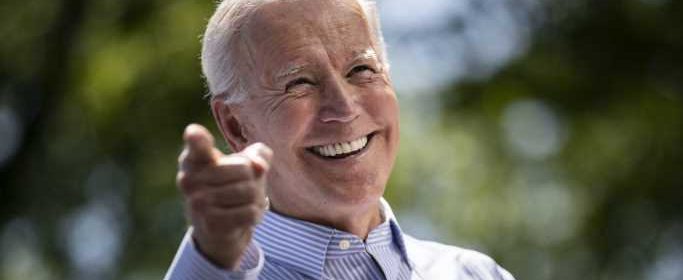

Solar Stocks Get Some Sunshine From Biden

With a couple of exceptions, solar industry stocks were posting decent gains Monday morning following President Joe Biden’s announced steps to boost solar manufacturing in the United States and roll back tariffs on solar modules and cells manufactured abroad for a period of 24 months.

Biden authorized the Department of Energy to use the power of the Defense Production Act to “rapidly expand American manufacturing of five critical clean energy technologies.” They are solar panel parts, building insulation, heat pumps, equipment for making and using clean generation fuels, and critical infrastructure components like transformers.

The president also is directing the development of master supply agreements for domestically made solar systems and a federal procurement program known as Super Preferences that applies domestic content standards for federal procurement of solar photovoltaic components.

Perhaps the biggest bang will come from Biden’s creation of a 24-month bridge period to give domestic manufacturers time to scale up to a size capable of supplying components to U.S. installers. This includes a temporary lifting of certain tariffs on components like modules and cells from Cambodia, Malaysia, Thailand and Vietnam.

Shoals Technologies Inc. (NASDAQ: SHLS) manufactures cable assemblies, monitoring systems and other electrical balance of system products for solar energy projects. The stock posted a 52-week low in late April and has jumped by more than 87% since then. Shares were up about 19% early Monday afternoon. Shoals stock has traded in a 52-week range of $9.58 to $37.61 and was moving Monday at about $18.20.

The news has given a double-digit boost to the share price of Albuquerque-based Array Technologies Inc. (NASDAQ: ARRY), which makes and sells the hardware and software that allows solar arrays and panels to track the sun. Array has more than doubled its share price since mid-May, and it traded up 18% in the early afternoon Monday at around $13.40. The 52-week range is $5.45 to $27.67.

Residential solar energy installer Sunrun Inc. (NASDAQ: RUN) traded up more than 8% Monday afternoon. Since last month, Sunrun’s share price has risen by 61% from a 52-week low of around $17.00. The stock’s 52-week high is $60.60, and shares were trading at $28.60 Monday afternoon.

Sunnova Energy International Inc. (NYSE: NOVA) is another supplier of residential solar and energy storage systems. Shares have jumped nearly 74% since mid-May’s 52-week low and were trading up about 7.4% Monday afternoon. The stock’s 52-week range is $12.47 to $46.40.

Solar energy component maker Enphase Energy Inc. (NASDAQ: ENPH) traded up more than 6% Monday afternoon. The stock posted its 52-week low of around $120.00 in late January and was trading at about $208 Monday afternoon, still well short of its 52-week high of $282.26.

Sponsored: Find a Qualified Financial Advisor:

Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes. Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests. If you’re ready to be matched with local advisors that can help you achieve your financial goals, get started now.

Source: Read Full Article