, has never publicly signaled any plan to step down.

Abel, a native of Edmonton, Alberta, has been a Berkshire vice chairman since 2018, after a decade building its Berkshire Hathaway Energy unit into a major U.S. power provider.

Berkshire did not immediately respond on Monday to requests for comment.

Speculation about succession began in earnest in 2006 when Buffett, then 75, discussed it in his annual letter to Berkshire shareholders.

He has transformed Berkshire since 1965 from a failing textile company into a $628 billion conglomerate with such businesses as Geico auto insurance, the BNSF railroad, several industrial companies, Dairy Queen ice cream and See’s Candies.

Buffett also told CNBC that if anything happened to Abel, the CEO job would go to Vice Chairman Ajit Jain, who oversees Berkshire’s insurance businesses but is a decade older.

Vice Chairman Charlie Munger, 97, had said at Berkshire’s annual meeting on Saturday that maintaining the company’s culture was important, and that “Greg will keep the culture.”

Munger, a Berkshire director, did not mention Jain, and his comment may have forced Buffett’s hand.

“I suspect Buffett disclosed this reluctantly,” even though “Abel’s coronation is not exactly a surprise,” said Jim Shanahan, an analyst at Edward Jones & Co.

Shanahan said he had a “great deal of comfort” with Abel, while saying he might depart from Buffett, who lets Berkshire’s business managers operate largely without his interference, by holding them accountable to achieve performance targets.

Other aspects of Berkshire’s succession plans are unchanged. Buffett’s son Howard is expected to become non-executive chairman, while investment managers Todd Combs and Ted Weschler are in line to become chief investment officer.

NEVER A DUMB THING

While Abel lacks Buffett’s magnetism and showmanship, he won Buffett’s confidence for his commitment to Berkshire’s culture, long-term thinking and ability to spend money wisely.

“He’s a first-class human being,” Buffett said in a video message in 2013. “There’s a lot of smart people in this world, but some of them do some very dumb things. He’s a smart guy who will never do a dumb thing.”

Abel graduated in 1984 from the University of Alberta.

Trained in accounting, the lifelong hockey fan worked at PricewaterhouseCoopers and geothermal energy firm CalEnergy before joining Berkshire Hathaway Energy, then known as MidAmerican Energy, in 1992.

Abel became MidAmerican’s chief in 2008, replacing David Sokol, who many investors thought was being groomed to replace Buffett and was given a broader role.

Sokol resigned in 2011 after Berkshire learned he had invested in Lubrizol while recommending that Buffett buy the chemical company, which he did. Regulators took no action.

Berkshire Hathaway Energy’s growth has benefited from the company’s ability, unusual in the utility industry, to retain earnings rather than pay dividends.

That freed Abel to buy assets such as the Nevada utility NV Energy and Alberta electric transmission company AltaLink, while expanding into renewable energy. The unit also controls one of the largest U.S. residential real estate brokerages.

Despite outward appearances, Abel has let his hair down in public.

In 2014, he accepted the Ice Bucket Challenge to raise awareness for amyotrophic lateral sclerosis, or Lou Gehrig’s Disease. Abel flashed two thumbs up to a camera as he got soaked with water.

Source: Read Full Article