U.S. Durable Goods Orders Plunge In January Amid Sharp Pullback In Aircraft Demand

New orders for U.S. manufactured durable goods pulled back sharply in the month of January, according to a report released by the Commerce Department on Monday.

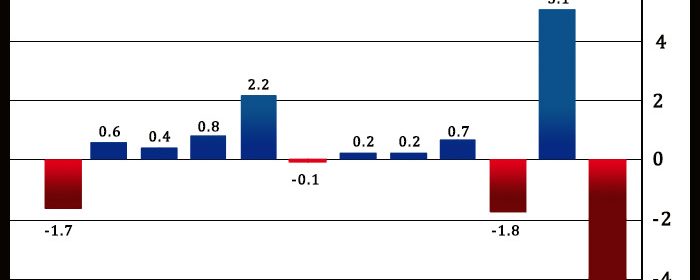

The report said durable goods orders plunged by 4.5 percent in January after surging by a downwardly revised 5.1 percent in December.

Economists had expected durable goods orders to tumble by 4.0 percent compared to the 5.6 percent spike that had been reported for the previous month.

The steep drop by durable goods orders came as orders for transportation equipment dove by 13.3 percent in January after soaring by 15.8 percent in December.

Orders for non-defense aircraft and parts led the way lower, plummeting by 54.6 percent in January after skyrocketing by 105.6 percent in December.

Excluding orders for transportation equipment, durable goods orders climbed by 0.7 percent in January after falling by a revised 0.4 percent in December.

Economists had expected a 0.1 percent uptick by ex-transportation orders compared to the 0.1 percent dip that had been reported for the previous month.

The rebound by ex-transportation orders partly reflected a 7.0 percent spike in orders for computers and related products as well as a 1.6 percent jump in orders for machinery.

“The 0.7% m/m rebound in core durable goods orders in January rounds off a month of strong activity releases and suggests business investment will hold up a bit better in the first quarter than we had thought,” said Andrew Hunter, Senior U.S. Economist at Capital Economics.

He added, “But that will probably still involve another decline in equipment investment, and the surveys point to much bigger falls to come.”

The report also showed orders for non-defense capital goods excluding aircraft, a key indicator of business spending, advanced by 0.8 percent in January after slipping by 0.3 percent in December.

Shipments in the same category, which is the source data for equipment investment in GDP, shot up by 1.1 percent in January after falling by 0.6 percent in December.

“As we regularly caution, high inflation means these nominal data overstate the real health of durable goods activity,” said Oren Klachkin, Lead U.S. Economist at Oxford Economics. “However, business investment appears to have started 2023 on a positive note.”

Source: Read Full Article