The manager of a new fund that's quickly broken into Wall Street's top 1% told us about the global strategy that's helping him return 5 times as much as his peers — and names 5 stocks that he's betting on long-term

- The Mercator International Opportunity Fund is delivering big returns from “mature” economies.

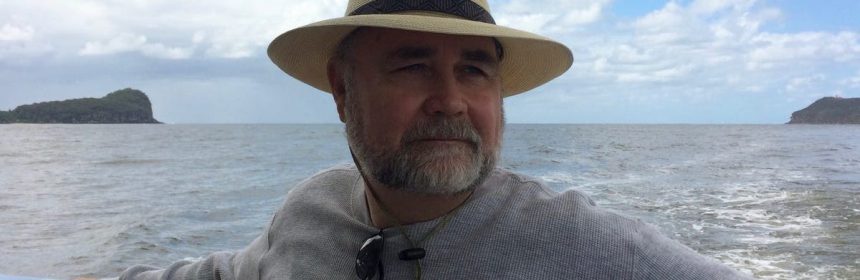

- Fund manager Hervé van Caloen told Insider how he targeted explosive growth out of the gate.

- van Caloen detailed how after two years of strong gains, he’s working in more discounted stocks. He also detailed five stock picks he recommends right now.

- Visit the Business section of Insider for more stories.

Everybody wants to make a good first impression, and for a mutual fund manager, nearly doubling investors’ money in the first three years will do the trick.

That’s what Herve van Caloen has pulled off with the Mercator International Opportunity Fund since its inception in April 2018. Investing in long-term trends like digitizing business and e-commerce, he’s assembled a diverse portfolio that held up well against struggling international indexes and stronger US-focused one.

As of February 22, the fund has returned 95.6% to investors since its inception, according to Morningstar. Over the last year it’s delivered at 80.8% return while its benchmark, MSCI’s All-Country World Index (ex-USA), is up a solid but much less impressive 18.7%.

“We look to buy stocks that we think will go up multiple times, not stuff that will outperform next quarter, not stocks that will have earnings surprise on the upside,” van Caloen told Insider in an exclusive interview.

His approach stands out because he’s picking winners from areas that don’t attract much enthusiasm from other investors. Van Caloen only invests in “mature economies,” with about three-fourths of his money in developed areas of Europe like the UK, France, Netherlands, and Scandinavia, and most of the remainder in Japanese stocks.

“I think the value added element of the emerging markets is basically nil,” he said. “What I focus on is companies, and companies with good prospects because they have great products or high value-added elements to it and potential great growth ahead.”

While his bets are spread out across industries, he has a notable position in semiconductor makers, arguing that developments like 5G broadband and the Internet of Things will make for a much longer-lasting increase in demand than the boom-and-bust cycles chipmakers have experienced in the past.

After two very strong years in a row, van Caloen says he’s adopting a more price-conscious approach.

“Especially now that we’ve made so much money in those growth stocks, I’m very agnostic about my investment style,” he said. “I’ve shifted a little bit more into turnaround situations, deep value companies.”

That shift hasn’t slowed him down in 2021. One reason is that his 2018 bet on BlackBerry paid off in a very unexpected way.

“I bought it years ago and it’s been a dog for a long time,” he said of the stock. “Their system, which is called QNX … is the platform for infotainment for more than 175 million cars around the world. So they have the installed base and they’re trying to use that to become what I’ve been calling the Android of the cars in the future.”

Van Caloen invested in BlackBerry at the launch of his fund, and while the stock is down slightly since then, the short squeeze in January sent its stock to more than $25 a share. He sold a chunk at around $22. That let him book a large profit while cutting his position back to where it started, at about 3% of his fund’s assets.

Asked about his top choices today, he answered with a mix of pure growth and “growth at a reasonable price” picks as follows.

(1) Aston Martin

The British automaker is van Caloen’s largest position. He says the brand suffered serious damage over the years, but thinks new CEO and former Mercedes-Benz executive Tobias Moers is off to a good start.

“They have just launched a new SUV that has been very well received by the market,” he said. “They are now going to try to repeat the success of Ferrari, not at the same level, by rebuilding the brand name through Formula One racing.”

He said that’s going to be a big help to Aston Martin’s marketing in Asia, Europe, and Latin America.

(2) Ocado

A more typical growth name is Ocado Group, which he says is taking its success in online grocery orders in the UK and striking international partnerships that will drive its growth in the future.

“They were the leaders and have developed a whole technology of managing the warehouses and being very efficient at delivering within a window of one hour grocery,” he said, explaining that Ocado is “basically becoming a technology company, selling their software and warehousing technology to the rest of the world.”

(3) Future

Future, based in the UK, owns a string of magazines including Golf Monthly, Guitarist, and PC Gamer. Van Caloen says it’s a surprisingly high-growth name because it revitalizes the publications it buys. That makes it a strong performer in an industry few investors seem optimistic about.

It is “reinventing the whole magazine business by bringing online and adding revenues by not just selling subscription and advertising, but selling a click through business as well,” he said. “Whenever there is a product that is highly recommended, they can actually click on it and buy right there.”

(4) Nidec

“They are world leaders in building motors for electric cars,” van Caloen says of Nidec, which has more than doubled in value since he bought it in early 2019. “It’s having a lot of success selling right now. There’s a huge demand for that. So they’re selling too many cars, not just in Japan, but then in Europe as well.”

(5) Watches of Switzerland

Recently he’s been building a position in Watches of Switzerland Group, a UK-based company that is well-run and is now expanding in the US and is position.

“They’ve made some acquisitions in the United States, turning around some of those stores,” he said. “The stores for high-end watches in the United States are far behind the quality of those stores in UK. So they bring in that quality here.”

Source: Read Full Article