GlobalWafers makes last ditch bid to save $5.3 billion Siltronic deal

BERLIN (Reuters) – Taiwan’s GlobalWafers made what it said was a final attempt to save a 4.35 billion euro ($5.3 billion) bid for Germany’s Siltronic on Monday by lowering the minimum acceptance threshold and extending its offer deadline.

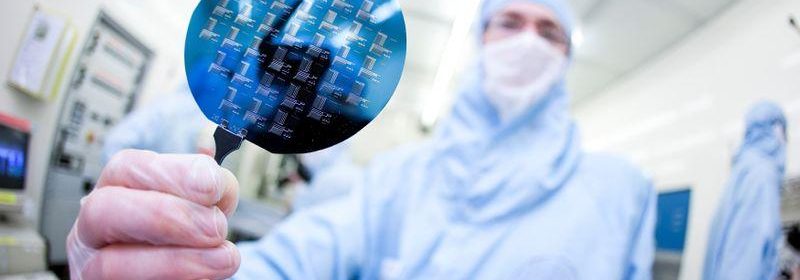

The proposed deal would combine GlobalWafers, the number three player in the 300 millimetre wafers market and Siltronic, the fourth biggest, to create the world’s second-largest player behind Japan’s Shin-Etsu.

GlobalWafers, which makes silicon wafers used in computers, smart phones, and other appliances, raised its bid for its German rival in two days last week to 145 euros from an original offer of 125 euros as it seeks to win over shareholders.

Shares in Siltronic were trading down 3% at 140.85 euros by 0855 GMT, while GlobalWafers’ stock was trading 3.6% lower.

The minimum acceptance threshold for the all-cash takeover offer had been cut to 50% from 65%, while the deadline for shareholders to accept the offer has been extended by two weeks until Feb. 10, GlobalWafers said.

GlobalWafers Chief Executive Doris Hsu said the latest offer was final and it will not pay more, if the minimum acceptance threshold is not met, adding the company would pursue “other growth options that are at an advanced stage of planning.”

The Taiwanese company holds a nearly 37% stake in Siltronic, including the 30.8% holding owned by former Siltronic parent Wacker Chemie.

Source: Read Full Article