Yearn Dilutes YFI’s Supply by 22%

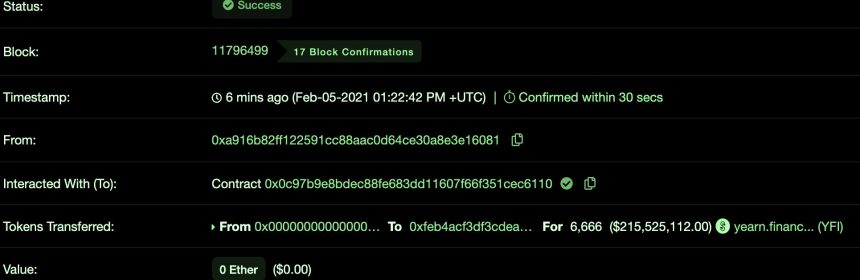

Yearn Finance has just printed $215 million worth of YFI tokens, raising their total supply from a fixed 30,000 to 36,666.

This dilution follows a governance proposal with the aim of “~1/3 of minted YFI to reward key contributors and put ~2/3 of minted YFI in the Treasury under the control of the community through future proposals.”

That 1/3rd currently is worth about $70 million, or just less than 10% of YFI’s nearly $1 billion market cap with it unclear currently when they plan to sell them and how much.

This comes just a day after there was yet another exploit of Yearn contracts leading to a somewhat small loss of $2.8 million.

In detailing what happened, PeckShield Inc smart contract auditing said a flashloan was used to game a flawed parameter.

YFI’s price is slightly down today with it overall not performing as well as its peers in part because there is much development and innovation going on at YFI and that code is tested in production, so there are occasional exploits as well.

YFI’s founder Andre Cronje argues that you can’t testnet the code because all the dapps are not on the testnet and thus the strategies that utilize all the other projects wouldn’t quite work.

So exploits here are just part of the business, with the field still very new and therefore quite some way from maturing.

It is constantly improving however with some dapps, like Yearn and Cream, merging more and more especially after the launch of zero collateral lending between these two dapps.

From our understanding the zero collateral part only refers to Cream not asking for any collateral on top of what YFI asks.

So it’s a confusing terminology because more correctly this can be called a merger of liquidity, something that can increase risk as Yearn bugs can ‘travel’ to Cream.

However, that’s the cost of innovation and now that devs have secured funding, we should expect quite more of it.

Source: Read Full Article