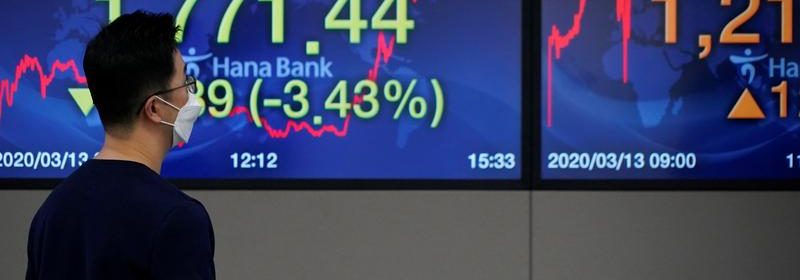

Analysts up Asia's forward 12-month earnings forecasts on recovery hopes

(Reuters) – Analysts continue to lift Asian companies’ forward-12 month earnings on optimism over economic recovery, although last month’s upgrades were the smallest in nine months, hit by worries over a surge in coronavirus infections in some areas.

Refinitiv data shows a rise of 0.6% in March in the forward 12-month earnings estimates of MSCI Asia-Pacific index firms, for the smallest upgrade since June last year.

(Graphic: MSCI Asia-Pacific index’s estimates change, )

“The earnings momentum, i.e. the percentage of upwards revisions versus total revisions, is above 60%, back to the level seen in 2017,” said Frank Benzimra, head of Asia equity strategy at Societe Generale.

However, he said failing vaccine roll-outs, a tightening in financial conditions due to rising UST yields and a stronger dollar could hit the region’s profits this year.

South Korea and Taiwan saw earnings upgrades of 3.5% and 2.4% each in the past month, helped by strong demand for technology products.

(Graphic: Breakdown by country for estimates changes in last 30 days, )

By sector, analysts raised earnings forecasts for Asia’s energy firms by 8%, buoyed by higher oil prices. Mining firms also saw earnings upgrades of about 5%, fed by a surge in commodity prices this year.

However, India, Indonesia and Thailand were among the nations that faced cuts in earnings over the past month, the data showed.

India, South Korea and Thailand have battled growing virus infections in the last few days, fuelling concern over further lockdowns in the region to curb the pandemic.

(Graphic: Breakdown by sector for estimates changes in last 30 days, )

Source: Read Full Article