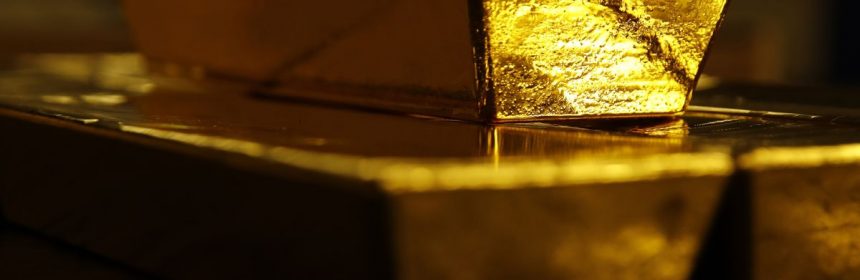

Gold Holds Gain as Investors Look to Stimulus, Weakening Dollar

Gold held gains after surging on Wednesday as the dollar extended declines and Joe Biden was sworn in as U.S. president, with investors looking ahead to the potential delivery of more fiscal stimulus. Silver was also in focus after global exchange-traded fund holdings hit an all-time high.

Bullion has pushed higher this week as the Bloomberg Dollar Spot index lost ground each day, whileglobal equities rose to a record. In confirmation hearings, Biden’s Treasury Secretary nominee Janet Yellen said spending was needed to fight the pandemic, while playing down concern over debt levels.

“Due to the smooth U.S. transition, investors have become more optimistic that stimulus measures will promote economic recovery and corporate earnings growth,” Huatai Futures Co. said in a report. Inflation expectations have continued to strengthen, and if non-U.S. currencies gain against the dollar, gold will be in a favorable position, the Chinese brokerage said.

Spot gold was steady at $1869.78 at 9:23 a.m. in Singapore after climbing 1.7% on Wednesday. Silver was 0.3% lower at $25.7687 an ounce, after ETF holdings jumped to 28,312.6 tons, according to an initial Bloomberg tally; that’s the highest figure on record. Platinum fell and palladium rose.

On the virus front, Biden plans to re-engage with the World Health Organization and will dispatch the government’s top infectious-disease expert to speak to the group this week. The new president’s team is worried that a more-transmissible strain of the virus threatens his plans to contain the outbreak.

Traders are also monitoring monetary policy decisions due on Thursday, including meetings of theBank of Japan and theEuropean Central Bank. Federal Reserve policy makers hold their inaugural meeting of 2021 next week.

| Related coverage: |

|---|

|

The Bloomberg Dollar Spot Index traded 0.1% lower. A fourth day of losses would be the longest losing run since Dec. 17.

Source: Read Full Article