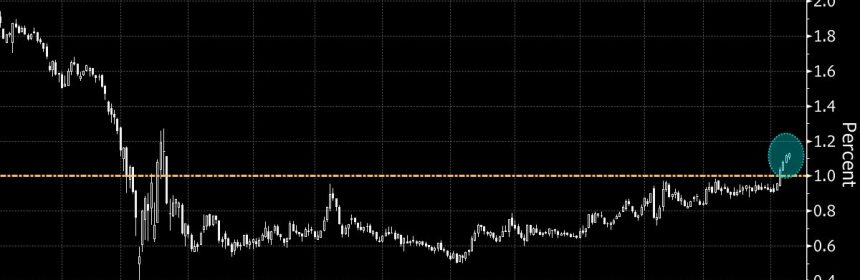

Once-Elusive 1% Yield Is Becoming Norm for 10-Year Treasuries

Treasuries extended last week’s selloff driven by fiscal stimulus optimism, keeping the benchmark 10-year note’s yield above the long-elusive 1% level for the fourth straight day.

Long-term yields in the world’s biggest debt market are settling into a new, higher range above the tough-to-crack perch set in March as traders bet President-elect Joe Biden, who takes office next week, will push for quick passage of more economic help. This comes as traders’ outlook for inflation hoversnear a two-year high.

“The trend in yields will continue higher,” Jim Bianco, president and founder of Bianco Research, said on Bloomberg TV. “Yields are probably justified given probably the $400 billion-plus stimulus that is going to come with a $2,000 check — with an infrastructure bill that’s coming after that and probably more stimulus down the road. More stimulus means more supply, and it means a higher chance of inflation.”

Arebound in share prices from their lows of the day also renewed the tailwind pushing yields up since last week’s Senate elections in Georgia gave Democratscontrol of Congress. A key measure of the U.S. yield curve — the gap between 2- and 10-year yields — expanded Monday to almost 100 basis points, a level it hasn’t reached since May 2017.

Pressure for higher long-term yields is also coming as the Treasury Department is set to sell $38 billion of 10-year notes and $24 billion of 30-year debt this week, matching records for reopenings of the maturities. First thing, though, the department will also offer a record $58 billion of three-year notes on Monday.

Source: Read Full Article