Silver prices, miners surge as retail buyers pile in

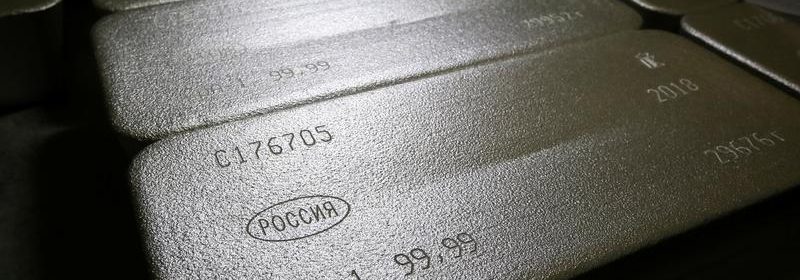

SINGAPORE (Reuters) – Silver prices leapt to a five-month high on Monday and small silver miners listed in Australia surged after social media calls to buy the metal and emulate the frenzy that has driven GameStop shares up 1,500% in two weeks.

Spot silver rose as much as 7.4% to $28.99 an ounce, the highest since mid-August. Shares in a handful of mining firms such as Argent Minerals, Boab Metals and Investigator Resources leapt more than 15%.

Coin-selling websites also reported unprecedented demand and flagged delays in delivering bullion. The moves are the latest example of small-time traders buying en masse, particularly of stocks and other assets that were heavily bet against, resulting in large losses for major investors. [MKTS/GLOB]

“There is this curious situation now where the Reddit crowd has turned its sights on a bigger whale in terms of trying to catalyse something of a short squeeze in the silver market,” said Kyle Rodda, an analyst at brokerage IG Markets in Melbourne.

“The most important factor here is that silver is heavily shorted, the paper market is much, much larger than the underlying commodity can justify,” he said.

“There’s a lot of commentary on these platforms to pile in to the miners.”

Silver prices are up 15% since Wednesday’s close, around when messages began circulating on forums such as Reddit encouraging users to buy the metal and drive up prices.

Source: Read Full Article