Ethereum Mints More Sharks and Whales Amid Discounted Prices

Despite being off to a good start this month, Ethereum has witnessed a significant pullback.

Mid this month, the cryptocurrency surged to a ten-month high of $2,140 thanks to the hype around the Shapella upgrade before collapsing by roughly 17%. Nonetheless, whereas such pullbacks are historically appreciated, especially considering investors often “buy the rumour and sell the news”, some signs suggest it might be a temporary decline.

Sharks And Whales Splurge On Ether

According to crypto analytics firm Santiment, there has been significant growth in the number of whales and sharks in the past 12 months. In a Friday tweet, the firm noted that there are now 380 more addresses holding 1,000 or more Ethereum (ETH) compared to last year, representing a 5.7% rise in large-volume investors.

In the past, such high accumulation levels have often signalled significant price movements, typically in a favourable direction. Additionally, this surge in accumulation usually occurs at the same time as price bottoms.

The increase in ETH whales and sharks can be attributed to the current market conditions. Ethereum’s price is still 60% down since its all-time high in May 2021, creating a prime opportunity for institutional investors and high-net-worth individuals to accumulate more of the digital asset at a discounted price.

Liquid Staking Soars

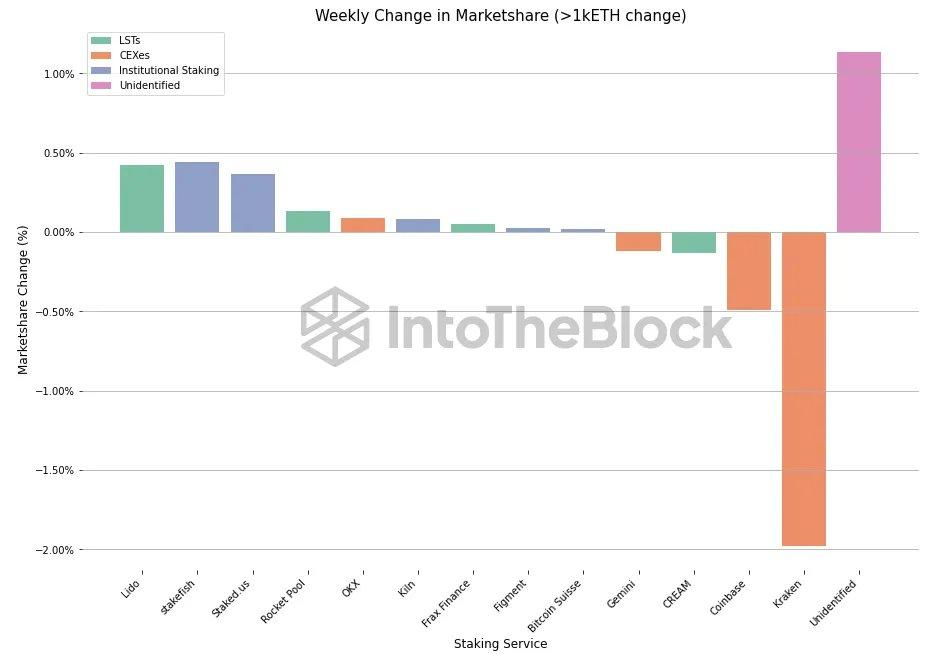

Moreover, the overall market volatility and the recent Shanghai upgrade have resulted in a noteworthy change in investor attitude towards Ethereum, recognizing the blockchain network’s potential for the future. On April 28, crypto analytics firm IntoTheBlock shared the chart below showing that liquid staking derivatives have been on the rise post-Shanghai. This week, Lido and RocketPool saw significant gains in ETH staking market share, while several US-based CEXes experienced declines.

Furthermore, data from Dune Analytics shows that investors have deposited over 571,000 ETH tokens worth over $1 billion into staking contracts. According to crypto analysts, most of these deposits were made through institutional staking service providers and also from investors reinvesting their rewards after withdrawing them.

With Shanghai behind, investors are even more stoked about what lies ahead for the world’s second-largest cryptocurrency by market capitalization. Apart from numerous upgrades aimed at improving the scalability, security, accessibility and efficiency of Ethereum, developers seem to be stopping at nothing to tackle one of the network’s biggest problems-gas fees.

Builders have been focusing on scaling solutions such as the zero-knowledge Ethereum Virtual Machine (zkEVM), which allows some data (particularly signatures) not to be included on-chain, saving on gas costs. In a recent blog, Vitalik Buterin noted that “the first steps of the transition may happen sooner than we expect” once we switch to Verkle trees and clients start gradually using ZK-EVMs.

At the time of reporting, Ether was trading at $1,906, up 0.43% in the past 24 hours. The price needs to surge and close above the $2,100 resistance for more upside.

Source: Read Full Article