Hershey’s turnaround story isn’t sweet. It’s salty.

Halloween expenditures expected to break records in 2022

Fox Business’ Madison Alworth reports from Rubie’s, the world’s largest Halloween costume manufacturer, with managing partner Joel Weinshanker to examine how inflation has impacted consumer spending.

Any stock that doubles in five years, outperforms tech giants over three years and beats more than 450 companies in the S&P 500 this year is clearly worth studying. And there is no better time to look at one of the biggest winners of a terrifying market than Halloween.

Because that company happens to be Hershey

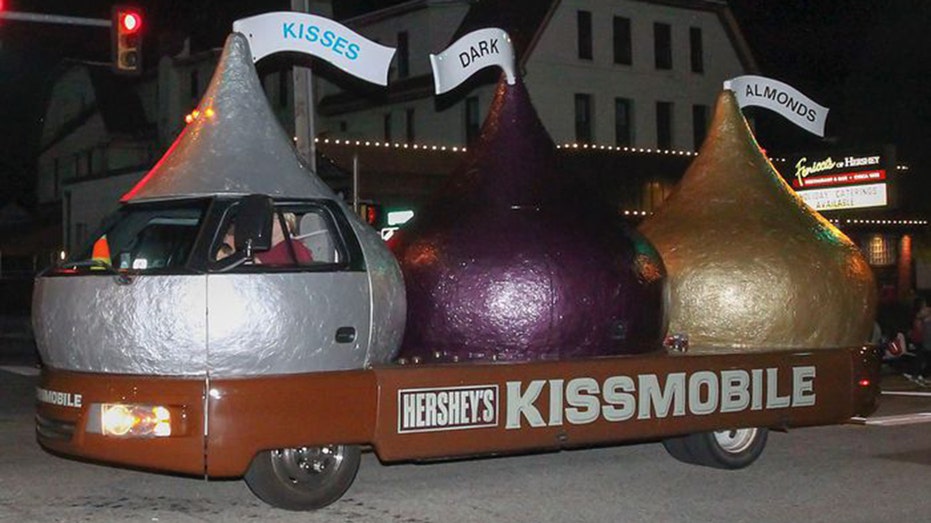

One of the many curious aspects of Hershey is that people who intuitively understand its business aren’t adults. They’re children. To be specific, they’re children around Hershey, Pa., which is among the world’s greatest places for trick-or-treating. Inside their Halloween bags next week will be five years of corporate strategy.

Hershey Co. miniature candies are displayed for sale inside of the company’s Chocolate World visitor center in Hershey, Pennsylvania, U.S., on Tuesday, Nov. 28, 2017. Hershey launched its first new bar brand, “Hershey’s Gold,” in 22 years nationwide (Luke Sharrett/Bloomberg via Getty Images / Getty Images) HERSHEY WARNS IT WON’T ‘FULLY MEET CONSUMER DEMAND’ THIS HALLOWEEN, CHRISTMAS How did the iconic American chocolate maker avoid the market meltdown? It turns out Hershey became more American and less reliant on chocolate. Such a tasty answer required the company to rethink what business it was in and where that business should be. Both decisions were surprising in their own ways, and both are worth thinking about while stuffing your face. The first was spending billions of dollars on popcorn, cheese puffs and pretzels. Hershey went on a spree of buying SkinnyPop, Pirate’s Booty, Dot’s Homestyle Pretzels and Pretzels Inc. over several years for reasons familiar to any sentient being: The company had a craving for sweet and salty. "We see great synergies there," said Kristen Riggs, Hershey’s chief growth officer. The second move was more contrarian. Hershey bucked the conventional wisdom—and its own history—by scaling back internationally and sharpening its competitive edge at home. With the company under pressure, it was a risky play. (Photo: Hersey’s) RITZ AND OREO JOIN TOGETHER FOR LIMITED-EDITION SWEET-AND-SALTY SNACK But since last Halloween, with the S&P down 17%, Hershey’s stock price is up 33%. It has soared more than 60% over three years and nearly 120% over five. The company was being targeted for a takeover in 2016, and now Hershey’s products like Reese’s and Kit Kats are performing more like gas and oil. There are many companies that will find themselves dealing with crises during this market downturn. Some will double down on existing strategies. Some will diversify. Hershey did both and discovered an unlikely new identity. "They’re not just a confectionery company anymore," said Morningstar analyst Erin Lash. That sounds a bit like Willy Wonka going keto. But this is a company based in a town built on chocolate and controlled by a powerful trust designed by founder Milton Hershey in 1905 to support his school for underprivileged children. Hershey has always been different from most corporations. Otherwise it might not be around. Almost every one of its rivals has salivated at the idea of buying Hershey. The company’s last battle for independence took place in 2016, when its stock was trading below $100, and Mondelez offered to pay $107 and then $115 a share in a deal that would have created the world’s largest candy maker. Hershey’s board rebuffed the approach from Mondelez, the parent company of Oreo, Cadbury and Sour Patch Kids, but the takeover bid lasted for months. Hershey, PA, USA – July 23, 2011: Children horsing around the height markers at Hersheypark. The different candy bars indicate different heights, which determine which rides children may go on. Today its stock price is above $230 because of what happened next. A management shake-up weeks later elevated Michele Buck to CEO, and she laid out her vision for a long-term strategy on her first day on the job. She told investors to expect changes. "We’ll have less growth in the international markets than perhaps we’ve seen in the past," Ms. Buck said in March 2017. "We’re clearly seeing that North America is going to be the biggest driver." It was counterintuitive, but she was right: North American sales went from 88% of Hershey’s total sales in 2017 to 92% in 2021. Instead of competing against varied tastes and established brands, Hershey pulled back internationally and shifted the playing field to where it already had the advantage. The company then extended its dominance at home, where the maker of Kisses and Whoppers commands a 46% share of the U.S. chocolate aisle, according to Ms. Lash’s estimates. It still has bets in foreign countries, but the future of Hershey will be determined by Americans. CLICK HERE TO GET THE FOX BUSINESS APP That’s because there was profound change happening much closer to home: The company suddenly had an appetite beyond sweets. It would cost a few billion dollars to find out if sweet and salty were complementary tastes in business, too. But what the company realized along the way is that Hershey doesn’t sell chocolate. It sells Hershey’s chocolate. There was no reason it couldn’t apply that model of selling recognizable brands to other snacks. First it tried mixing candy with jerky. This didn’t go well. Hershey’s deal for the artisanal beef-jerky maker Krave Pure Foods in 2015 was a surprising acquisition that signaled to Wall Street the company’s broader ambitions. Hershey would have to eat chocolate-covered crow—Krave was sold back to its founder in 2020—but it was not deterred. Soon it tried again with popcorn. Anyone who has been to the movies could have predicted that Hershey and popcorn would be a much better fit. "SkinnyPop was a seminal moment for us as a company," said Ms. Riggs, who was named chief growth officer right before the pandemic. That deal in 2017 pushed Hershey to acquire Pirate’s Booty in 2018 and Dot’s in 2021. The company’s North American sweets portfolio is generating more revenue than ever. But salty grew faster than sweet for two consecutive quarters after the company broke out sales figures earlier this year for the first time. Hershey expects them to keep growing. Of course it does. I could feel myself getting hungry as I heard Ms. Riggs say words like "Reese’s popcorn in a test market" and "Reese’s stuffed with potato chips" and "Reese’s filled with pretzels." There were other huge shocks that changed Hershey’s trajectory, like the pandemic and candy inflation. Also, the invention of resealable packaging for the eight people on earth who can resist crushing a bag of Reese’s Peanut Butter Cups in one sitting. But this version of corporate reinvention worked because Hershey at its core remains the same. It isn’t suddenly trying to be a metaverse company. It’s a snack company. Now it just has more snacks. Hershey exploited its relationship with retailers to get those brands into stores and brought its expertise about consumer behavior to their products. The sweet accentuated the salty. GET FOX BUSINESS ON THE GO BY CLICKING HERE That’s what the children of Pennsylvania will learn when they scale a Kilimanjaro of candy next week, and there are few better spots for trick-or-treating than the home of Ms. Riggs. "I have everything," she says. Everything includes the latest Reese’s products, Hershey’s Cookies ’n’ Creme bars, Jolly Rancher gummies and, yes, Dot’s pretzels. Halloween is a convenient reminder that you don’t have to follow the money at Hershey. You could just follow the candy. Source: Read Full ArticleTicker Security Last Change Change % HSY THE HERSHEY CO. 234.61 +1.87 +0.80% Ticker Security Last Change Change % MDLZ MONDELEZ INTERNATIONAL INC. 60.31 +0.41 +0.68%