Fed Raises Interest Rates By Another 75 Basis Points, Signals More Rate Hikes

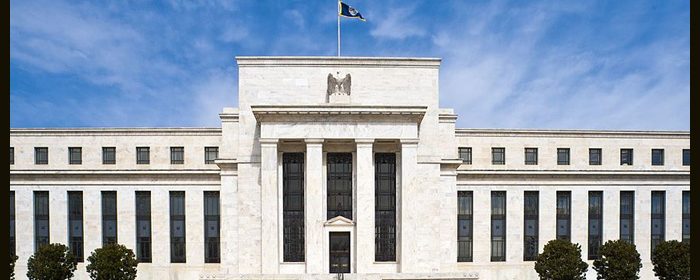

The Federal Reserve announced its highly anticipated monetary policy decision on Wednesday, raising interest rates by another three-quarters of a percentage point.

Citing its dual goals of maximum employment and inflation at a rate of 2 percent over the longer run, the Fed decided to raise its target range for the federal funds rate by 75 basis points to 3 to 3.25 percent.

The move marks the third straight 75 basis point rate hike by the Fed and lifts rates to their highest level since early 2008.

With inflation remaining elevated, the Fed also said it anticipates that ongoing interest rate increases will be appropriate.

Economic projections provided along with the announcement suggest Fed officials expect to raise rates to 4.4 percent by the end of the year, well above the 3.4 percent forecast in June.

Fed officials expect to increase rates to 4.6 percent by the end of 2023 before eventually scaling back rates in 2024 and 2025.

The latest projections also showed Fed officials now expect GDP to inch up by just 0.2 percent in 2022 compared to the 1.7 percent jump forecast in June.

The median forecast for GDP growth in 2023 was also lowered to 1.2 percent from 1.7 percent in June. GDP is expected to grow by 1.7 percent in 2024 and by 1.8 percent in 2025.

Fed officials also modestly increased their forecasts for consumer price growth over the next three years, with consumer prices expected to spike by 5.4 percent this year before price growth slows to 2.8 percent in 2023 and 2.3 percent in 2024.

The Fed’s statement was largely unchanged from July, although the central bank said recent indicators point to modest growth in spending and production after previously saying the indicators have softened.

In his post-meeting press conference, Fed Chair Jerome Powell reiterated the central bank’s strong resolve to bring inflation down to 2 percent, pledging to “keep at it until the job is done.”

Powell suggested the Fed will need to raise rates to a “restrictive level” and keep them there “for some time” in order to combat elevated inflation.

The Fed chief also said reducing inflation will likely require a “sustained period of below trend growth,” which he acknowledged could lead to “some softening of labor market conditions.”

“Restoring price stability is essential to set the stage for achieving maximum employment and stable prices over the long run,” Powell said. “We will keep at it until we’re confident the job is done.”

The Fed’s next monetary policy meeting is scheduled for November 1-2, while the final meeting of the year is set for December 13-14.

Source: Read Full Article