Ethereum Miners Double Capacity as 5,000 ETH Burns

Ethereum miners have increased the gas limit following the EIP1559 upgrade that kicked in this Thursday.

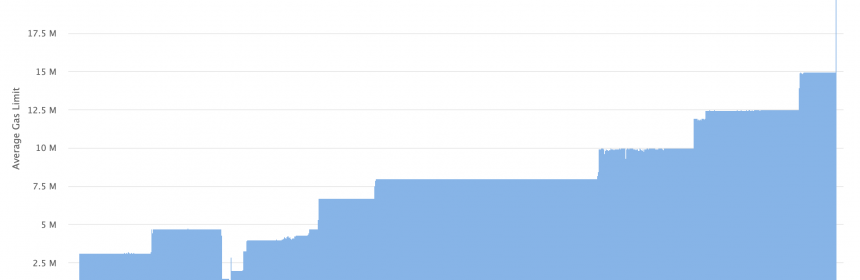

The gas limit is now voted up to 30 million units from 15 million set in April following the then increase in network fees.

That’s in line with recommendations as the new fee algorithm sets a base fee at a level that targets 50% of available capacity.

Fees thus have fallen to an average of less than $2 per transaction, including complex swap transactions, while capacity has increased to its highest level ever.

That means ethereum should now be able to handle about 3.5 million transactions a day, up from a peak of 1.7 million reached on May 10th.

That’s while 4,765.3934 ETH has been burned as of 15:04 PM euro time, worth $13.2 million almost precisely 24 hours after the upgrade kicked in at 14:37 PM yesterday.

Capacity was being voted down initially however so the burning may have run quicker for the first day, with it now running at about 132 eth per hour, worth $370,000.

In general, about $10 million are paid in fees per day during a normal period of relatively low fees, so about $10 million eth should be burned a day.

That means about 50,000 eth will be burned in ten days and we should see the crossing of the 100,000 eth milestone this month, maybe August 25th or so, with that worth about $280 million.

About 150,000 eth are burned a month, so the ◊1 million milestone should be crossed in February or March with the burning only increasing, it can not decrease as these can’t be unburned.

That translates to about $1 billion a quarter, or circa 400,000 eth, at an average of $10 million a day, an average that may increase now that capacity has doubled.

Capacity has increased both in regards to the doubling of the gas limit, as well as in regards to adding a cost to ‘spam’ transactions, micro-payments used by miners primarily but also others presumably in part to reduce capacity so as to increase fees.

Holders now benefit from any such shenanigans because the burned eth acts as a dividend of sorts with ethereum so becoming a yield producing asset just for holding it, and doubly so if you also stake.

Source: Read Full Article