Total Value Locked in DeFi about to double

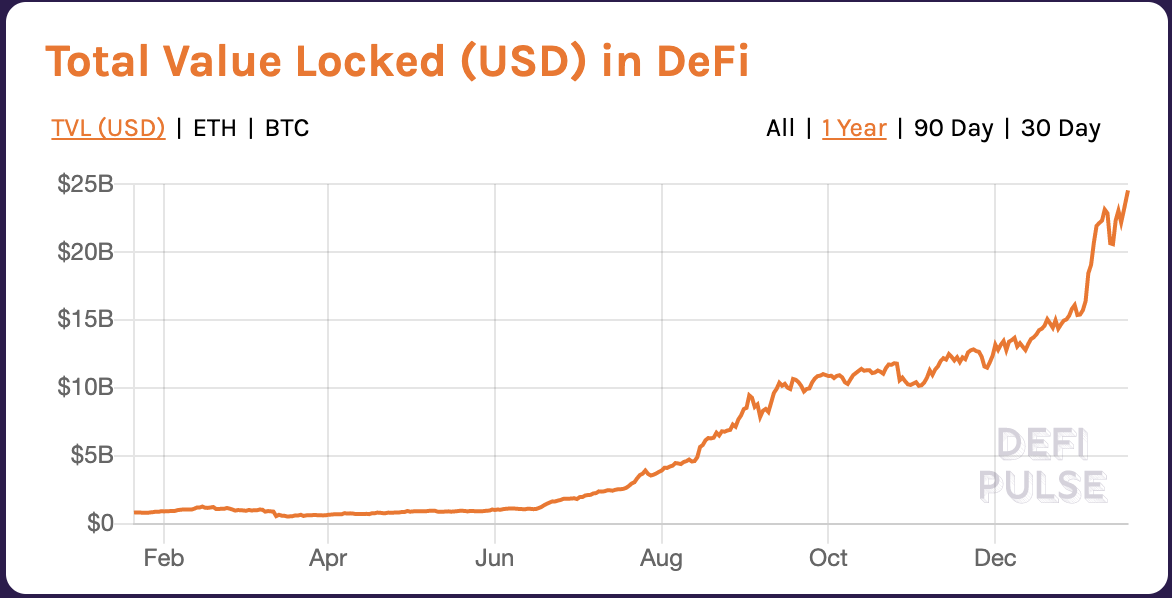

Following the strong increase in DeFi TVL (Total Value Locked) over last summer, the amount (in US dollars) continues to rise. A sharp surge since the beginning of December has seen the TVL practically double.

DEFI PULSE

DeFi Pulse lists around 60 DeFi projects from the areas of Lending, Dexes, Derivatives, Payments, and Assets. On the other hand, Coin Gecko publishes the market cap of the top 100 DeFi coins, regardless of type. This enables the likes of Chainlink, the top Oracle project, to be listed. The market cap for DeFi on Coin Gecko is presently sat at a little over $35 billion.

As Bitcoin and Ethereum accumulate and continue their advance, interest in DeFi has intensified, leading to a rise in the token price of most DeFi projects.

Ethereum itself is the platform that almost all DeFi altcoins are based on. With Ethereum 2.0 now launched and the thorny issues of scaling and high gas fees hopefully soon to be addressed, most DeFi projects are likely to remain on Ethereum.

Other Blockchains, such as Cardano, Polkadot, and Binance Chain are looking to get their own market share of DeFi, and Polkadot, for example, has its own fast-growing ecosystem of altcoins that operate solely on the Polkadot Blockchain.

The Bluechip DeFi projects

Maker is the top DeFi token, and currently has a dominance of just over 17%, according to DeFi Pulse. It is the governance token in the MakerDao ecosystem, and complimentary to the Dai token, which is a stable coin pegged to USD.

Aave, another coin in the DeFi lending sector, is an open-source, non-custodial lending protocol that facilitates decentralised lending and borrowing. TVL in Aave has recently risen to nearly $3.5 billion.

Synthetix is the leading DeFi derivatives platform. It enables users of the SNX token to create ‘Synths’, which are representations of real-world assets, brought over to the Ethereum blockchain as ERC-20 tokens, where they can be freely traded.

Uniswap is the top DEX (Decentralised Exchange) and it employs liquidity pools instead of order books, thereby cutting out the ‘middle man’ exchange. Users of the platform can swap any ERC-20 token for ETH or any other, as long as the liquidity exists for the swap. Users who supply liquidity are paid fees for every transaction, depending on the size of their share of the particular pool.

DeFi growth and regulation

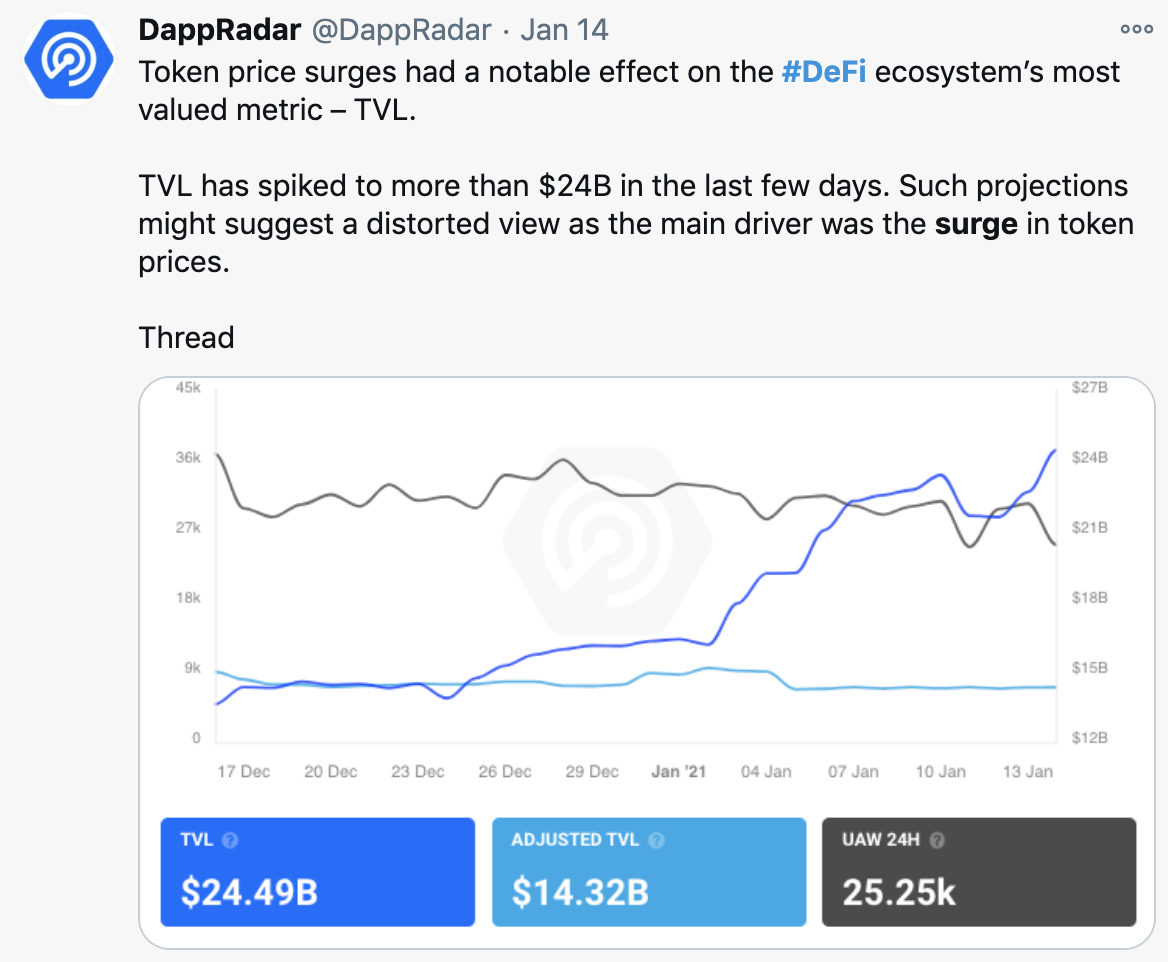

DappRadar suggests that rising token prices of DeFi coins have led to a ‘distorted view’ of TVL. This could be true, but the fact that Decentralised Finance knocks spots off anything comparable in the traditional finance space, means that this sector is likely to attract more users and therefore grow strongly over the coming months.

There are still scenarios that might reverse this trend – that of deep regulation of the sector, some coins getting sued by the SEC as being unregistered securities, or even an outright ban on using these platforms. Whatever happens though, the DeFi space is presently a hive of financial entrepreneurism and new ways of earning yield are progressing with breakneck speed.

Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Related TAGS:

You can share this post!

Source: Read Full Article