Total Market Cap of Stablecoins Reaches Highest Level Since May 2023, Says Latest Stablecoins Report From CCData

CCData, a global leader in digital asset data and an FCA-authorised benchmark administrator, has released the December 2023 edition of the “Stablecoins & CBDCs” report. This report provides a comprehensive analysis of the stablecoin sector, which has seen significant growth and interest over the past year. CCData’s expertise in aggregating and analyzing diverse datasets offers a detailed overview of the market, encompassing trade, derivatives, order book, historical, social, and blockchain data.

Some Highlights from the Report:

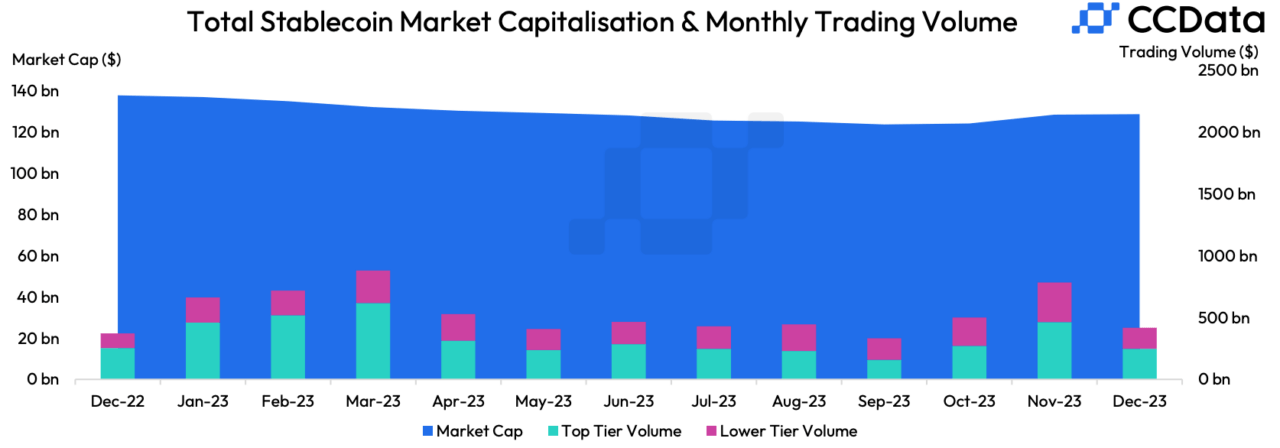

Surge in Stablecoin Supply

November witnessed a 3.43% increase in the total market capitalization of stablecoins, reaching $128 billion. This rise marks the largest monthly supply increase since February 2022. As of December 18th, the market cap further increased by 0.17% to $129 billion. However, stablecoin market cap dominance dipped to 8.07% in December, the lowest since December 2021.

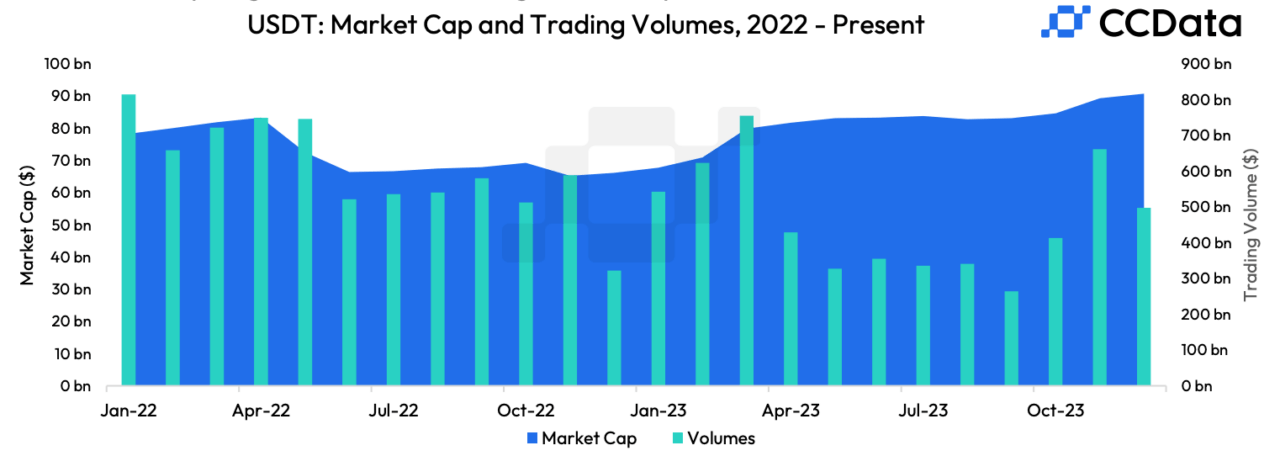

USDT’s Market Cap Milestone

USDT’s market capitalization breached $90 billion for the first time in December. FDUSD’s market cap soared by 92.6% to $1.63 billion as of December 18th, setting a new record. USDT’s market dominance reached 70.2%, the highest since January 2021. Trading volume for USDT pairs on centralized exchanges hit $662 billion in November, the highest since March 2023.

FDUSD’s Remarkable Growth

FDUSD’s market capitalization rose dramatically by 92.6% to $1.63 billion as of December 18th, marking a new all-time high. This surge led FDUSD to surpass BinanceUSD (BUSD) as the fifth-largest stablecoin, trailing only USDT, USDC, Dai, and TrueUSD.

Binance Withdraws Support for BUSD

On December 15th, Binance announced the discontinuation of support for BUSD, a stablecoin that had been experiencing a continuous decline for 13 months, falling to a market cap of $1.47 billion in December. BUSD once constituted 36.4% of Binance’s trading volumes but has been phased out in favor of TrueUSD and First Digital USD following a Wells Notice from the SEC in February.

Source: Read Full Article